What You'll Learn

How buffered notes work, their growth potential, and how they aim to provide downside protection

Different types of buffered notes and how they vary in structure, risk, and return potential

Potential benefits and important considerations regarding buffered notes

How buffered notes may compare to traditional equity investments

Buffered notes are designed to target market exposure, a pre-determined investment time frame, a level of downside protection, and growth. Issued by investment banks, structured investments were introduced in the 1990s and have evolved to keep up with various investment objectives.1 Technology advances, such as algorithmic capabilities and data analytics, have enabled issuers to develop bespoke payout structures further.2

Buffered Notes: What They Are and How They Work

Buffered notes are a type of structured note designed to allow participation in the upside of an underlying asset or set of assets while aiming to preserve principal investment if held until maturity. As the name suggests, buffered notes come with a downside protection mechanism— the “buffer”—which limits or absorbs losses while, in turn, potentially capping gains.34 Buffered notes are linked to an underlying asset such as an equity index, single stocks, an exchange-traded fund, commodity, or interest rate. If the underlying asset appreciates, investors benefit up to a potential cap. Conversely, if the underlying asset declines in value, the buffer absorbs losses down to a preset level, but remains subject to the credit risk of the issuer.

Illustrative Example: If a structured note has a buffer of 10%, and the underlying asset declines 5%, the investor receives 100% of their principal at maturity (subject to the issuer’s credit risk). Conversely, if the underlying asset declines 50%, the investor loses 40% of their principal.5

Buffers can potentially be applied to multiple structures like:

