Secondaries have become increasingly popular for private equity LPs and GPs to seek liquidity.1 Now, thanks in part to recent instability in public markets, individual investors with capital to spare may also benefit from this evolving asset class.

So far in 2022, uncertainty across markets—caused by persistently high inflation and monetary tightening2—has prompted public market selloffs and pricing adjustments in private markets.3 Subsequently, institutional portfolios appear to be in a state of flux and imbalance.4 Overallocated to private funds and searching for liquidity, institutional limited partners (LPs) are turning to the secondary market to help bring their allocations back in line.5 Meanwhile, a mediocre exit environment has the potential to motivate general partners (GPs) to initiate their own secondary deals.6 In turn, individual investors, who have historically underallocated to private equity, could seek to take advantage of the current dislocation in secondary markets by stepping up as buyers and providing liquidity to their institutional counterparts.

In this piece we explore the market dynamics that may be driving this dislocation and the conditions that could potentially prolong this window of opportunity for secondaries buyers.

The Secondary Market’s (Re)Balancing Act

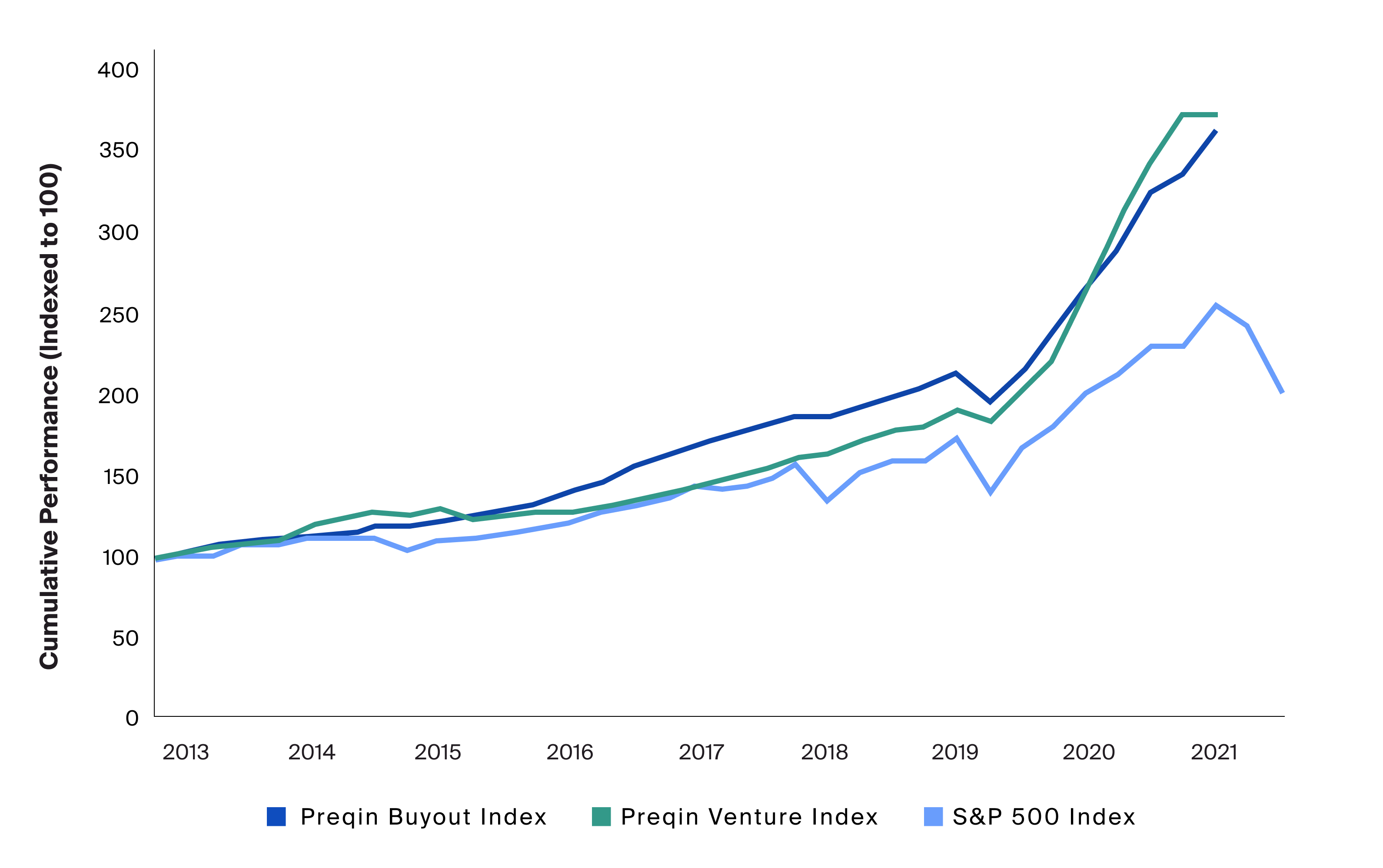

Historically, LPs looking to rebalance their portfolios have provided the bulk of supply in the PE secondary market.7 The pressure on LPs to recalibrate their portfolios tends to be particularly strong when private equity outperforms public markets8— and in principle, even stronger when already underperforming public markets sell off further.9 Such a scenario can potentially create a seismic imbalance in asset allocations, leaving private equity allocations higher as a proportion of total portfolio value than targeted (or permitted, in some cases). This tension arises especially when investors’ portfolios are constrained by strict institutional mandates and risk management requirements.10 We’ve recently seen such an environment develop: since 2013, private equity broadly outperformed public equities, generating a 17.3% annualized return as measured by the Preqin Private Equity Index, compared to 12.6% for the S&P 500 index.11 When public equity markets fell dramatically in the first half of 2022, the existing imbalance between the two broad asset classes within portfolios was exacerbated.

Source: Bloomberg, S&P 500 index represented by SPX, as of 6/30/2022; Preqin, Buyout represented by the Preqin Buyout Quarterly Index, Venture represented by the Preqin Venture Quarterly Index, as of 12/31/2021.

