Investors tend to rely upon well-known risk-adjusted return measures—such as Sharpe and Sortino ratios—when using alternative strategies to build diversified portfolios and extract differentiated returns. But are investors sometimes forgetting about other important properties that may create a well-diversified portfolio?

What you’ll learn:

Trend following is one of the largest and most established hedge fund strategies, which aims to diversify against negatively skewed portfolios.

With negative correlation to global equities and a shallower max drawdown, trend following may serve as a diversifying complement to a traditional equity allocation.

In tempering volatility and drawdown, investors would have historically enjoyed a smoother ride with an allocation to trend-following funds.

In this piece, we will investigate the potential benefits of incorporating investments with characteristics of positive skew into a portfolio, specifically, trend-following strategies.

What Is Skewness?

Skewness is the third central moment in a return distribution that is often used to measure the distribution’s departure from symmetry.1 Simply put, assets or strategies that exhibit positive skew normally have many small losses and few large gains.2 Alternatively, negatively skewed assets or strategies typically experience many small gains and few large losses.3

Experienced financial advisors may be more familiar with negatively skewed strategies. A long position in global equities, for example, is perhaps the most popular illustration of a negatively skewed investment. Such positions are typically characterized by occasional outsized drawdown and consistent appreciation over the long term.

What Is Trend Following in Alternative Asset Management?

Trend following is one of the oldest strategies often employed by macro hedge funds, and with over $350 billion in assets under management across firms, it’s one of the largest.4 Trend following involves the use of a systematic process to identify price movements in both rising and falling markets. Without a specific bias, these strategies take both long and short positions across global markets.5 Managers of trend-following strategies do not always seek to understand why these price movements or trends are occurring. Rather, they may design systematic processes to attempt to benefit from their emergence.6 Strategies are typically diversified across a variety of assets and generally trade centrally cleared futures and currency markets.7