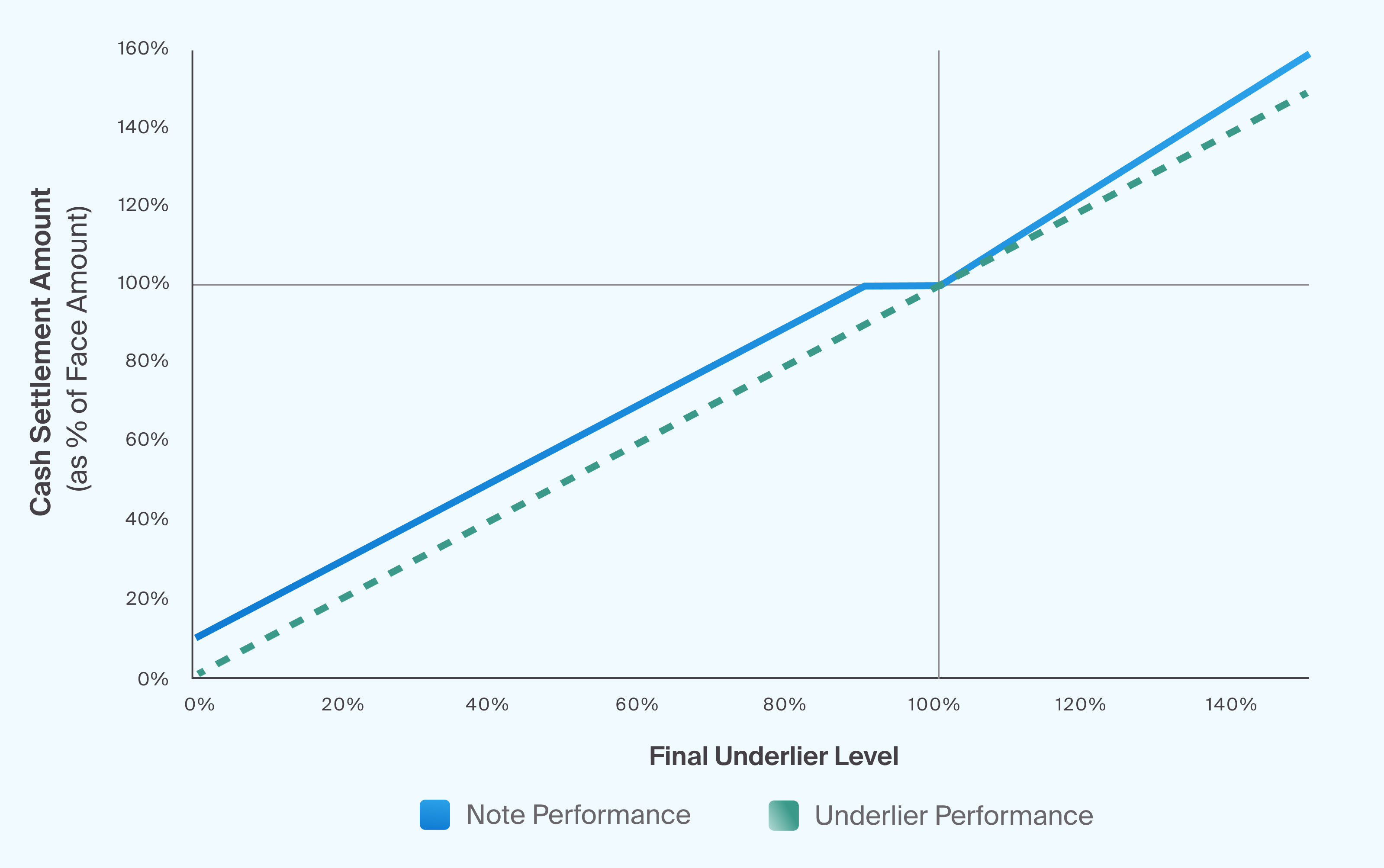

Buffer Uncapped Growth Note (Exhibit 1)

A Buffered Uncapped Growth Note is a structured investment that offers exposure to market upside without a cap, while providing a buffer against a portion of downside losses based on the performance of an underlying index. It combines growth potential with limited risk mitigation, making it a flexible tool for navigating market volatility.

