Financial advisors now have a selection of fund structures available to access private markets strategies for their clients; yet, the fund structure they choose may not only influence the relative liquidity of an investment but also affect the strategy’s implementation and the cash and portfolio management required.

What You'll Learn

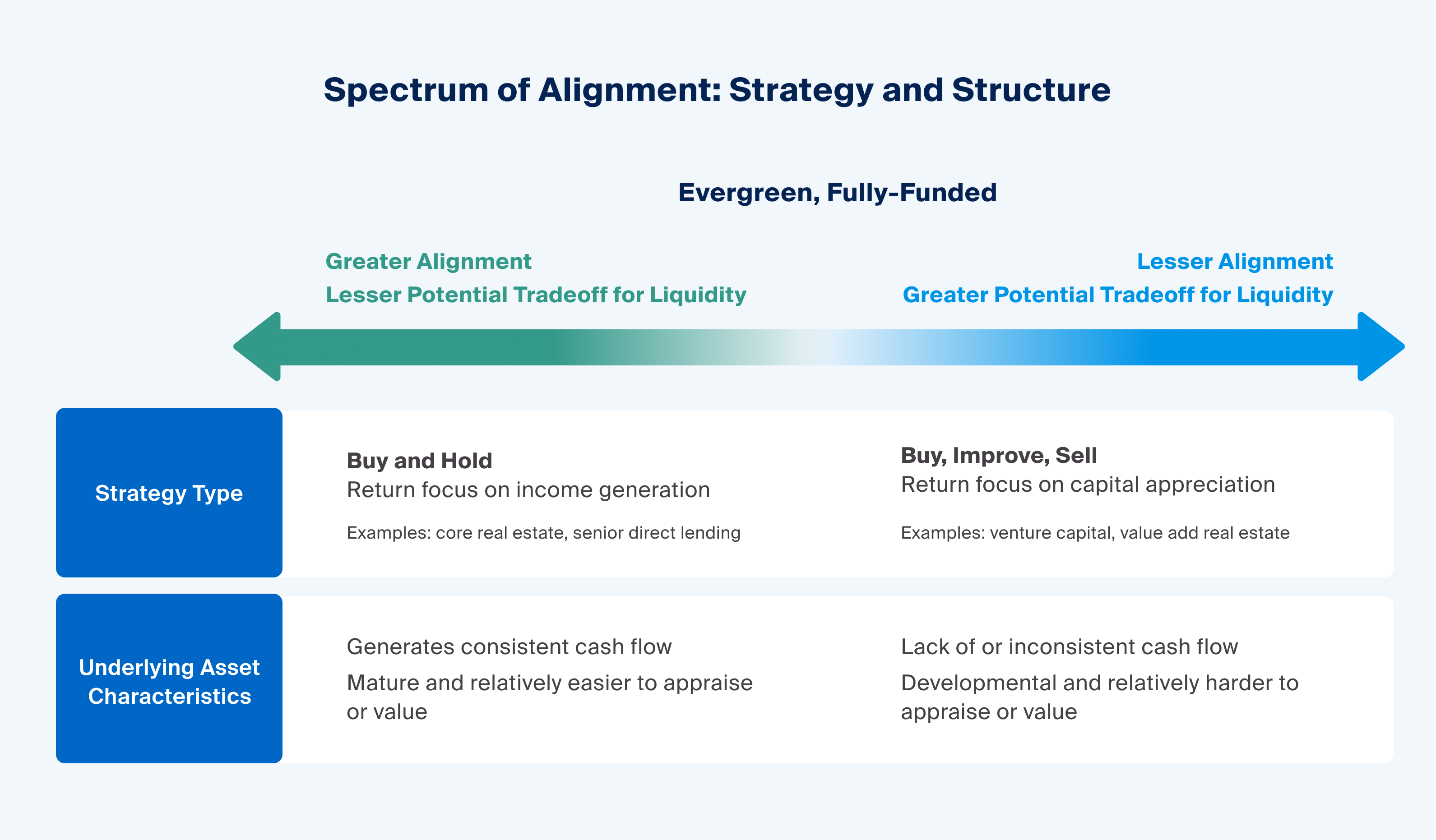

Though offering liquidity can come at a cost to investors in an evergreen fund, certain strategies may help mitigate that drag. Income-generating strategies, like core real estate or senior direct lending, for example, may help supplement the fund’s cash flow, potentially reducing the need for significant liquidity sleeves that may impact fund returns.

Certain fund structures may influence the amount of concentration or diversification within the underlying portfolio, given the availability of capital for new investments.