The Potential Diversification Benefits of Trend Following

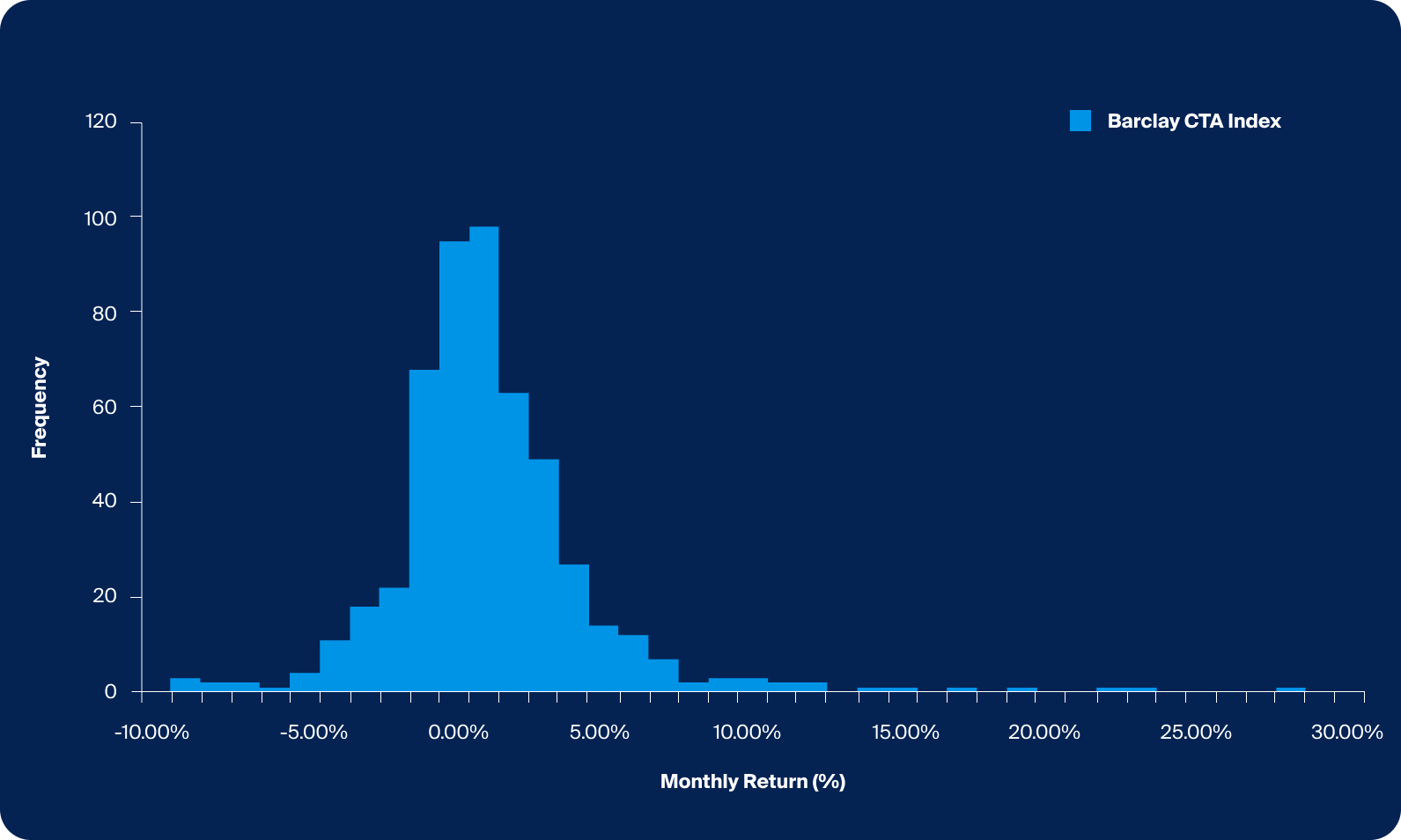

Commodity trading advisors, or CTAs, are firms that generally execute trend-following strategies. The Barclay CTA Index is a popular industry benchmark that is equally weighted with over 400 constituents. The histogram below shows the monthly performance distribution of a typical trend-following strategy in which returns are positively skewed or concentrated on the right side.8 As opposed to the performance of traditional equity indices, which often exhibit negative skewness, below captures the essence of the trend-following experience: many months of small losses that are smaller in magnitude than the wins.

Source: Bloomberg, Barclay CTA Index from January 1980 to December 2022.

The histogram shows the monthly performance distribution of a typical trend-following strategy in which returns are positively skewed or concentrated on the right side. As opposed to the performance of traditional equity indices, which often exhibit negative skewness, below captures the essence of the trend-following experience: many months of small losses that are smaller in magnitude than the wins.