Since 2013, private equity broadly outperformed public equities, generating a 17.3% annualized return as measured by the Preqin Private Equity Index, compared to 12.6% for the S&P 500 index.[1]

Preqin; Bloomberg, as of 12/31/2021.

This growing disparity in the first half of the year was already matched with a surge of LPs rushing into the secondary market to sell their private equity interests. LP-led transaction volume ballooned to $33 billion through the first half of 2022, an increase of 74% from the same time last year.12 Fundamental market theory suggests that such an increase in supply without a similar growth in demand typically increases pricing power for buyers and may lead to a fall in secondary pricing.13

On top of the record LP-led transaction volume in the first half of the year, “excess” private equity holdings may have yet to hit the secondary market as LPs wait on the sidelines due to valuation uncertainty.14 GPs typically provide valuation marks to their LPs with a two-quarter lag, causing a subsequent delay in the reporting of broader private equity holdings.15 As a result, some investors have held off on rebalancing, believing the overallocation issue may rectify itself if private equity valuations follow public market prices down,16 as they have tended to do in the past.17

Yet, for those institutions still waiting to rebalance their portfolios, the issue may not be alleviated by a significant enough markdown in private equity. Early signs indicate Q2 2022 marks will be flat to slightly down—nowhere near the 20.6% drawdown in the S&P 500 in June 2022 from its all-time high in December 2021.18 With potential clarity around new and only modestly lower valuations for their private equity holdings, these institutions may become more comfortable transacting on the secondary market. More LPs selling stakes in the secondary market may mean even more favorable conditions for buyers ahead.

Slowing Exit Environment: GPs May Look to the Secondary Market

The same widespread uncertainty driving this relative glut in LP-led transactions may also have the potential to drive up GP-led transaction volume. Even before the recent inflation-triggered market turmoil, GP-led secondaries had grown to nearly half of total annual secondary volume, as GPs sought to leverage the secondary market as an alternative source of liquidity for exits and to fund continuation vehicles to keep higher-quality assets longer.19 In the current environment, a lack of attractive traditional exit opportunities may encourage GPs to seek interim liquidity from the secondary market at an even greater pace than in recent years.