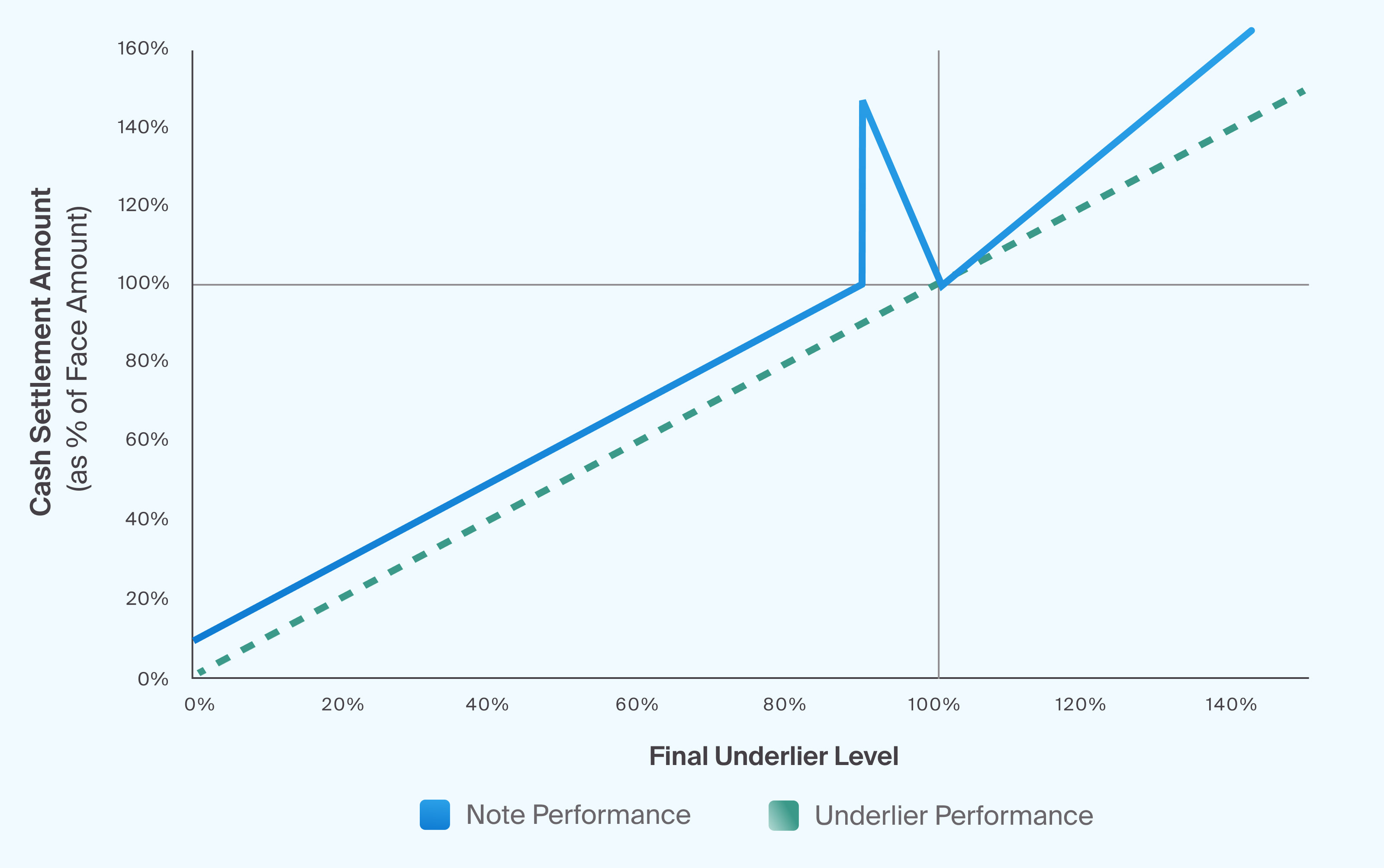

Buffer Dual Directional Uncapped Growth Note (Exhibit 2)

A Buffer Dual Directional Capped Growth Note may offer the potential for positive returns in both rising and moderately declining markets, with gains capped and a built-in buffer to reduce losses beyond a set threshold. It’s designed to enhance outcomes in flat or volatile markets while limiting downside exposure.

