In our previous analysis, we found that private equity funds that deployed capital in relatively lower valuation environments and recessionary environments tended to outperform those with other vintages. In the following article, we expand the analysis to the sub-asset class level and assess the potential importance of entry point and vintage diversification as it relates to recessions.

What you’ll learn:

Private equity funds vintaged in recession years on average outperformed those vintaged in years leading up to a recession.

Outperformance during recession years seemed to apply historically across buyout, venture, and private real estate funds but by different magnitudes.

Given the uncertainty in timing a recession, financial advisors may find pacing commitments over time and building a vintage-diversified portfolio a prudent approach to investing in private market assets.

Our analysis consists of buyout and venture capital funds, as well as private real estate, which, through drawdown vehicles, similarly raise and then deploy capital in a fixed time frame. Growth equity was excluded in this analysis due to limitations in data, yet we would expect a similar trend in line with the vintage performances of private equity more broadly.

Since they are typically paired with downturns in the stock market, recessions may provide private equity investors with an attractive backdrop of depressed valuations.1 Given the potential for acquiring companies or assets at cheaper prices, funds that make investments through these periods may be positioned for better ultimate outcomes relative to funds that deploy capital in richer valuation environments. In this piece, we aim to understand whether private market funds have historically experienced what some have called a “golden vintage” in recessionary environments.2

While it is difficult to time the market or know exactly when a recession will take place, any conclusions suggesting outperformance in any specific vintage year are derived from historical data, which is not indicative of future outcomes. Advisors might instead consider the data to reinforce the potential importance of vintage diversification as part of a structured, long-term approach to allocation.

