Hedge funds have long been utilized by investors to seek to access and unlock several potential key benefits when creating a well-diversified portfolio. To start, they may have the ability to provide positive returns in both rising and falling equity and bond markets.1 Additionally, they may also allow investors to access a variety of uncorrelated returns through exposure to non-traditional or idiosyncratic risk factors, resulting in alpha.2 Given this, they may help to improve the return consistency of an overall portfolio, as well as provide protection against drawdowns in the broader market. Below, we will investigate how hedge funds have performed versus the global equity markets since the turn of the century to highlight the potential for these benefits to be realized by investors.3

Same Destination, Different Journey

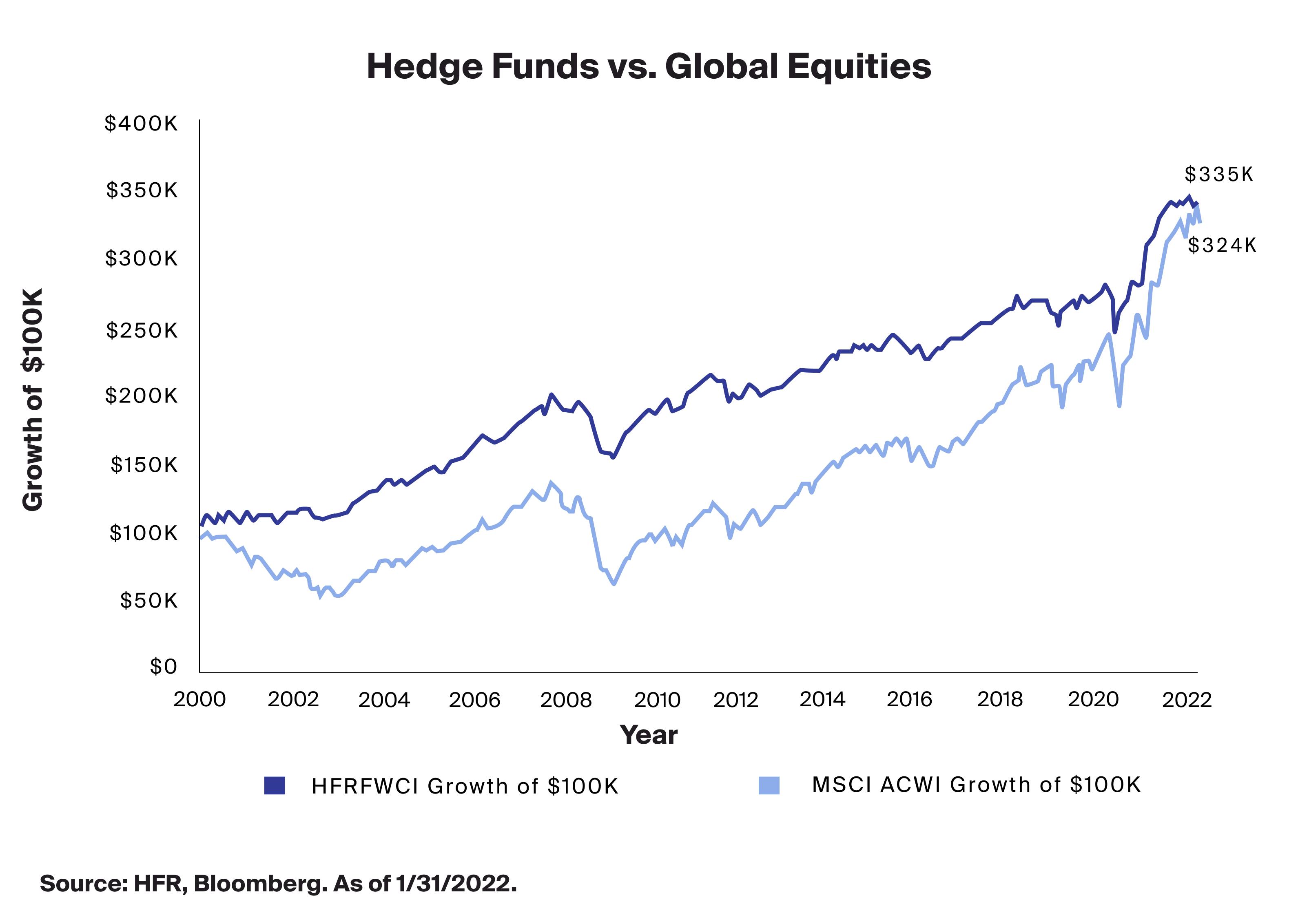

Over the past 22 years both hedge funds, as represented by the HFR Fund Weighted Composite Index (HFRFWCI), and global equities as represented by the MSCI All Country World Index (ACWI) returned almost 3.5 times their initial value. The below chart however, highlights that for most of the observed period, hedge funds outperformed global equities. This advantage was generated in part from lower drawdowns in times of financial crisis, like the GFC of 2008, combined with a lower level of overall volatility of hedge funds relative to equities. These factors appear to have contributed to hedge funds’ ability to maintain returns through the end of Q1 2021, when global equity returns closed the lead on hedge funds due to the accelerated recovery from the depth of the pandemic.