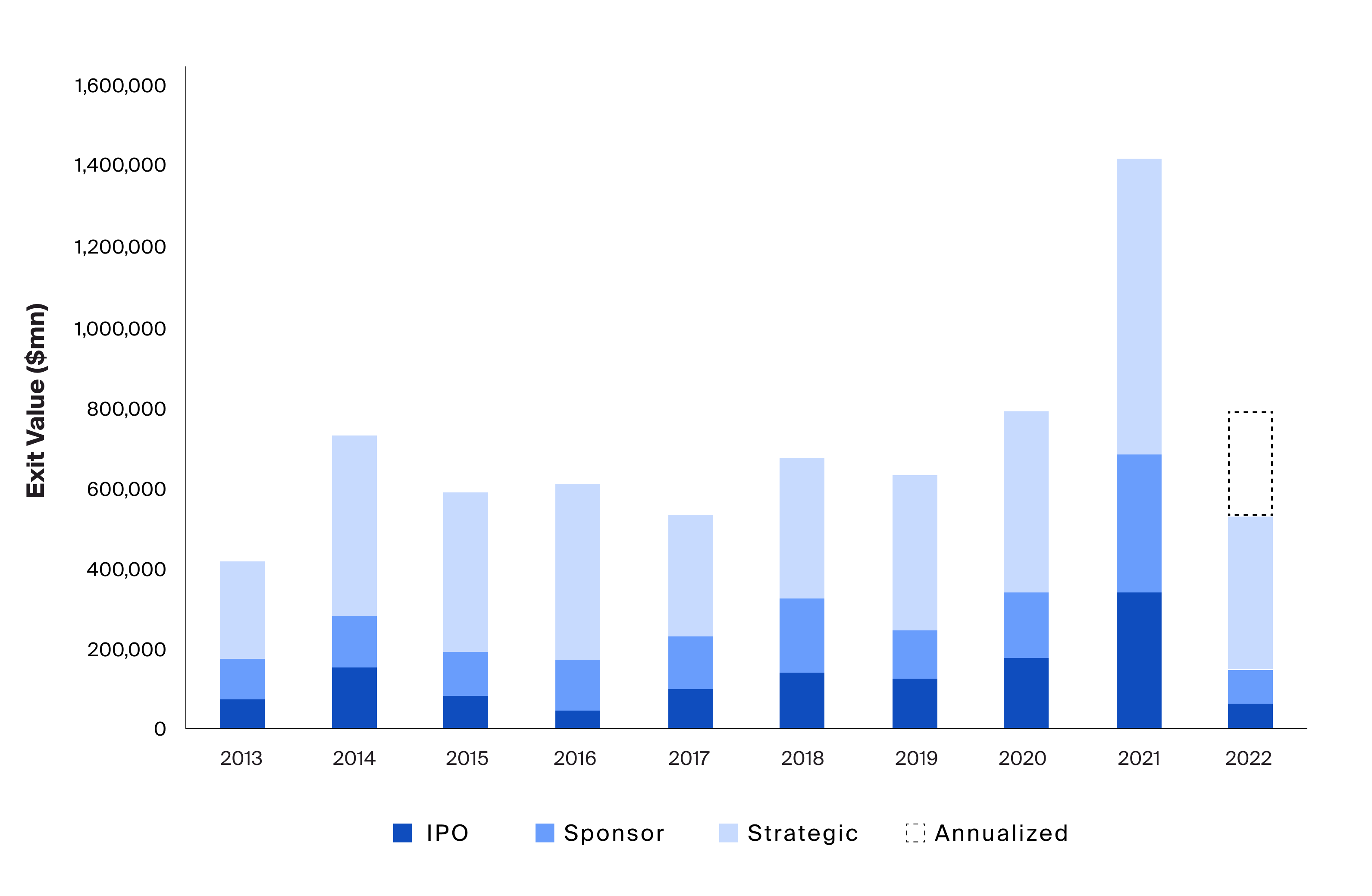

Indeed, ongoing market uncertainty may be leading to hesitation from both buyers and sellers of private companies and contributing to a significant decline in overall PE exit activity. IPO activity has declined dramatically, falling 76% on an exit value basis compared to the same time last year (Exhibit 2). Sponsor-to-sponsor exit volume has also fallen, down 62% (Exhibit 2) from the same time last year as higher interest rates have tempered purchases by fellow private equity funds.20 Exits to strategic buyers have been less affected thus far but are still down 28% from the same time last year (Exhibit 2). M&A activity may slow meaningfully as well with investors increasingly demanding that companies curb capital spending to improve balance sheets and return cash to shareholders.21

Source: Preqin, Buyout and Venture exit data, IPO represented by exit type IPO, Sponsor represented by exit type Sale to GP, Strategic represented by exit type Trade Sale and Merger, as of each fund’s last reporting date.

Exits to strategic buyers have been less affected thus far but are still down 28% from the same time last year.

In this environment, GPs may be reluctant to sell or IPO their prized assets at compressed multiples; many have instead chosen to extend fund durations or use continuation vehicles, which offer committed LPs the option to either lock in gains or continue investing in the same asset within a new fund.22

It turns out, when given the option to participate in a continuation vehicle, as many as 90% of LPs opted instead for liquidity during the first half of the year,23 a trend that may continue given the portfolio imbalances. With LPs opting out, GPs may need to turn to the secondary market to fund their continuation vehicles. Since GPs are more motivated to extend their holding period only for assets which have, in their view, meaningful additional upside potential, selectivity regarding underlying assets, as well as asset quality, in the secondary opportunity set may also be increasing as these continuation funds proliferate.

It’s also notable that when GPs simply update terms and extend the length of their funds due to a lack of attractive exit options, the potential for delayed distributions may also incentivize LPs to sell on secondary markets, as a way to cash out when they originally anticipated.24

Read more about the reasons for the longer-term growth in GP-led secondary volume in “The Evolution of the Private Equity Secondary Market.”