Trend Following and Non-Correlated Returns

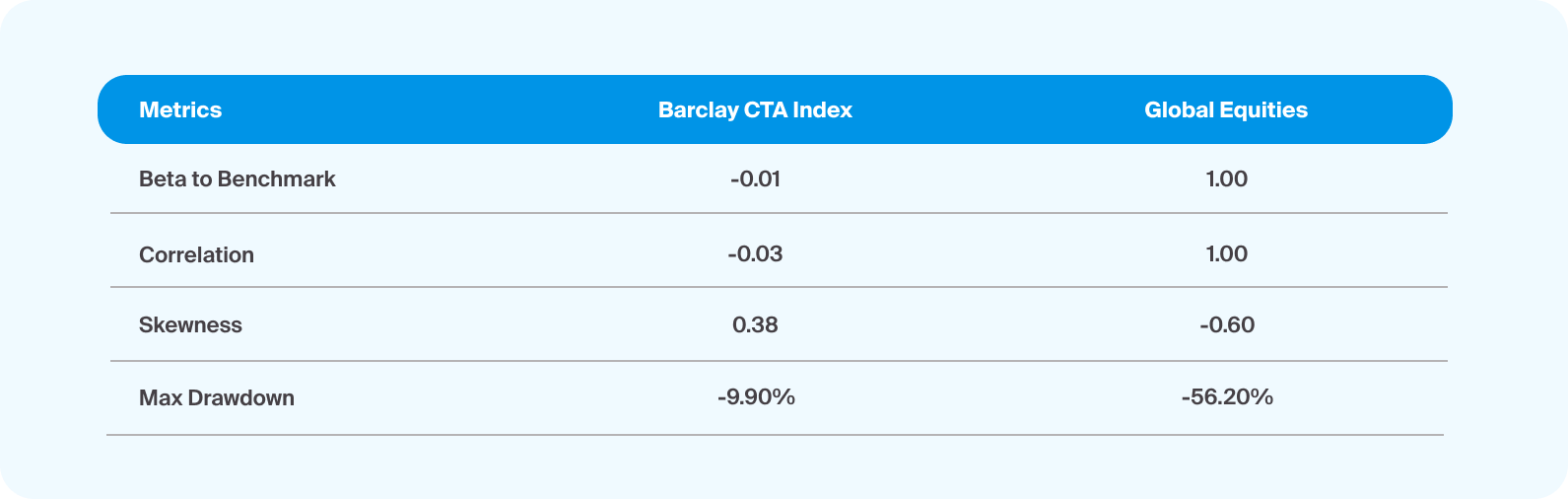

Below we look at the performance metrics of trend-following strategies since the turn of the century. Compared to global equities, we can see that trend following has produced some potentially attractive diversifying properties. With negative correlation to global equities and a shallower max drawdown, trend following may serve as a diversifying complement to a traditional equity allocation.

Source: Bloomberg, Venn, Barclay CTA Index, Global Equities Represented by the MSCI ACWI Index, as of December 2022.

We look at the performance metrics of trend-following strategies since the turn of the century. Compared to global equities, we can see that trend following has produced some potentially attractive diversifying properties. With negative correlation to global equities and a shallower max drawdown, trend following may serve as a diversifying complement to a traditional equity allocation.

Exploring Trend Following’s Ability to Generate “Crisis Alpha”

