What Is Private Debt?

Broadly, private debt (or private credit) refers to loans that are privately negotiated between two parties as opposed to traditional syndicated bank loans or bonds issues that are more widely available to fixed income investors.

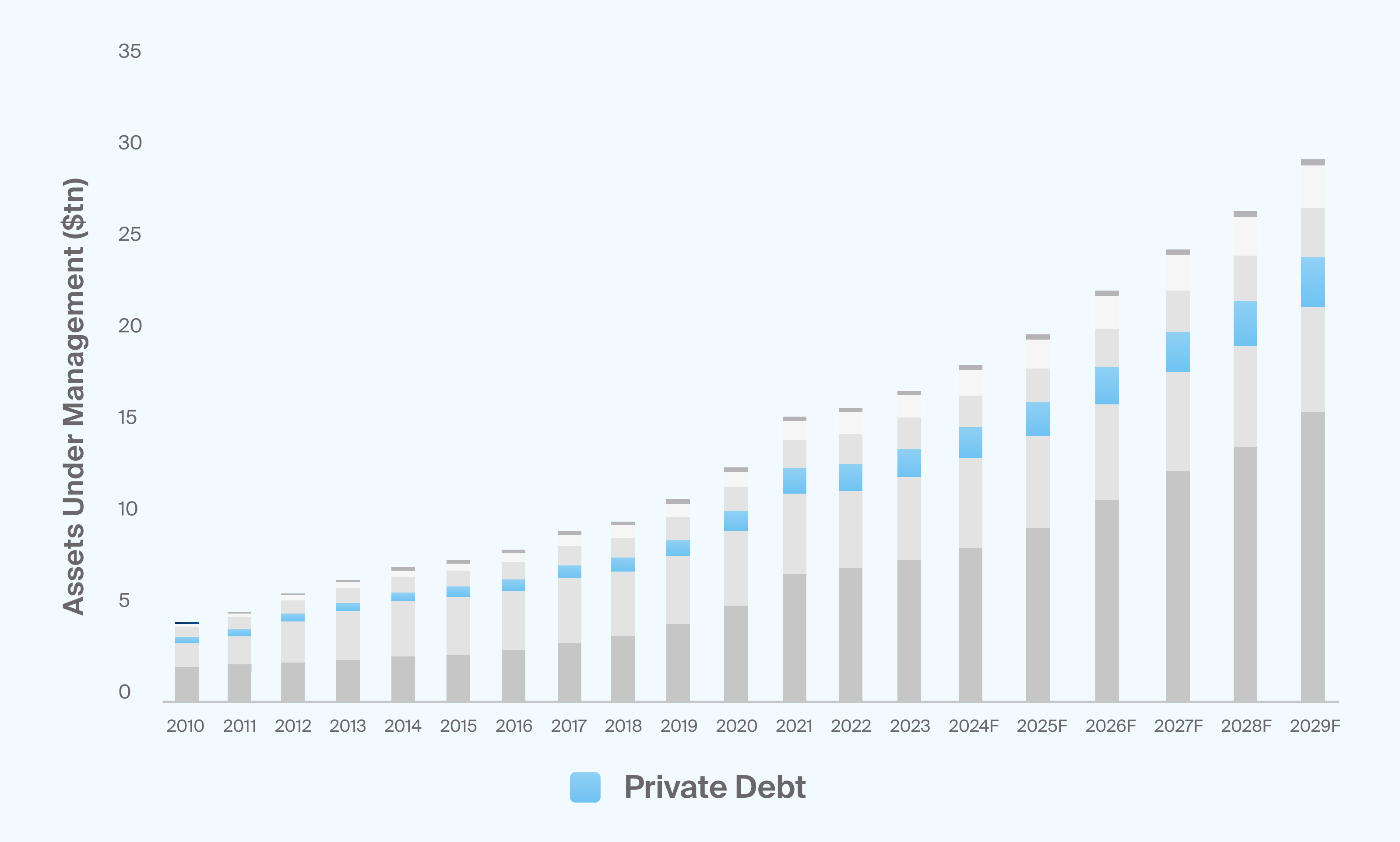

Private debt started to gain more investor attention and assets following the 2008-2009 financial crisis, when banks were under pressure to reduce risk on their balance sheets and tighten lending standards. By comparison, some other alternative asset classes, such as hedge funds and private equity, are relatively more mature and have more assets under management (AUM). With AUM surpassing $1.5 trillion by 2024 and could surpass $2.6 trillion by 2026, according to Preqin (Exhibit 1).

Source: Preqin, Future of Alternatives 2029; AUM values for 2024 to 2029 forecasted by Preqin.

