We enter the third quarter of 2022 with a clearer understanding that inflation may not be as “transitory” as it was first labeled by some and subsequently recast by the Fed in December 2021.

Just how long might this environment last? To attempt to understand if our high inflationary environment (and the Fed’s hawkish stance) will sustain beyond external factors like COVID-19, related supply chain shocks and the invasion of Ukraine, we have looked to components and drivers of price growth with potentially longer term implications.

Given the pressures of today's unique blend of high inflation, a labor shortage, and rapidly rising interest rates, it may be time to re-evaluate traditional asset allocations that have been utilized more commonly in the low-inflation, easier monetary environment of the past. To understand the implications of this challenging environment, we examine previous periods of rising interest rates to assess how traditional fixed income has performed and discuss potential yield-generating alternatives such as direct lending, rate-linked notes and private real estate.

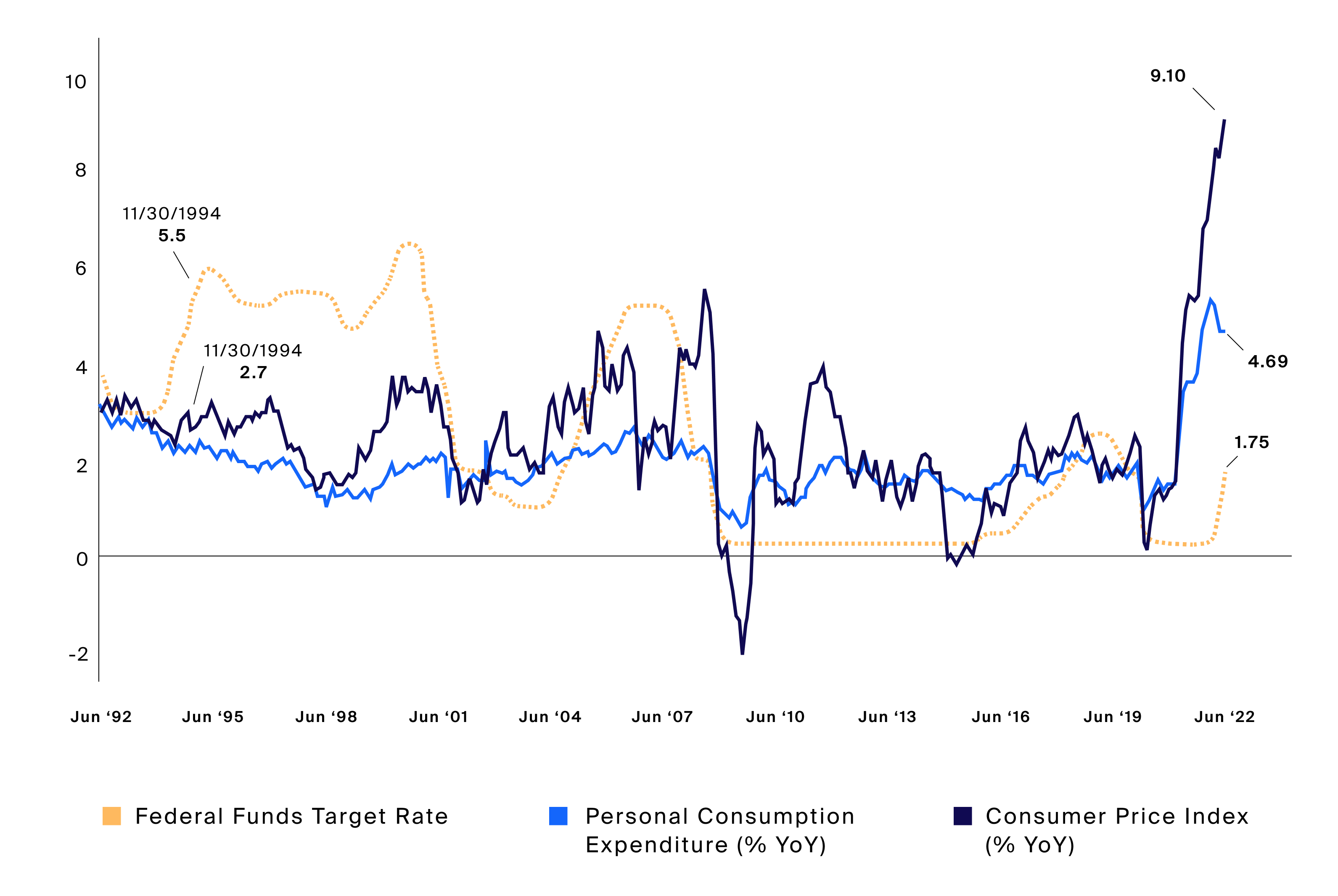

Source: Bloomberg, Federal Funds Target Rate represented by the FDTR Index, Personal Consumption Expenditure (% YoY) represented by the PCE CYOY Index, Consumer Price Index (% YoY) represented by the CPI CYOY Index as of 6/30/2022.

In June, following the 8.6% CPI reading, the Fed raised interest rates by 75 basis points, the largest single decision increase since 1994, when the benchmark rate was raised to 5.50% and CPI was just 2.7%.

In June, following the 8.6% CPI reading, the Fed raised interest rates by 75 basis points, the largest single decision increase since 1994, when the benchmark rate was raised to 5.50% and CPI was just 2.7% (Exhibit 1). The latest CPI print of 9.1% exceeds previous forecasts and potentially indicates that the Fed’s rate hikes may have proven ineffective in combating inflation thus far.

With the increase in July, CPI and price increases broadening beyond the highly volatile energy and food components, the Fed may be compelled to further accelerate its rate hikes. In fact, swap markets imply that market participants are now considering a 50% probability of the Fed hiking by 100 basis points in the upcoming FOMC meeting.1 For perspective, a 100 basis point rate hike would be the single largest increase since overnight rates were first utilized in the 1990s.2 While energy prices have fallen over the past month, it’s becoming more apparent that certain elements of inflation may be more difficult to slow down.