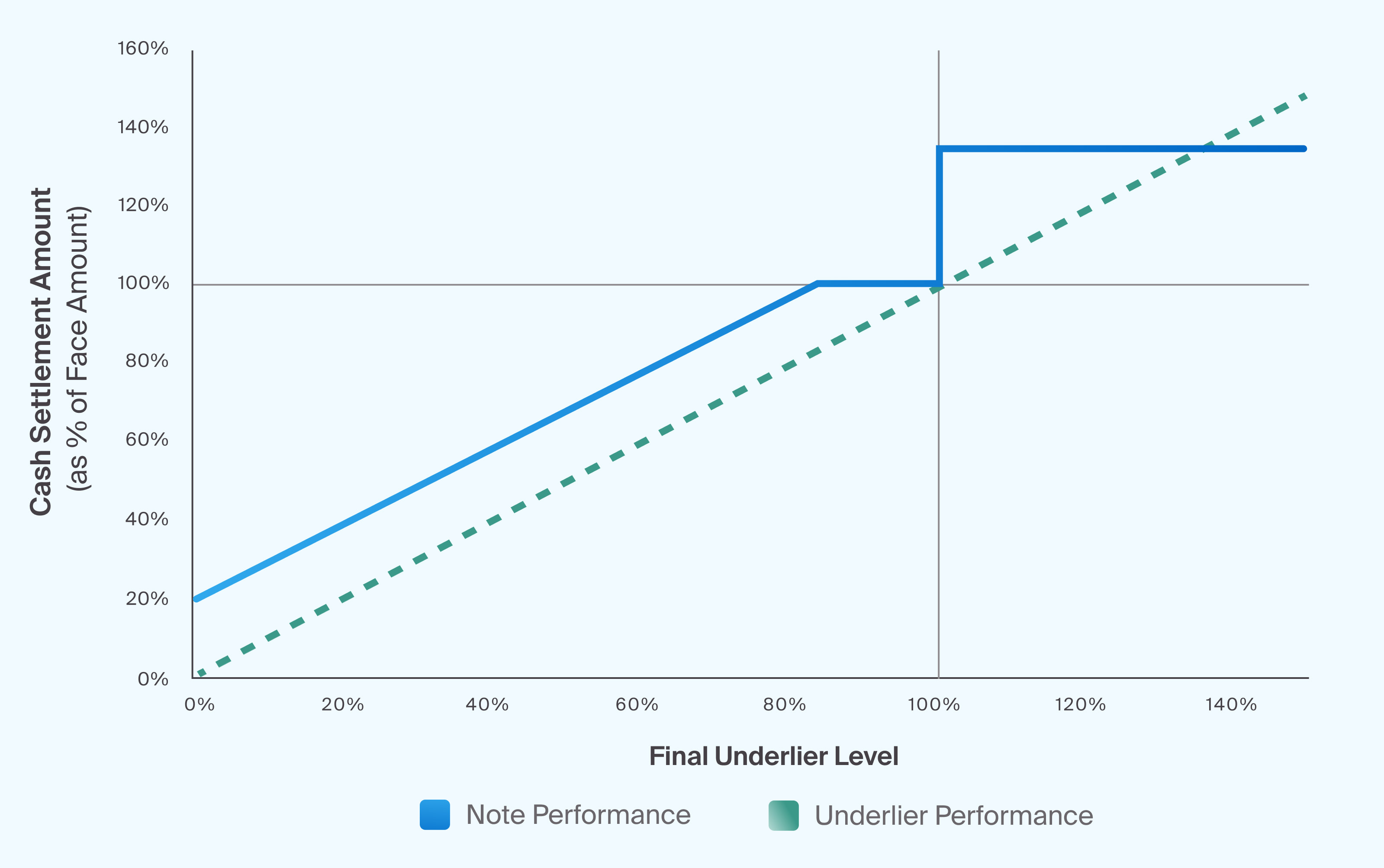

Buffer Digital Growth Note (Exhibit 3)

A Buffer Digital Growth Note is a structured investment that targets a fixed return if the underlying index finishes above a preset barrier level at maturity, regardless of how much it rises. It includes a downside buffer to reduce loss exposure if the index declines, up to a specified threshold.

