Last week, the U.S. Federal Reserve (Fed) took the broadly expected step of raising interest rates for the first time since 2018 to attempt to rein in rampant inflation. The 25-basis point (bps) hike, while small, is significant as it marks a potential shift to a tightening regime that may set us on the path towards a more normalized approach to monetary policy. At the same time, we have seen a resurgence of COVID-19 cases in Asia that threatens to disrupt already fragile supply chains, Russia’s continued incursion of the Ukraine continues to threaten and destabilize both the geopolitical and global economic landscape. Taken together, these events have impacted markets from a macro perspective, potentially ushering a forward return environment that may be driven more by macroeconomic factors than it has been in recent history. Against such an economic backdrop, global macro hedge funds may provide a diversification benefit to offset volatility and the lasting impacts of global uncertainty.

Revisiting Global Macro

Before we dive into the potential diversification benefits of global macro hedge funds, it is worth revisiting what they are. A global macro hedge fund is generally defined as a strategy that seeks to take directionally long or short exposures to different macroeconomic and geopolitical factors, including but not limited to, interest and foreign exchange rates, political events and international relations, essentially focusing on the systematic risk of markets.1 They can employ discretionary or systematic styles, and may utilize fundamental or technical inputs to alpha generation from the exposure to different risk premia, or betas.2 Given global macro’s historical ability to deliver positive absolute returns in prior crises, such as the credit crisis, tech bubble burst and pandemic sell-off3, many investors seek exposure to global macro as a way to diversify equity market risks.4 Given the confluence of macroeconomic and geopolitical risks impacting equity markets, we are again seeing renewed interest in macro hedge funds by advisors.

Seeking To Diversify Equity Market Risk With Global Macro

Effective diversifiers are investments that when added to a portfolio, either increase the expected return per unit of risk, or reduce a portfolio’s overall risk, leaving expected return unchanged.5 The historical performance of global macro hedge funds highlights how this strategy can potentially do both.