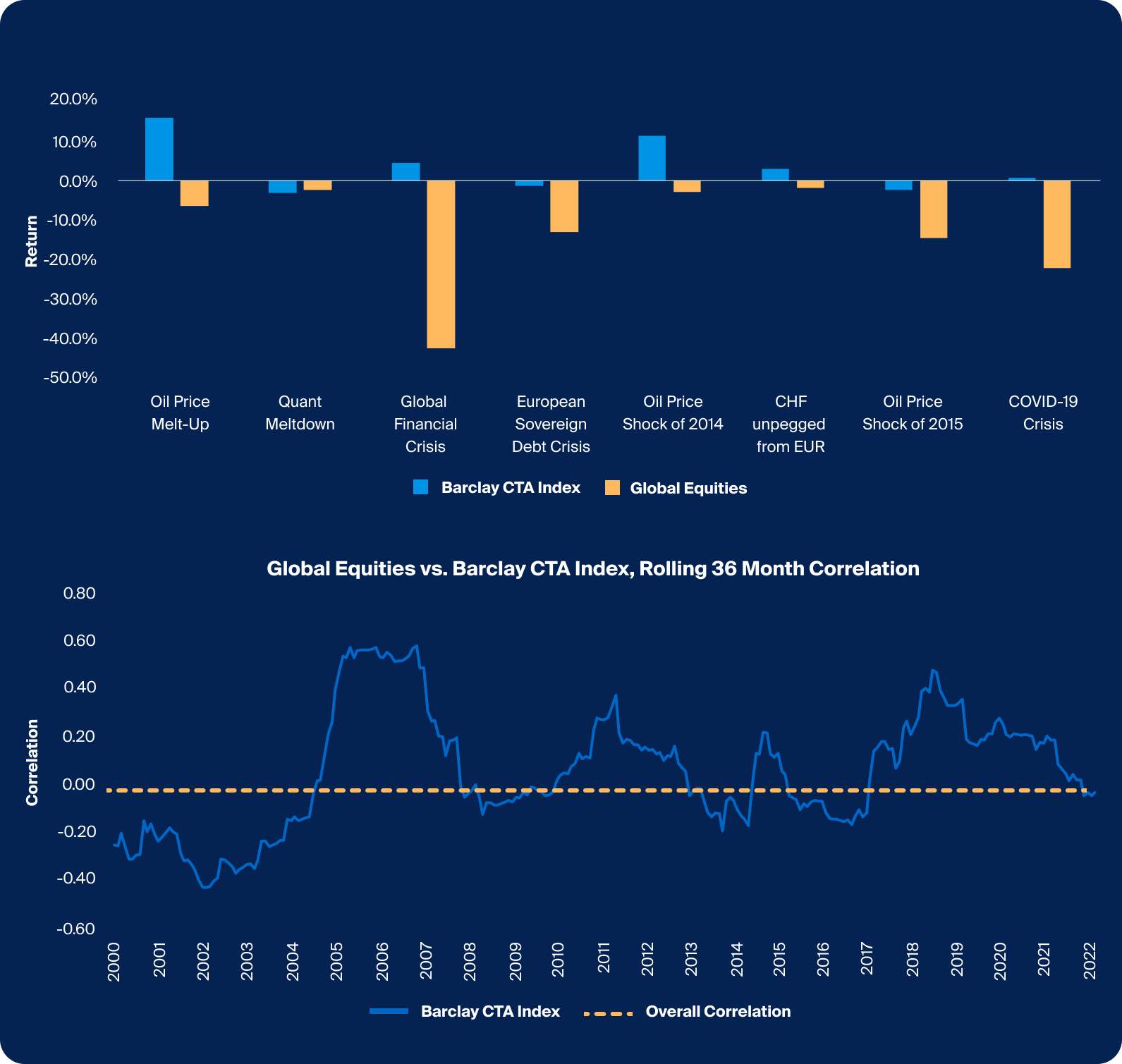

Coined by Kathryn Kaminski in 2010, crisis alpha opportunities are profits gained by exploiting the persistent trends that occur across markets during times of crisis.9 10 While defining a crisis may be difficult, below we highlight a handful of well-known periods of global equity market stress since 2000. In addition, we measure the correlation of these strategies to global equities over the same period.

Source: Bloomberg, Venn, Barclay CTA Index, Global Equities represented by MSCI ACWI Index. Notable Periods determined by Venn, as of December 2022.

We highlight a handful of well-known periods of global equity market stress since 2000. In addition, we measure the correlation of these strategies to global equities over the same period.

Risk Considerations for Trend-Following Strategies

As highlighted earlier, trend following may provide protection during market stress; however, allocators should be cautious when thinking about the strategy as a pure-play tail hedge.11 While trend-following strategies have generally performed well on average, they have been more vulnerable during sharp, short-term declines.12 The banking crisis of recent months provides an example of an environment where trend-following strategies can face challenges. As the two-year Treasury yield posted its largest two-day drop since 2008, March 2023 was characterized with high-rate volatility and reversals that are not typically friendly to these strategies.13 Advisors should consider their clients’ hedging and diversification needs before investing in this space.