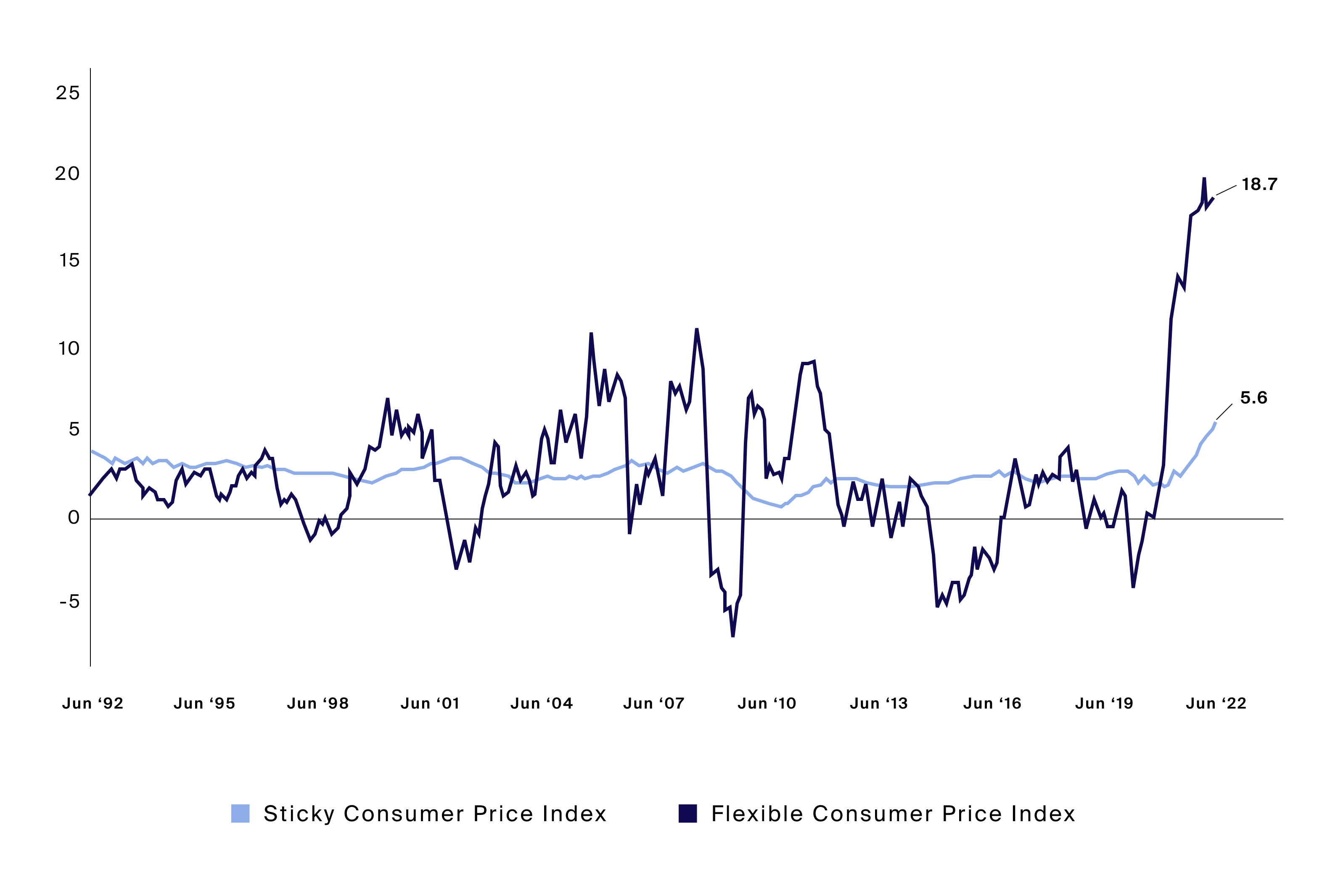

Source: Bloomberg, Sticky Consumer Price Index represented by the SCPIS12M Index, Flexible Consumer Price Index represented by the SCPIF12M Index, as of 6/30/2022.

“Flexible” components of CPI, comprised primarily of food and energy, make up approximately 30% of headline CPI and look to have peaked after surging from confounding supply-side shocks. However, Sticky CPI has risen 193 basis points from the start of the year, while Flexible CPI is up an additional 88 basis points in the same period following its first decline since its multi-decade high in March (Exhibit 2).

“Flexible” components of CPI, comprised primarily of food and energy, make up approximately 30% of headline CPI and look to have peaked after surging from confounding supply-side shocks.3

However, Sticky CPI has risen 193 basis points from the start of the year, while Flexible CPI is up an additional 88 basis points in the same period following its first decline since its multi-decade high in March (Exhibit 2). These “sticky” components, which include expenditures such as housing, medical care services and education, tend to be more forward-looking and may be more difficult to reign in.4 For example, rent tends to report with a multi-month lag and given typical year-long lease terms, will likely be a significant positive contribution to year-over-year inflation looking ahead.5 The rise in these components may reinforce price growth above the Fed’s target range, even if and when the price impact of supply chain disruptions alleviate and the Ukraine war deescalates.