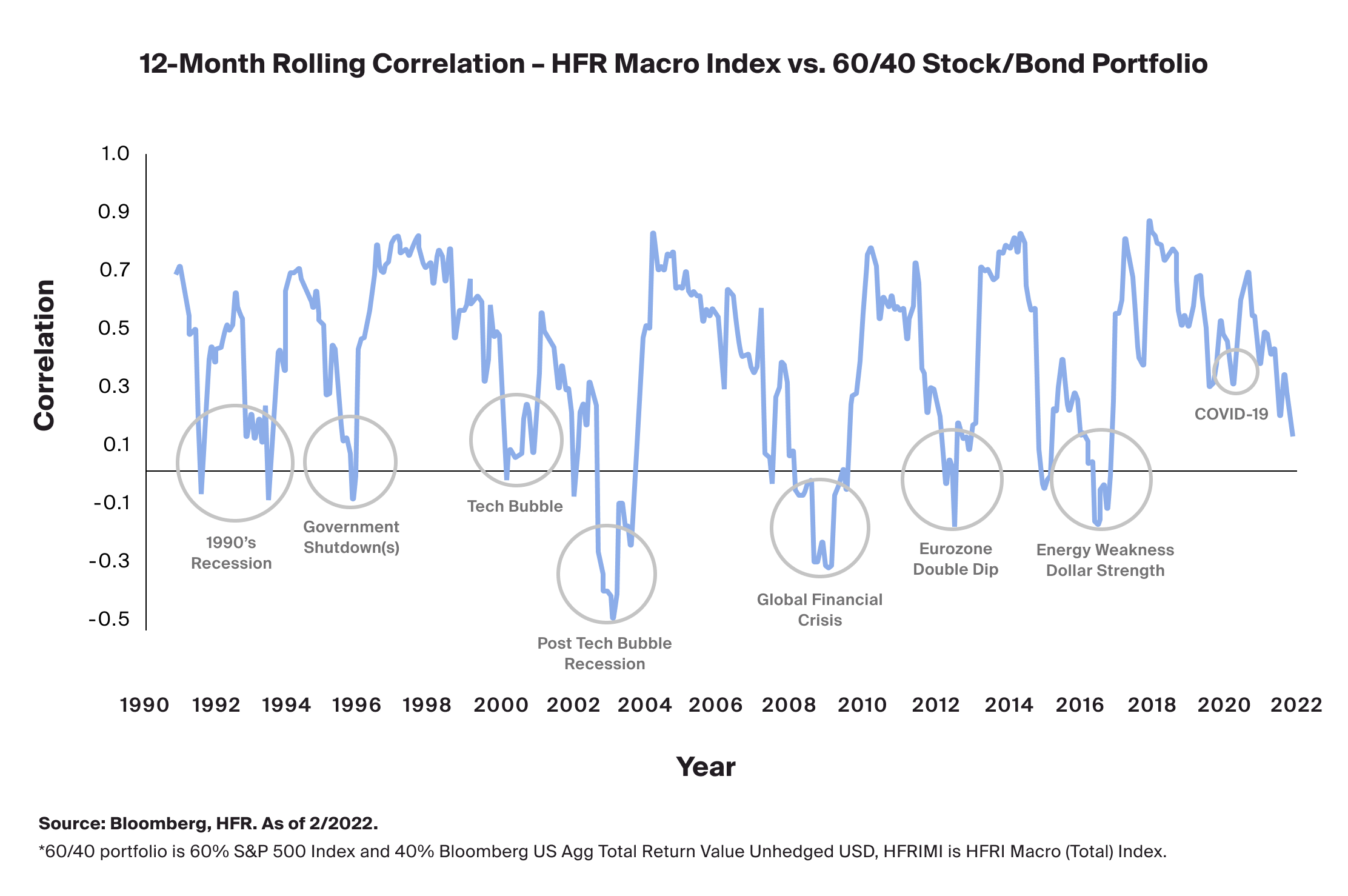

First, looking at historical correlations of global macro hedge funds relative to the 60/40 stock/bond portfolio over the last 30 years, we can see that in periods of crises, correlations have declined and moved toward zero. This divergence in performance indicates the diversification benefit of global macro strategies. In some instances, correlation has not only declined, but it has turned negative, allowing global macro hedge funds to potentially add to a portfolio’s overall return while value of the 60/40 stock/bond portfolios would decline.

