Global Macro Outperforms on Macroeconomic Uncertainty

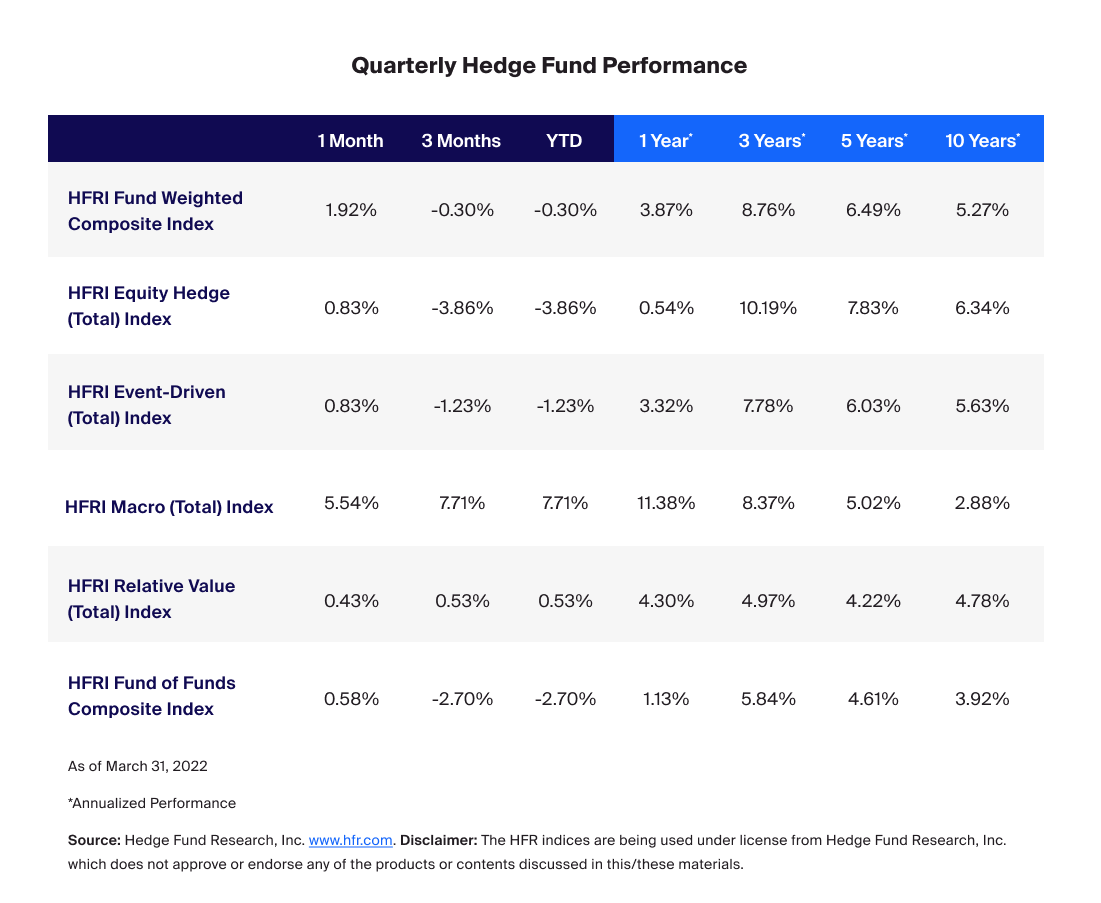

The first quarter of the new year saw broad declines across risk assets with stocks and bonds ending the period lower. This marked a reversal from the start of the year when the S&P 500 Index and Down Jones Industrial Index hit record highs on the back of the continued economic recovery from the pandemic.1 Inflation continued to trend to the upside, as the Bureau of Labor Statistics Consumer Price Index hit 7.9% in February, the highest level in 40 years.2 Concern that the U.S. Federal Reserve would have to tighten monetary policy faster and higher than previously expected drove much of the risk-off sentiment.3 Against this backdrop of uncertainty, heightened volatility and ongoing geopolitical tensions, hedge funds decline modestly with the HFRI Fund Weighted Composite Index (HFRI FWCI) dropping -0.30%. The represented relative outperformance versus the S&P 500 Index and the Bloomberg U.S. Aggregate Bond Index which declined -4.95% and -5.93% respectively.

Equity Hedge: The HFRI Equity Hedge (Total) Index detracted -3.86% over the first quarter, as the index was unable to recover early losses in both Technology and Healthcare sectors, as well as Fundamental Growth, despite gains in Equity Market Neutral and Energy & Basic Materials.

Event-Driven: : The HFRI Event-Driven (Total) Index detracted -1.23% over the first quarter, as losses in Activist and Special Situations overcame gains in Distressed/Restructuring and Merger Arbitrage.

Macro: The HFRI Macro (Total) Index added +7.71% in the fourth quarter, recording one of its best quarterly gain on record as market volatility driven by inflation and interest rate tightening, coupled with geopolitical tensions created dislocations and dispersion in fixed income, equities and commodities. Gains were led by Commodities, Systematic Directional and Trend Following with no significant detractors over the quarter.

Relative Value: The HFRI Relative Value (Total) Index added +0.53% in the first quarter, as the U.S. Treasury yield curve inverted creating opportunity in Yield Alternative and Volatility, as well as Fixed Income Asset Backed strategies.

Fund of Funds: The HFRI Fund of Funds Composite Index detracted -2.70% in the first quarter.