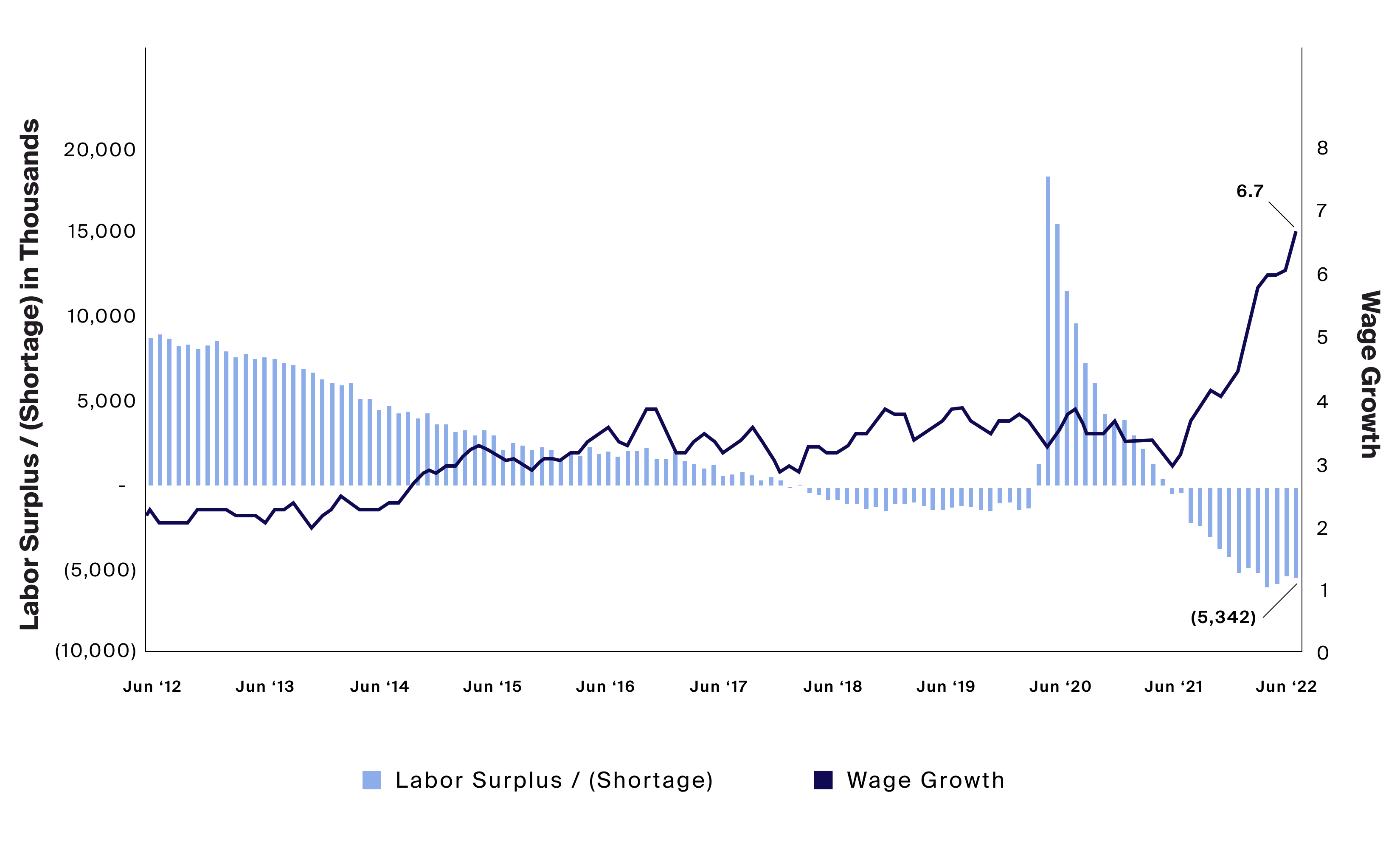

Source: Bloomberg, Labor Surplus / (Deficit) represented by the difference between the USUETOT Index and the JOLTTOTL Index, Wage Growth represented by the WGTROVER Index, as of 6/30/2022.

Wages are an input for company costs and continue to rise in unison with the largest labor shortage in decades – as calculated by taking the difference between total US unemployed workers in the labor force and total US job openings. As a result of this calculation, a negative value implies there is a shortage of unemployed workers in the labor force to fill jobs posted. Wage growth has accelerated 370 basis points since the labor shortage appeared in May.