Performance of Vintages on a Recession Timeline

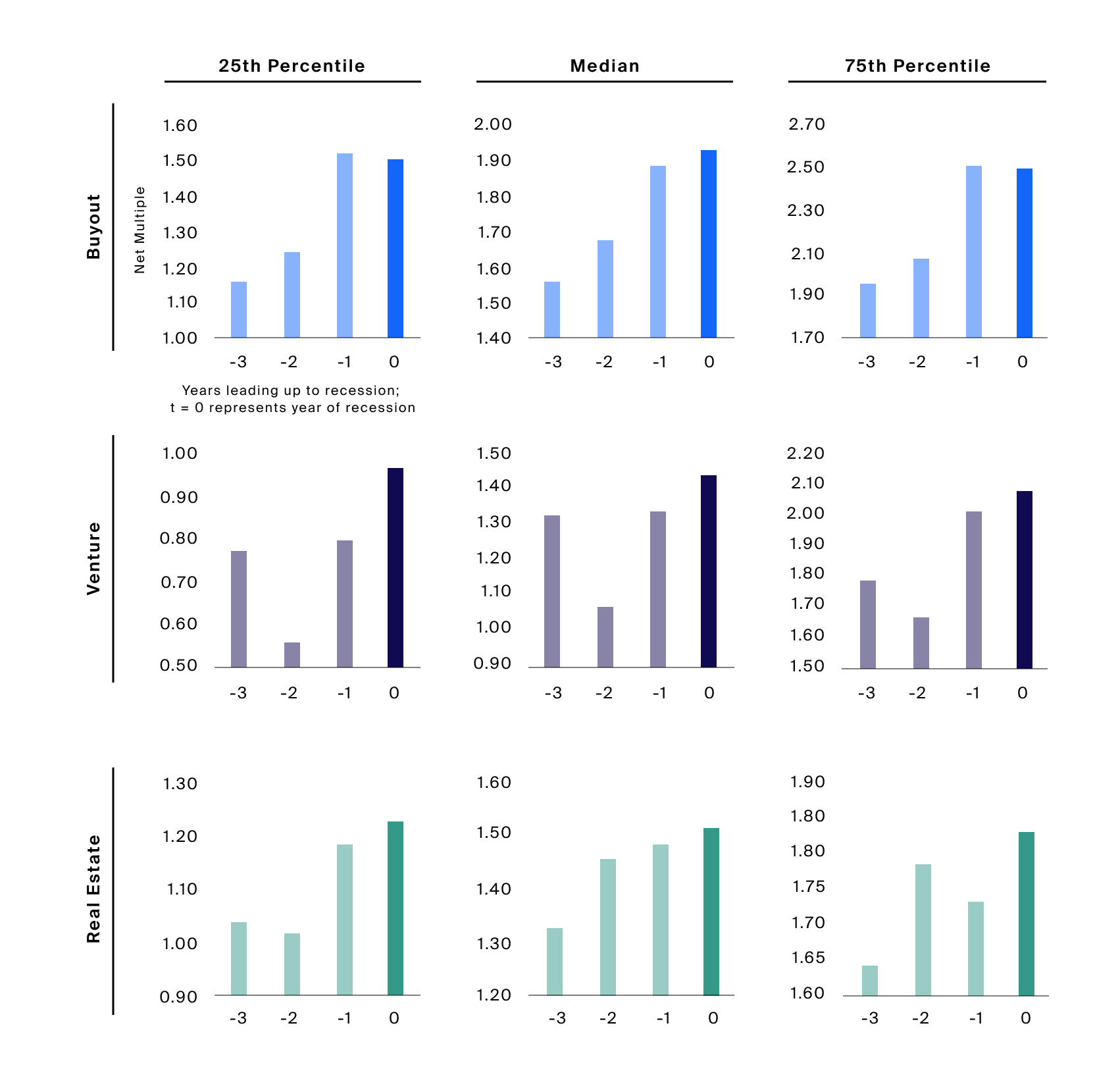

To assess whether the entry point for private market strategies had any notable influence on their ultimate performance, we organized vintages around their proximity to two recent recessions, specifically the Global Financial Crisis from 2008-2009 and the Dot-Com Crash of 2001. We then calculated the 25th percentile, median, and 75th percentile net multiple return from those vintage cohorts. In all vintage years, funds are mature, having minimum age of at least 10 years.

In most cases across asset classes, recession-year vintages (T0 in Exhibit 1) averaged the highest net multiple return at each level compared to funds with vintages in the three years leading into a recession. The degree of ultimate outperformance by recession-year vintages did, however, differ across peer performance levels and strategies.

Source: Preqin, Private Capital Benchmarks 25th percentile, median and 75th percentile net multiple for Buyout - All, Venture - All and Real Estate – All, using most-up-to-date data, as of 12/2022. Recession periods represented by NBER methodology, net multiple depicted is the average net multiple between vintages for the same t value, utilizing recession years 2001 and 2008-2009.

In most cases across asset classes, recession-year vintages averaged the highest net multiple return at each level compared to funds with vintages in the three years leading into a recession. The degree of ultimate outperformance by recession-year vintages did, however, differ across peer performance levels and strategies.

For buyout funds, performance across the peer groups seemed to gradually improve leading into recent recessions. However, buyout vintages in T-1 for the 25th percentile and 75th percentile performed slightly better than T0 on average. The median for each vintage saw the highest net multiple return in T0, returning an additional 0.04x compared to T-1.

For venture capital funds, recession-year vintages returned an average 0.97x net multiple at the 25th percentile. Funds at the same percentile in vintages prior to recessions did not fare as well, returning an average 0.71x net multiple. At the median and 75th percentile, recession-year vintage funds returned an additional 0.21x and 0.26x of invested capital, respectively, compared to the average returns produced by funds vintaged during the prior three years.

Private real estate funds also historically have had “golden vintages” in recession years. Private real estate recession-year vintages returned an additional 0.15x of invested capital at 25th percentile, 0.08x at the median, and 0.11x at the 75th percentile, compared to the averages at each of those levels in the preceding years.

We find that “golden vintages” in years of recession did seem to apply historically across buyout, venture, and private real estate funds in most cases—although the degree of outperformance differed based on funds’ relative peer performance ranking and strategy.

Could 2023 Be a “Golden Vintage” for Private Market Strategies?

As the Fed continued hiking rates throughout 2022, odds of a U.S. recession for 2023 climbed from 30% in June to 70% by December, according to a Bloomberg monthly survey of economists.3 Still, there are some who think that the Fed may effectively engineer a soft landing. A more optimistic view from Goldman Sachs, for example, details a continued period of below-potential growth, which could gradually rebalance supply and demand in the labor market and dampen wage and price pressures with a slower rise in unemployment.4 In addition, the impact of tightening financial conditions on GDP growth may diminish through the end of 2023. Either way, the jury is still out.