Dispersion Was a Factor Driving the Difference

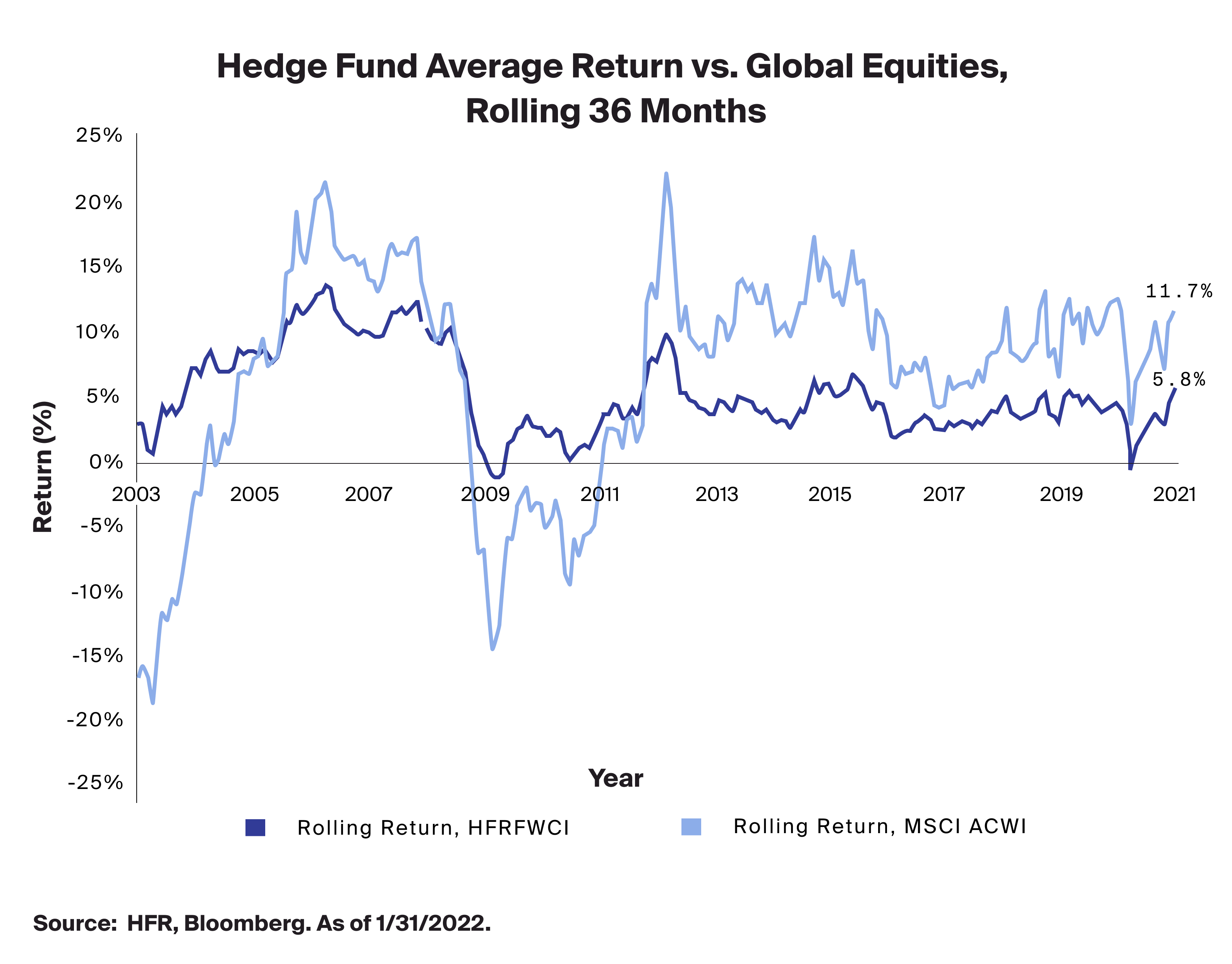

As mentioned above, the lower overall volatility in hedge funds seems to have accounted for the smoother performance trajectory in comparison to global equities. If we break down the returns into a rolling 36-month return series, we can see just how pronounced this performance dispersion was. As seen in the chart below, equities started emerging from the Dot-Com Bubble in the early 2000’s with a significant drag, lower than -15%. Looking to the performance of hedge funds over the same time, we note that there were only two periods in which performance was overtly negative. The first dip was at the bottom of the Global Financial Crisis (GFC) in February 2009 and the second, at the depths of the pandemic in April 2020. In both cases negative performance reached a mere -1.4% and -0.2% respectively. This compares favorably to global equities, which also experienced two periods of negative performance, but did so for both a longer period and to a much greater extent. This downturn was -18.9% and -14.6% respectively.

The exploration of this data leads us to believe that over a rolling 36-months, hedge fund investors may not have lost money if they held an initial investment in the HFRIFWCI, though it must be noted that this is not an investable benchmark. Because this is not an investable benchmark, this brings to light the importance of manager selection when building out a hedge fund portfolio. In addition, the lower dispersion in rolling 36-month returns of hedge funds should have helped dampen overall portfolio volatility.