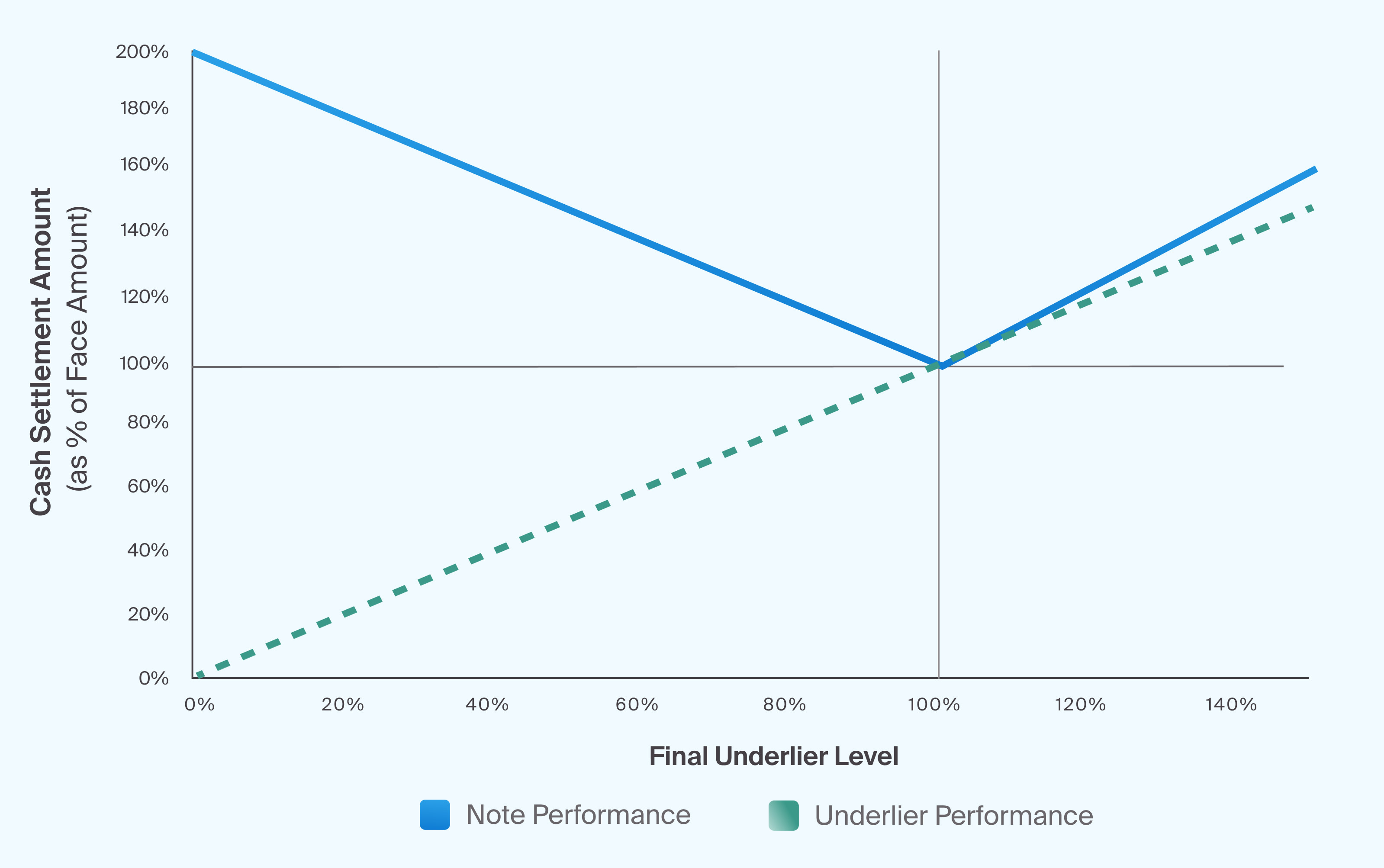

Dual Directional Floor Uncapped Growth Note (Exhibit 4)

A Dual Directional Floor Uncapped Growth Note is a structured investment designed to provide enhanced upside participation if the underlying index rises, and also provides positive returns if the index declines—while fully protecting the principal at maturity. It features no cap on returns and includes a 100% floor, meaning no loss of principal if held to maturity.

Risks and Considerations

It's important to note that while buffered notes aim to provide a degree of downside protection, they may also limit the upside potential, all while remaining subject to the credit risk of the issuer. Therefore, it's essential to carefully review the terms of the buffered note in the corresponding prospectus.

Credit Risk: Structured notes are the issuer's unsecured debt obligations. As such, payments, including principal repayment, rely on the issuer's creditworthiness and ability to meet its obligations.

Market Risk: The value of a structured note can rise or fall based on movements in its underlying asset(s). These fluctuations may be driven by market volatility, economic trends, interest rates, regulatory changes, and industry developments, making performance dependent on various dynamic factors.

Liquidity Risk: Structured notes are designed to be held to maturity. They are generally illiquid securities, though limited liquidity may be available, though not guaranteed, subject to certain penalties or fees for early redemption. There is no obligation for the issuer to provide opportunities for liquidity before maturity. An investment may be worth less than the initial principal amount if sold or redeemed before maturity.

Reinvestment Risk: Some structured notes may be called before maturity, meaning they could be redeemed early. If this happens, there’s no guarantee that investors will find a reinvestment opportunity with a similar return or risk profile.

Tax Treatment: The tax implications of structured notes depend on their specific structure and the type of account in which they’re held. Refer to the offering documents and consult a tax advisor for personalized guidance for complete details.

Dividends and Distribution on Underlying Assets: Structured note investors typically won’t receive dividends or distributions from the underlying assets during the note’s term. These payouts aren’t included in the calculation of returns, meaning potential earnings come solely from the note’s performance.

Summary

As part of the structured investment landscape, buffered notes may provide a layer of principal protection while allowing for market participation. Buffered notes may appeal to certain advisors in volatile markets whose investment objective is growth.

These notes are typically linked to an underlying asset, such as a stock index or ETF, and feature a built-in “buffer” that absorbs a set percentage of principal losses while offering un- capped or capped upside potential. Although buffered notes aim to provide a degree of downside protection, they may also limit the upside potential, all while remaining subject to the credit risk of the issuer. These investments carry risk including, but not limited to, entire loss of principal. Past performance is no guarantee of future results.

Sign up for the CAIS platform to explore more structured note education.