Wages are an input for company costs and continue to rise in unison with the largest labor shortage in decades – as calculated by taking the difference between total US unemployed workers in the labor force and total US job openings. As a result of this calculation, a negative value implies there is a shortage of unemployed workers in the labor force to fill jobs posted. Wage growth has accelerated 370 basis points since the labor shortage appeared in May (Exhibit 3).

Although real wage growth (nominal wage growth less inflation) is still negative, accelerating wages may contribute to inflation in the medium term as short-term factors subside. This dynamic appears to have begun shifting as more and more companies, particularly early-stage firms and technology, have announced hiring freezes and even layoffs,6 resulting in the most recent 8-month-high initial unemployment claims of 251,000.7 However, the labor shortage driven by the substantial number of workers lost through the “Great Resignation” may require more time to work through. It should be noted that the labor shortage is particularly concentrated in non-professional and business services industries, like manufacturing, retail, leisure and hospitality.8

While some signs of weakness have appeared, the labor market as a whole has stayed positive, with the unemployment rate remaining at a historically low 3.6% as of June.9 The Fed’s dual mandate – price stability and maximum employment – dictates the utmost economic priorities of the central bank and may raise the possibility of deploying an extraordinarily hawkish policy to re-establish price stability, as the employment side of their mandate remains relatively undisturbed for the time being.