Persistently Lower Volatility

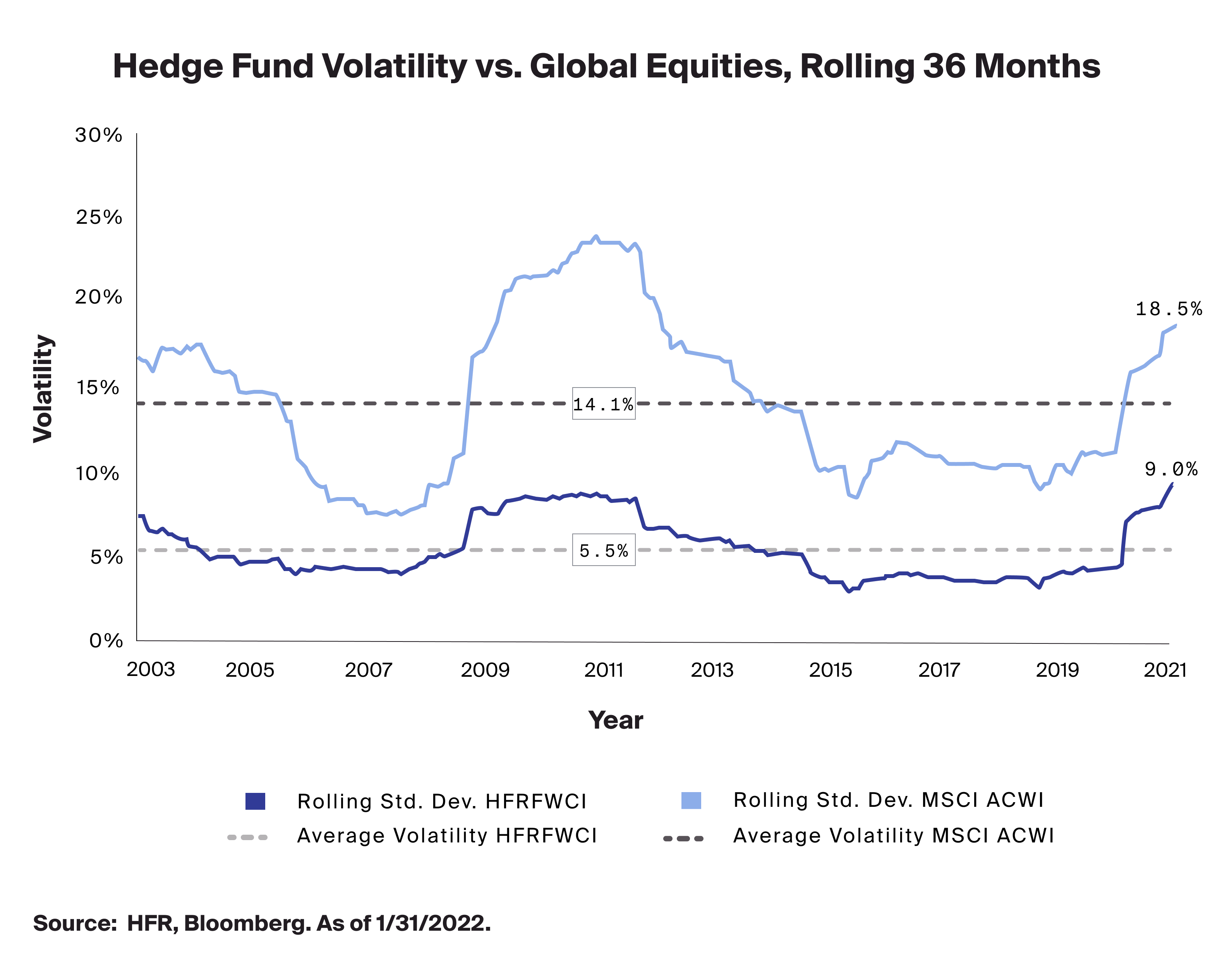

Using the same time period, we also looked at the volatility of hedge funds with respect to global equities. The volatility of hedge funds was consistently lower than that of global equites with an average of 5.5% in comparison to global equities which saw 14.1%. This is an average relative volatility difference of 8.6%, which is quite extensive. It is also interesting to note that the highest volatility level was displayed in global equities during January 2011, when the MSCI ACWI index saw a return of 24.1%, almost three times greater than that of hedge funds over the same time. As mentioned above, this lower overall volatility experienced in hedge funds might be attributed to the diversification benefit that hedge funds are generally equipped to provide.