A Potential Entry Point for Individual Investors

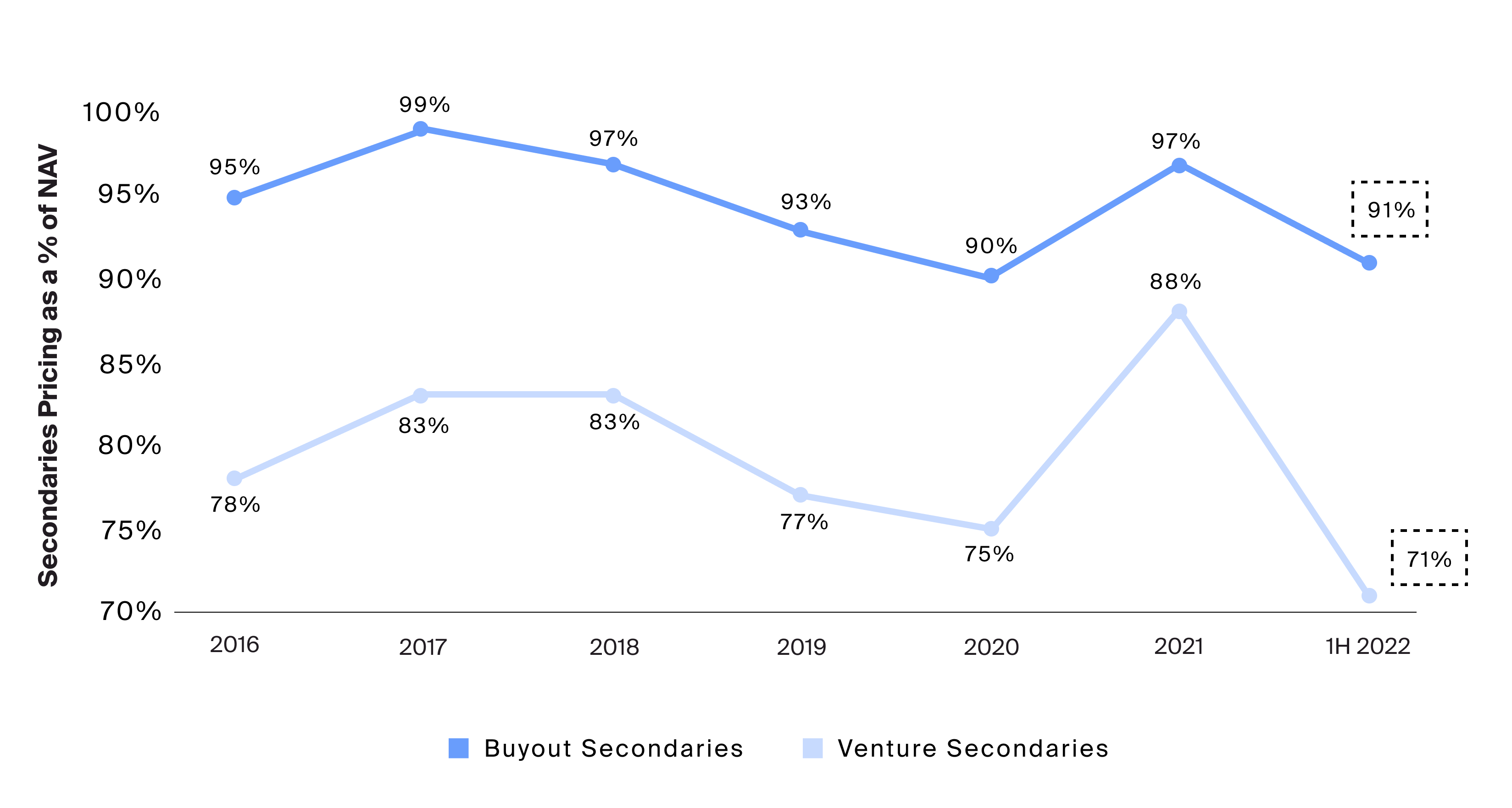

The combination of the aforementioned factors has the potential to drive up secondary transaction supply from both LPs and GPs. This increase in supply has already influenced pricing, with discounts steepening in the first half of 2022 and secondary transaction pricing falling to the lowest levels in recent years (Exhibit 3).

Source: Jefferies 1H 2022 Global Secondary Market Review, July 2022.

The combination of the aforementioned factors has the potential to drive up secondary transaction supply from both LPs and GPs. This increase in supply has already influenced pricing, with discounts steepening in the first half of 2022 and secondary transaction pricing falling to the lowest levels in recent years.

Pricing for secondary venture transactions has fallen even more dramatically in the first half of the year as buyers have pulled away from these higher-risk assets (Exhibit 3). While these earlier-stage companies often experience cash flow challenges, secondary buyers who choose to assume these risks may now have a temporary opportunity to gain exposure to these high-growth assets or funds at a significant discount.

How Long Might This Dislocation Persist?

Irrespective of the current opportunity, which may make investing in secondaries attractive in the near-term, secondary PE funds may offer unique benefits in any market environment. It is also worth noting that secondary funds have provided a higher median IRR and lower dispersion of returns compared to their primary private equity fund counterparts.

Despite these potential advantages, secondaries investors must still take note of the common risks related to private equity investing. Notably, the potential performance of any private equity fund’s underlying portfolio companies is not guaranteed, and investors may still lose all or some of the capital they invest. Secondaries investments may also be relatively illiquid, particularly if they underperform and become less saleable on the secondary market. Investors in fund-of-funds or specialized secondary funds may also be charged two tiers of manager fees and expenses, which may limit overall performance.

Individual investors may now have temporary window of opportunity to scale up their private equity allocations at potentially attractive price points. The duration and the depth of this dislocation ultimately depends on the path of the economy. The confluence of continued economic uncertainty, persistently high inflation, and an aggressively hawkish Fed means greater downside is possible for public equity markets. Traditional exits may also continue to be unfavorable. As a result, catalysts appearing to drive the record secondary volume and the resulting market dislocation so far in 2022 may persist in the coming quarters.