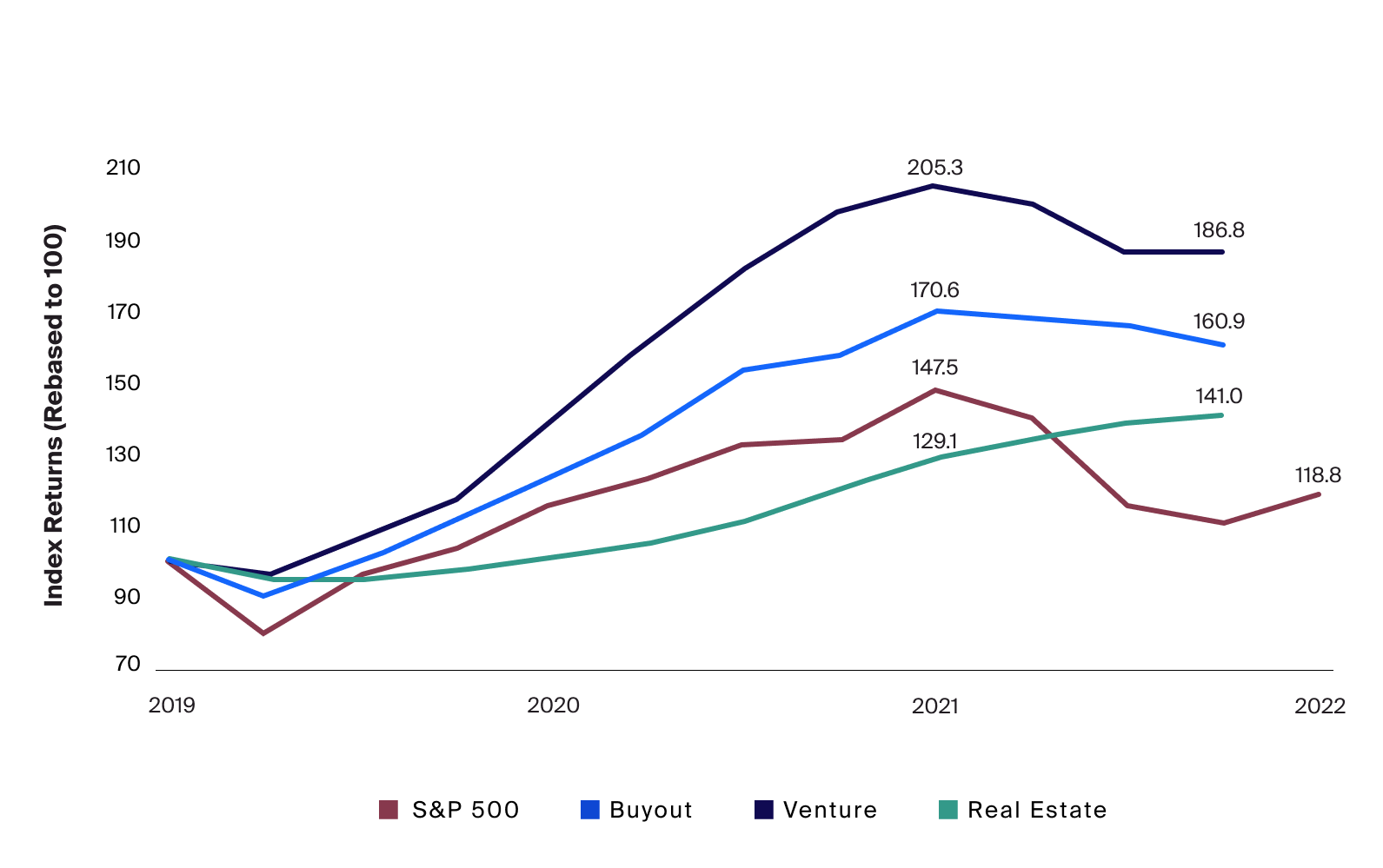

Attractive entry points are also dependent on private market multiples compressing—following public markets down, at least to some extent. As of September 2022, private markets strategies had not reported a fall to the degree we have seen thus far in equities. Buyout, venture and real estate returned -5.7%, -9.0% and 9.2% respectively since December 2021, compared to equities that fell -24.8% from their peak over the same period (Exhibit 2).

Source: Bloomberg, S&P 500 represented by SPX Index, as of 12/2022. Preqin, Preqin Quarterly Index for Buyout, Venture, and Real Estate, as of 9/2022.

Attractive entry points are also dependent on private market multiples compressing—following public markets down, at least to some extent. As of September 2022, private markets strategies had not reported a fall to the degree we have seen thus far in equities. Buyout, venture and real estate returned -5.7%, -9.0% and 9.2% respectively since December 2021, compared to equities that fell -24.8% from their peak over the same period.

Private market valuations often lag public markets as multiples may not oscillate in response to market sentiment or daily price swings as frequently.5 In addition, funds with capital locked up have no incentive to access immediate liquidity.6 Marking down assets in private market funds may only occur in funds that have overpaid for poor-performing businesses, absent a severe market downturn which does not seem to be yet occurring as GDP rose in the third quarter of 2022.7

While the outlook for recession later this year remains uncertain, if history is any indication, such an environment may suggest a relatively strong vintage for buyout, venture, and private real estate funds broadly. If we do not experience a recession, private market multiples may not trend down, limiting the potential upside for funds deploying capital this year.

The Case for a Vintage-Diversified Private Markets Portfolio

Entry point does appear to matter across private market strategies. While this analysis indicates recessionary vintages have proven to be stronger than those preceding, the backdrop and dynamics of each recession are unique and thus difficult to predict.

To mitigate selection bias and potential concentration within a specific vintage year, investors may find pacing commitments over time and building a vintage-diversified portfolio a prudent approach to investing in private market assets. Regardless of entry point, the rising probability of recession and the prospect of a “golden vintage” may introduce new opportunities to allocate to private markets.