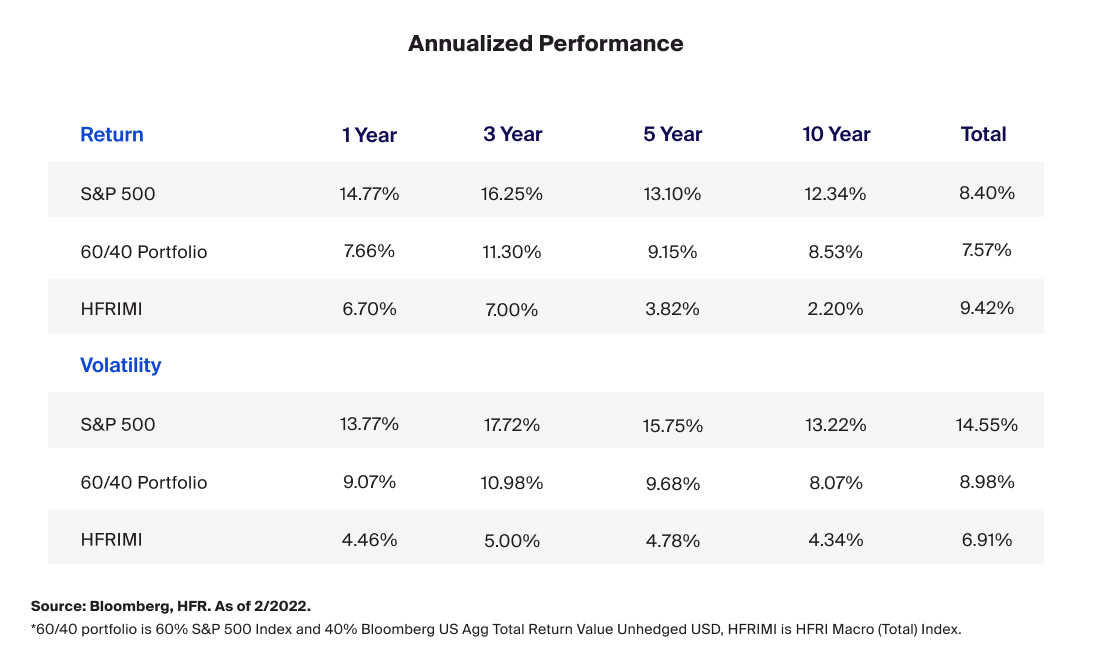

From a risk and return perspective, we can look to the below table to notice that over the entire period, global macro hedge funds returned more per annum than both the S&P 500 and the 60/40 stock/bond portfolio with less risk. It is interesting to note that over the past 5 and 10 years, returns from global macro hedge funds have been challenged, and this is generally accepted to be a factor of significant monetary policy accommodation by the Fed following the Global Financial Crisis.6 The Global Financial Crisis is believed to have dampened the volatility and dispersion of risk assets, thereby dulling the impact of macroeconomic return and the ability of global macro hedge funds to deliver alpha. Regardless, as a long-term strategic allocation, global macro hedge funds may have enhanced the return of the 60/40 stock/bond portfolio.

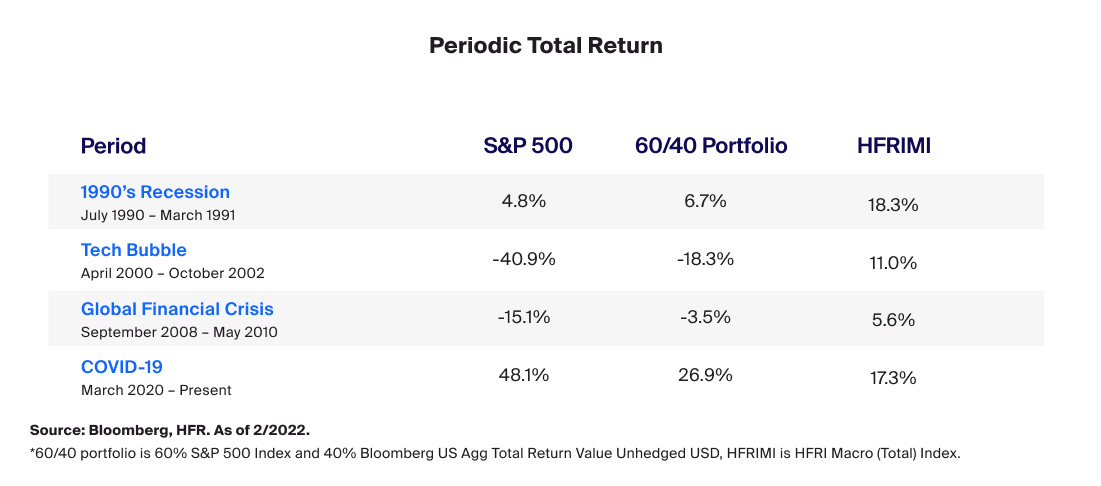

Expanding our analysis, we looked at 4 periods of extreme market stress – the 1990’s recession, the burst of the tech bubble, the GFC and the COVID-19 pandemic. In each instance, global macro hedge funds delivered a positive absolute return, as well as a positive relative return when compared to the S&P 500 and the 60/40 stock/bond portfolio.