Diversification of Systematic Risk

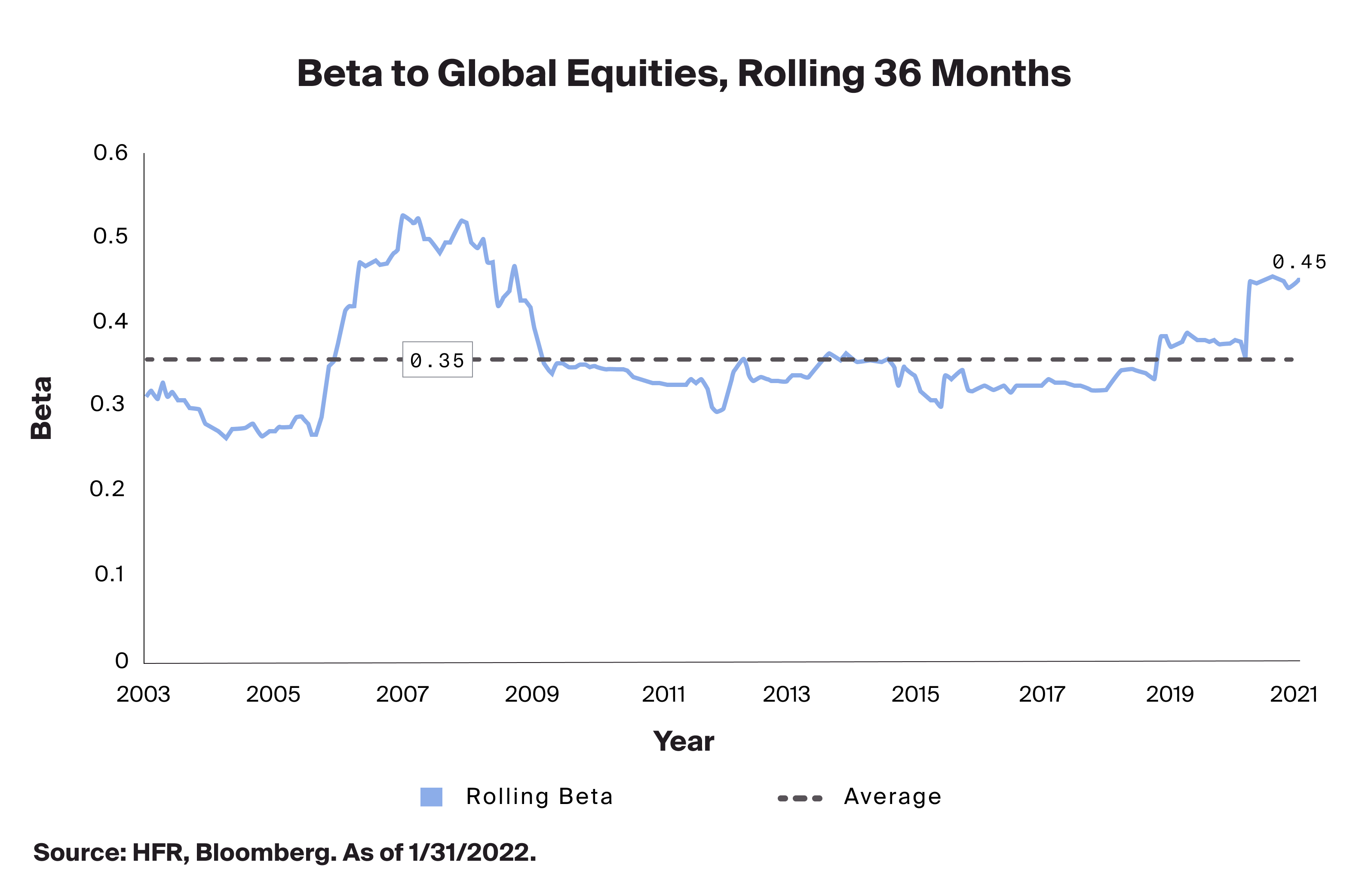

The last factor we look at to compare hedge funds and global equities is the beta. Beta is a commonly used measurement that quantifies how closely an asset moves relative to the broader market or a specific index comparison. In looking at the beta between hedge funds and global equities it may be valuable to investigate how hedge funds can further diversify the systematic risk associated with the broader markets. A beta of less than 1.0 generally indicates that hedge funds tend to be less volatile than that of global equities, which we have already addressed by noting overall volatility is lower historically in hedge funds. In addition, adding hedge funds to a portfolio that already includes global equities may realize a diversification benefit and a reduction of broader market volatility.

This analysis also seeks to address a common misconception that hedge funds should, in all market conditions, outperform equities. Given the lower overall volatility, and sub 1.0 beta, it would be difficult for hedge funds to persistently outperform global equities outside of a risk-adjusted basis. This is not to suggest that hedge funds are incapable of outperforming equity, rather that a typical expectation of a hedge fund is to provide consistent risk adjusted return in all market conditions.