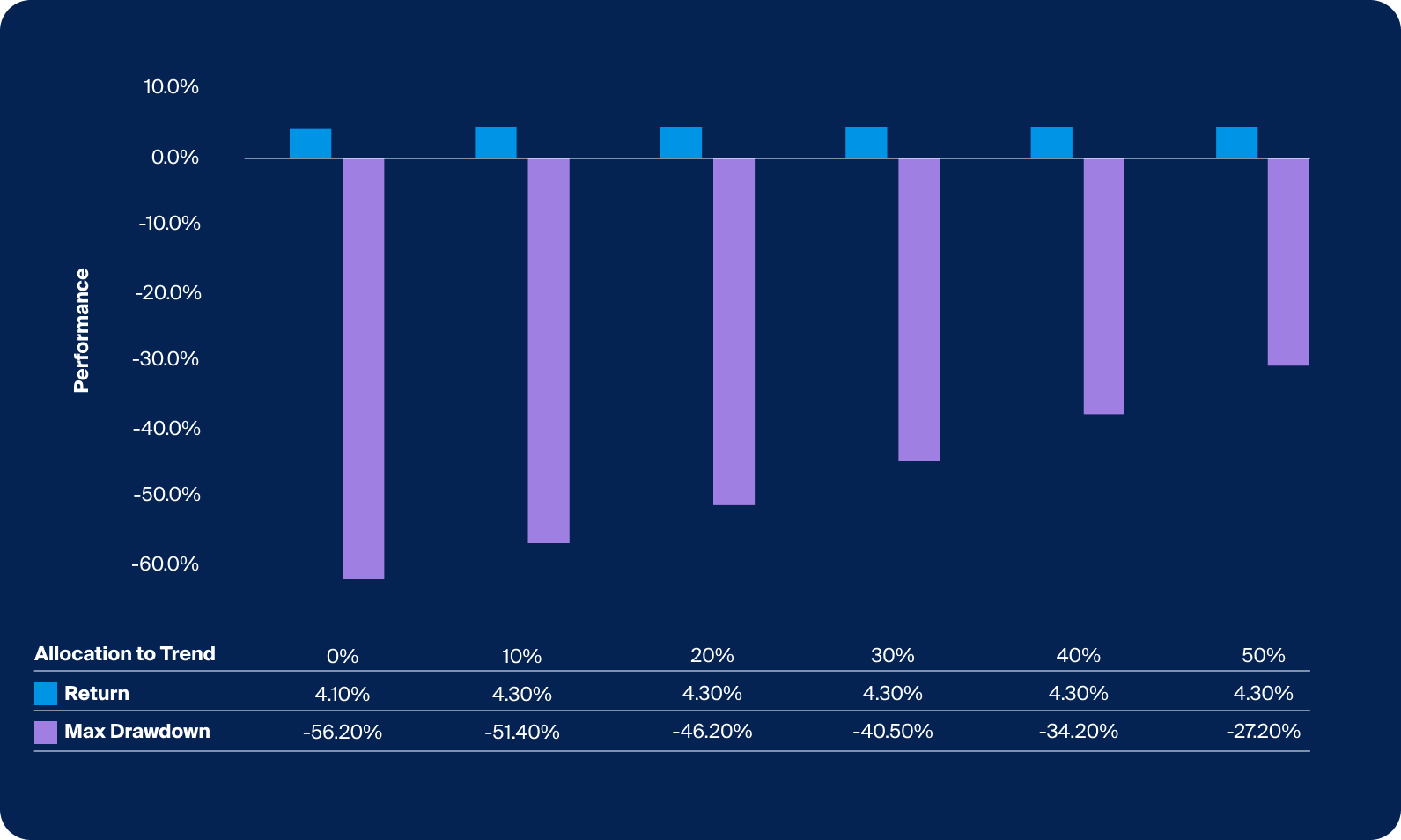

Trade-Offs of Trend-Following Strategies

Now that we have shown the potential of trend following as a differentiated source of return, let’s explore its potential role in an equity portfolio and its potential capacity to mitigate risk without sacrificing overall return. Below, we show a variety of allocations to both trend-following strategies and global equities, rebalanced on a quarterly basis in incremental allocations of 10% up to 50%. It’s clear that trend following’s diversifying properties establish not only an incremental increase in overall return but a material benefit to capital preservation, marginally across allocation sizes. In tempering volatility and drawdown, investors would have historically enjoyed a smoother ride with an allocation to trend-following funds.

Source: Bloomberg, Venn, MSCI ACWI Index, Trend represented by Barclay CTA Index, allocations rebalanced quarterly, as of December 2022.

We show a variety of allocations to both trend-following strategies and global equities, rebalanced on a quarterly basis in incremental allocations of 10% up to 50%. It’s clear that trend-following’s diversifying properties establish not only an incremental increase in overall return but a material benefit to capital preservation, marginally across allocation sizes. In tempering volatility and drawdown, investors would have historically enjoyed a smoother ride with an allocation to trend-following funds.

Given the uncertainty surrounding global equities, historical performance may suggest that a greater allocation to trend-following strategies could provide an additional layer of diversification to traditional portfolios, as they seek to provide a calmer ride through volatile markets.