Private debt started to gain more investor attention and assets following the 2008-2009 financial crisis, when banks were under pressure to reduce risk on their balance sheets and tighten lending standards. By comparison, some other alternative asset classes, such as hedge funds and private equity, are relatively more mature and have more assets under management (AUM). However, private debt AUM grew to almost $1.2 trillion by the end of 2021 and could reach $2.7 trillion by 2026, making it one of the fastest-growing alternative asset classes.

Historically, from a credit-rating perspective, private debt has been compared most closely to non-investment grade syndicated leveraged loans and high-yield bonds, but there are several differences. Syndicated leveraged loans and high-yield bonds are usually rated by credit rating agencies—which is helpful for assessing default risk—and can be traded on secondary markets.

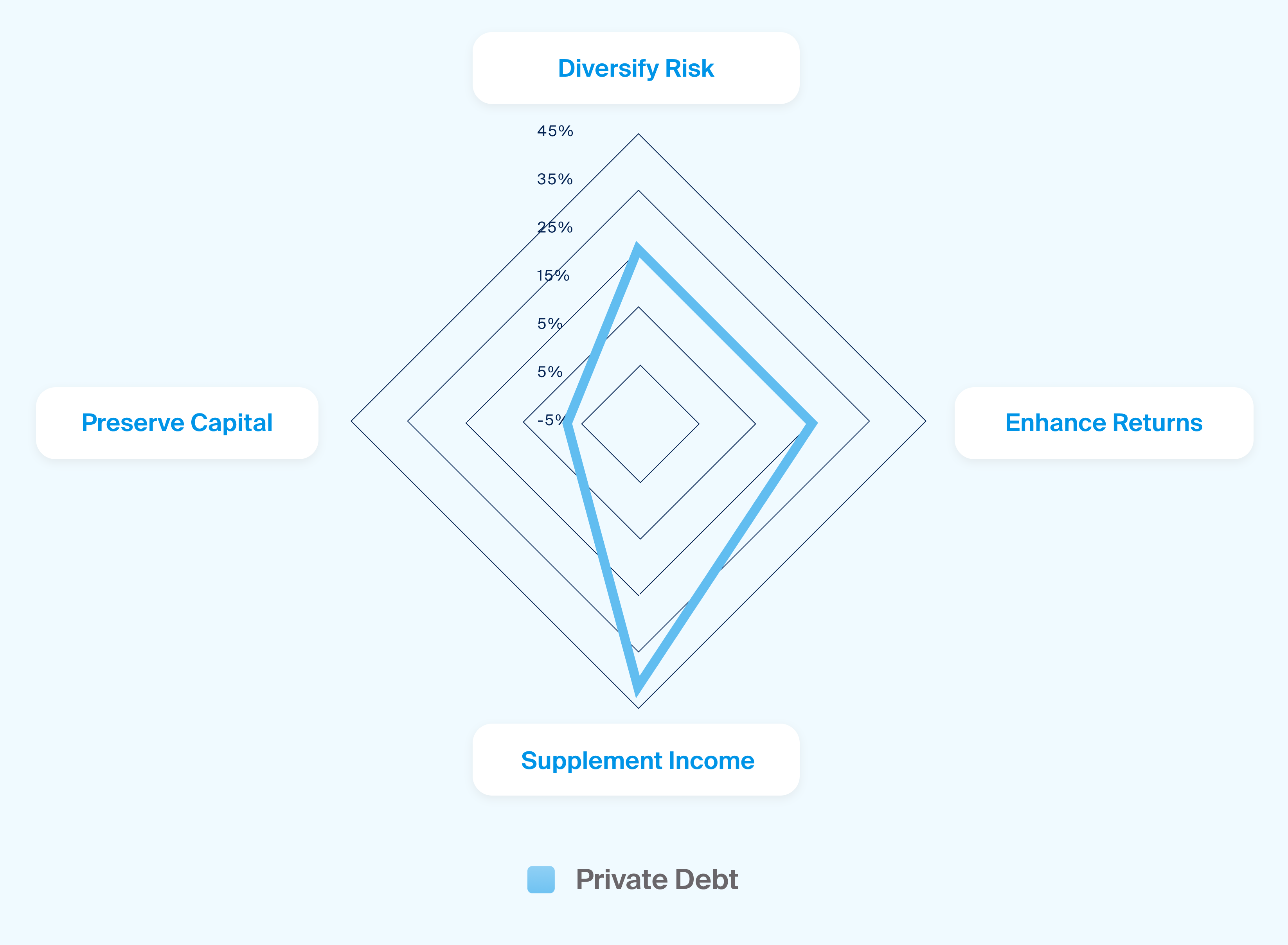

Private loans, by contrast, do not tend to be independently rated, so credit default risk can be harder to evaluate. A secondary market for private debt is growing yet still lacks the degree of activity as in private equity or traditional fixed income; therefore, private debt remains less liquid. These factors can make private debt riskier so that it is priced at a premium to traditional fixed income investments, offering the potential for higher yields and returns (Exhibit 2).