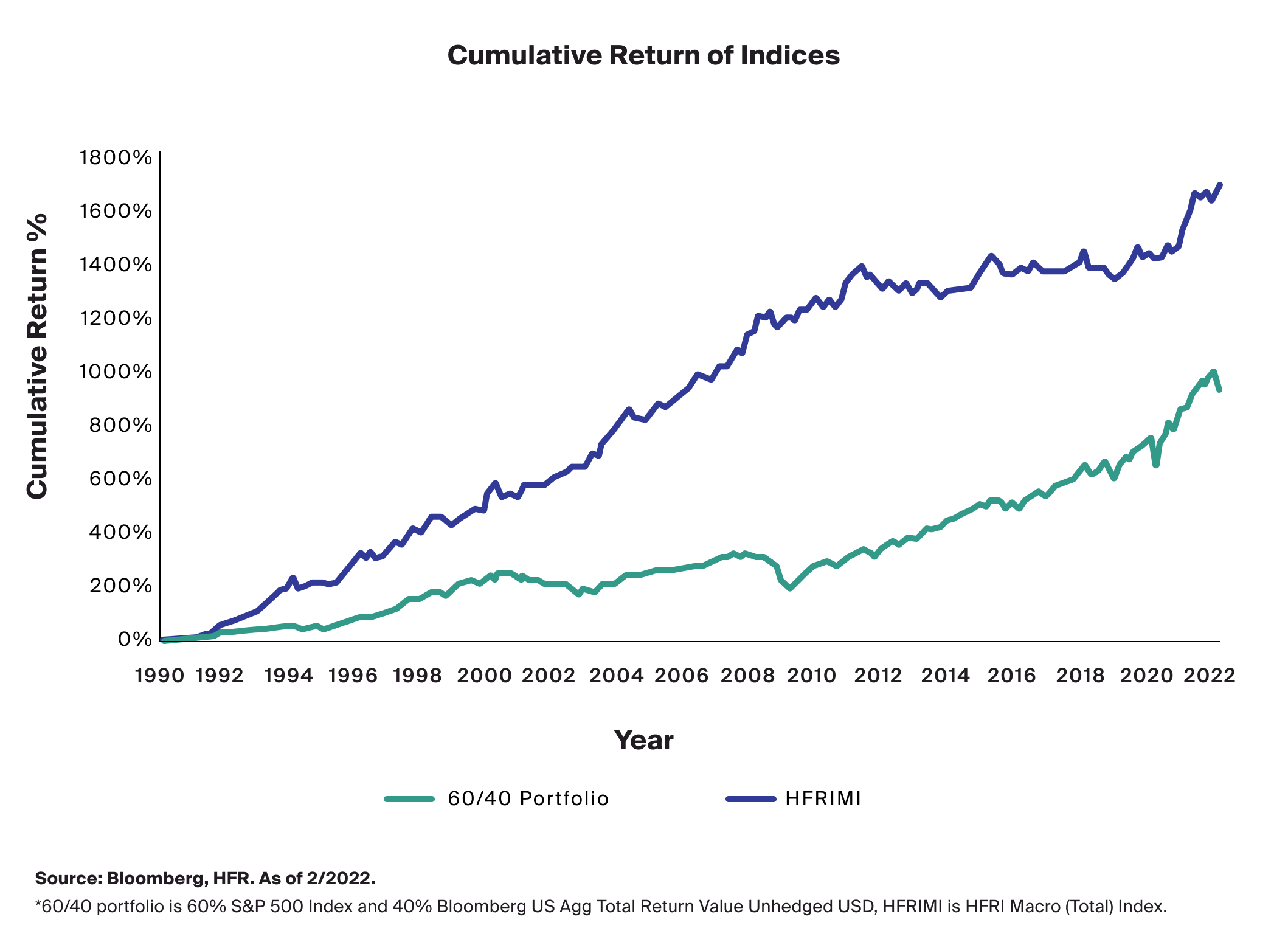

Finally, when looking at the cumulative return of global macro hedge funds relatively, we can see two important observations. First, from 2010 until early 2020, global macro hedge funds traded sideways. As mentioned above, this is generally accepted to have been due to the dampening of macroeconomic policy and instruments to the detriment of this strategy. But more importantly, the second observation is that since 2020 when the world was upended by the pandemic, the performance of global macro hedge funds has once again moved higher. This is likely due to the shift mentioned in the opening to a market more driven by macroeconomic drivers on the back of the normalization of monetary policy, as well as the rise in geopolitical events that influence the overall market.

From this analysis, we can see that global macro hedge funds have the potential to diversify the risk and enhance the return of the 60/40 portfolio and may be a valuable tool for portfolios in times of equity market stress.