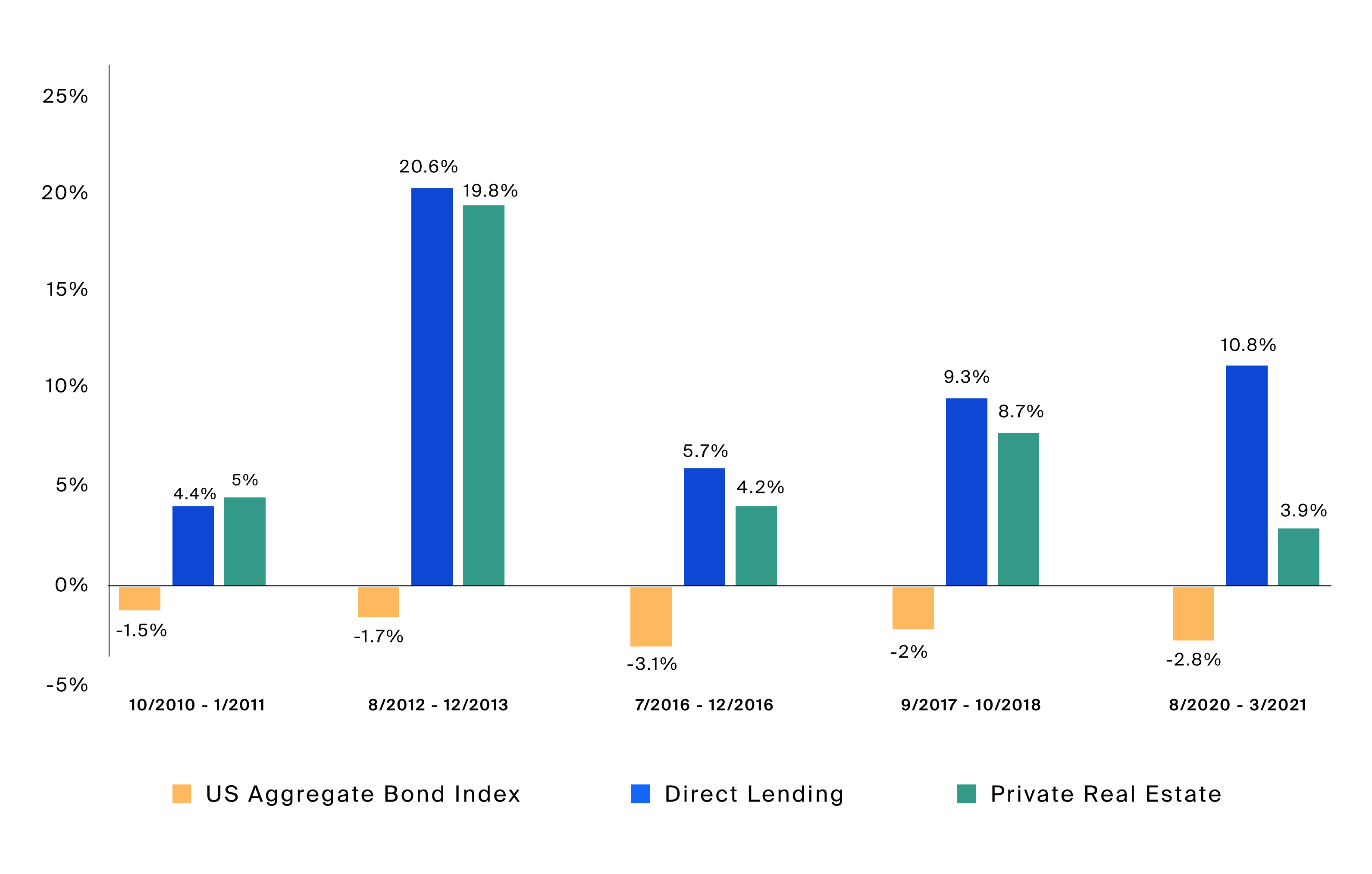

Source: Bloomberg, US Aggregate Bond Index represented by the LBUSTRUU Index, Direct Lending is represented by the CDLI Index, Private Real Estate represented by the NPPIODIV Index, rising rate environments represented by periods when the yield on the USGG10YR Index increased 100 bps or more, as of 6/30/2021.

Many investors have had less experience in navigating a rising rate and high inflation environment, after over a decade of relatively stable growth in equities and a thirty-year bull market (falling rates) for bonds. However, for brief periods of rising rates in the past decade, traditional fixed income investments have shown their weakness.

Many investors have had less experience in navigating a rising rate and high inflation environment, after over a decade of relatively stable growth in equities and a thirty-year bull market (falling rates) for bonds. However, for brief periods of rising rates in the past decade, traditional fixed income investments have shown their weakness (Exhibit 4). In today’s tumultuous market environment, traditional fixed income investments have suffered their largest losses year-to-date in over three decades, with more pain on the horizon if rates continue to increase as projected.

Direct Lending

As short-term rates are raised to combat inflation, floating-rate loans may benefit from coupons linked directly to floating reference rates (like SOFR or LIBOR) and are highly responsive to the Fed’s target rate. As a result, floating-rate loans may simultaneously supplement yield and provide a hedge against interest rate risk, unlike their traditional fixed income counterparts. Direct lending funds, which are typically comprised of secured loans to middle-market private companies, may offer investors exposure to floating-rate notes through various structures like traditional drawdown funds and perpetually offered non-traded BDCs.

Rate-Linked Notes

Some investors may be interested in seeking to capitalize on the potential for higher interest rates through more customized exposures to floating rate securities. Rate-linked structured notes may offer the ability to gain levered underlying exposure to floating reference rates (like SOFR or LIBOR) while potentially providing a stream of coupon payments. These strategies may outperform traditional fixed income investments in a scenario where high nominal rates continue to rise. Other rate-linked notes may involve directional positions tied to the steepening of the yield curve, yet may involve risks should the credit market improve and yields fall.

Private Real Estate

Private real estate has historically proven to be a strong hedge to inflation.10 This asset class may offer investors a differentiated return stream, particularly for sectors in real estate that may be positioned to take advantage of tax incentives like qualified opportunity zones or secular trends like the shift to e-commerce and the exodus to less densely populated areas. Private real estate income has historically increased faster than inflation,11 driven by the ability to increase rental rates through contractual adjustments in leases.

Given the potential for inflation to remain above the Fed’s target range and the possibility of aggressive money tightening continuing to drive up interest rates, it may be a good time for financial advisors to revisit their asset allocations. Alternatives may be potentially appealing to those traditional fixed income investors who may be vulnerable in this new macro environment.