Private debt can also provide a differentiated source of returns for a portfolio through a variety of structures and strategies. A vehicle often utilized to access private debt investments is a fund structured as a limited partnership. Unlike some other private investments, private debt funds often have a shorter fund life, due to shorter maturity dates or prepayment prior to maturity.1 Evergreen private debt vehicles are also increasingly available for advisors seeking limited liquidity, with roughly $500 billion in assets under management in these vehicles in 2024.2

Source: CAIS and Mercer, “The State of Alternative Investments in Wealth Management 2023,” December 2023.

From a credit-rating perspective, private debt is generally considered comparable to non-investment grade syndicated leveraged loans and high yield bonds but there are several differences. Syndicated leveraged loans and high yield bonds are usually rated by credit rating agencies, which is helpful for assessing default risk, and can be traded on secondary markets. Private loans do not tend to be rated, so credit default risk can be harder to evaluate and there may not be an active secondary market, which makes the securities much less liquid. These factors can make private debt riskier so that it is priced at a premium to traditional fixed income investments, offering the potential for higher yields and returns for investors.

What Are Common Types of Private Debt Strategies and How Do They Work?

We describe common categories of private debt, which feature a range of risk and return profiles.

Direct lending refers to private corporate loans that are typically backed by future cash flows or specific assets of a company, including physical property. The debt may be structured as senior, junior, or mezzanine.

Distressed debt strategies seek out companies that are undergoing financial difficulties, such as bankruptcy proceedings, generally with the intention of gaining control and increasing the value of the company through a variety of strategies including restructuring, becoming equity owners, or realizing a relatively higher private market valuation versus the public market.

Special situations can include debt investments across the capital structure, trading in the secondary market, direct origination, or distressed debt.

Structured debt is typically used by companies that have highly specialized and specific needs. Additionally, structured debt helps borrowers mitigate the risk of underlying assets through the process of securitization. Collateralized loan obligations (CLO), asset-backed securities (ABS), and mortgage-backed securities (MBS) are all examples of structured debt.

Mezzanine debt strategies provide subordinated financing positioned between senior debt and equity in the capital structure, typically offering higher yields through fixed-interest payments coupled with equity-linked instruments such as warrants.

Asset-based lending or specialty finance tend to include a diverse range of niche asset types, often with less correlation to broad economic conditions. These strategies generally involve loans that use a borrower’s assets, or cash flows from those assets, as collateral. They may be classified by industry segment, such as consumer credit, equipment finance, litigation finance, music/film royalties, structured settlements and infrastructure finance, among others.

Considerations and Risks When Investing in Private Credit

Manager Selection and Access to Deals: When researching managers, advisors can focus on a number of attributes, starting with the proven ability to analyze credit default risk and structure the terms of a loan. Certain lenders may also have a competitive advantage when it comes to sourcing attractive deals, either through their relationships with private equity sponsors or through their experience and reputation in the private credit markets, potentially giving them access to non-syndicated/off-market deals.

Structure of the Loan: Some key terms of a private loan that can lead to value creation include:

Floating-Rate Coupon: Private lenders issue credit at a spread above a certain benchmark, such as the US 10-Year Treasury, so that the contractual coupon adjusts over time leading to lower duration, or interest rate risk, versus the traditional fixed income benchmark. This can be helpful in times when interest rates are rising.

Origination Fee: This fee earned by the lender for underwriting and making a loan is considered part of the return stream from private credit and is typically paid upfront.

Covenants: Lenders may be able to negotiate stronger covenants and protections than in the syndicated bank loan market. Additionally, having greater access to the financial information of the borrowing company may allow lenders to monitor early warning signs of financial stress and take corrective action in the event of covenant breaches or defaults.

Credit/Default Risk: The historical default and recovery rates of private loans can be difficult to estimate because the information is not publicly available, which creates greater uncertainty around the performance of these loans relative to traditional fixed income securities. In cases where the borrower may not have been credit worthy enough to secure a loan from a bank, the risk profile could be higher.

J-Curve: Private debt may not experience the same J-Curve—a pattern of negative cash flows in the early years, due to capital calls and management fees paid before there is a chance for the investment to generate returns—as many other private investments. This is because current income received from borrowers may contribute positively to returns in the early years.

Liquidity and Volatility: Private loans are typically held by a single originator and a secondary market may not exist; when it does, it may still be much less liquid than traditional bond markets. This lack of activity may result in fewer valuation adjustments compared to more frequently traded securities that are regularly marked to market. What may appear to be lower volatility may not reflect the underlying changes in valuation. Some areas of private credit, such as those that invest in the distressed debt of highly syndicated offerings or distressed sovereign issuances, may mark to market quite often and demonstrate high volatility.

The private debt market is expected to continue to grow and become more accessible as advisors continue to seek new sources of income and returns to complement more traditional fixed income investments and other alternative investments.