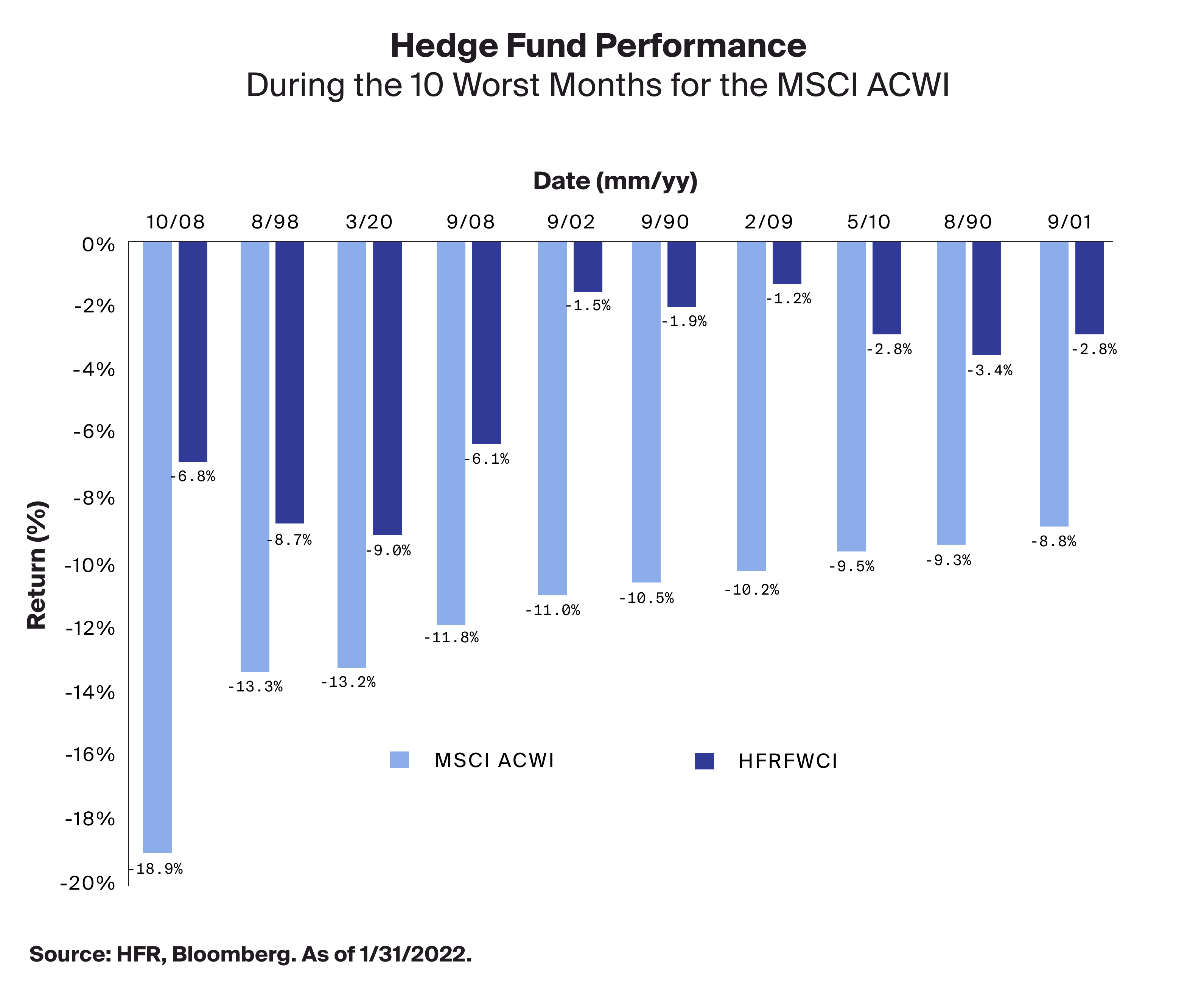

All Together Now

So, what does it all mean? If we look at the top 10 drawdowns in the MSCI ACWI relative to the performance of hedge funds, we see that in each of these periods, hedge funds outperformed on a relative basis, albeit with negative absolute returns – the drawdowns were shallower in each instance. This highlights a strongly held belief in investing, that diversification may be the only free lunch. While hedge funds are not a panacea for overall stock market volatility, they can be a powerful diversification tool that may enhance the return of a portfolio as well as provide a diversification benefit that may dampen overall volatility.

Given the outlook for equities, and the above analysis, it may be a good time for financial advisors to consider an allocation to hedge funds, in order to realize the extensive benefits that they may provide.