Drawdown fund structures tend to require a more complex cash management strategy than structures that require fully funded investments.

A portfolio that uses finite-life structures may require a more thoughtful and patient approach to reach and maintain a target private markets allocation that is vintage diversified; meanwhile, investors in evergreen structures may take advantage of reinvestment approaches, such as DRIPs, to maintain a desired private market allocation through the same fund.

In the first part of this series assessing private markets fund structure trade-offs, we explored the differences in liquidity between evergreen, fully funded structures and finite-life, drawdown structures and importantly how this difference may impact a fund’s return. In part two, we focus on whether certain alternative strategies may better align with the liquidity needs of evergreen structures to meet potential redemption requests. We also explore potential differences when implementing and managing these fund structures in clients’ portfolios.

Alignment With the Underlying Investment Strategy

Fund structures that offer investors liquidity at the fund level, as we discussed in our previous article, can come at a cost with respect to returns when it comes to private market investments, the magnitude of which may depend on the degree of alignment between the underlying investment strategy and the fund structure.

Source: Timothy M. Clark and Alicja I. Biskupska-Haas, “Open-End vs. Closed-End Real Estate and Infrastructure Funds,” Real Estate Finance Journal, Spring 2017.

Footnotes

For illustrative purposes only.

Certain private market strategies and asset types may mitigate the potential tradeoff of returns for fund-level liquidity in evergreen, fully funded structures.

Investment strategies, such as core and core-plus real estate or senior direct lending, that target stable, cash-flowing assets may more easily match the liquidity needs of an evergreen, fully funded structure. Assets that tend to generate more reliable income should provide a more stable source of cash that the fund manager can use to meet redemption requests. Mature assets with more predictable cash flows may also be more easily appraised and valued, making these assets potentially more aligned with fund structures that may be forced to dispose of assets to meet redemption requests that exceed existing sources of liquidity.1

Evergreen structures can also be utilized for strategies that attempt to generate returns by acquiring assets with the intention to improve them and ultimately sell them—like value-add real estate or certain private equity strategies. However, such assets typically lack the consistent cash flow necessary to supplement potential redemption needs in a semi-liquid structure. As such, evergreen funds may need to apportion larger liquidity sleeves;2 and, as we discussed in our last article, these sleeves can affect the fund’s overall performance.

In contrast, by locking up capital, finite-life vehicles try to limit potentially value-destructive situations in which a manager would be forced to sell a difficult-to-price or highly illiquid asset before they can realize additional value, which could be to the detriment of existing investors.

Sub-optimal alignment between fund-level liquidity and asset-level liquidity may not be the be-all and end-all of selecting an appropriate fund structure. Other considerations, like access, or eligibility, may be more important for certain investors. Ultimately, the tradeoff between return and fund-level liquidity will be dependent on the fund and the fund manager. However, advisors should understand that investing in certain strategies and asset types in a more flexible structure may come at a greater relative cost, particularly in situations where net redemptions from the fund are large and persistent.

Investment Strategy Implementation

Because of the typical lifecycle of finite-life, drawdown funds, managers tend to focus their portfolios only on their best ideas, deploying their pool of available capital into these ideas over the investment period.3 When fundraising, the manager typically announces a target fund size, and the investor can decide whether they believe in the manager’s ability to deploy that volume of capital effectively.

With a limited rather than continuous or uncapped fundraising structure, managers can adopt a more concentrated approach, focusing only on their highest-conviction opportunities in a given time frame. Such concentration may be better aligned with a strategy that aims to optimize total return.

The potential trade-off is that investors typically commit capital to these structures before investment begins, potentially exposing themselves to blind pool risk.4 Similarly, finite-life structures can require a more patient approach as the exposure to the desired asset class depends on the pace at which a manager calls capital. Investors in these drawdown fund structures are often exposed to low or even negative returns in the early years of the fund life due what’s known as the J-curve effect, which may be due to some combination of management fees charged on unfunded commitments and holding investments that have yet to mature or generate positive returns.5

By contrast, fully funded, evergreen structures can provide investors with immediate and continuous exposure to an existing and generally more diversified pool of assets—mitigating both blind pool risk and effects of the J-curve.6 Meanwhile, existing investors in these funds can benefit from increasing diversification as long as the fund continues attracting additional net inflows.7 This level of diversification may be most suitable for an investment strategy that seeks to optimize its portfolio for stable cash yields and mitigate the idiosyncratic, downside risk of single assets.8

Cash Management

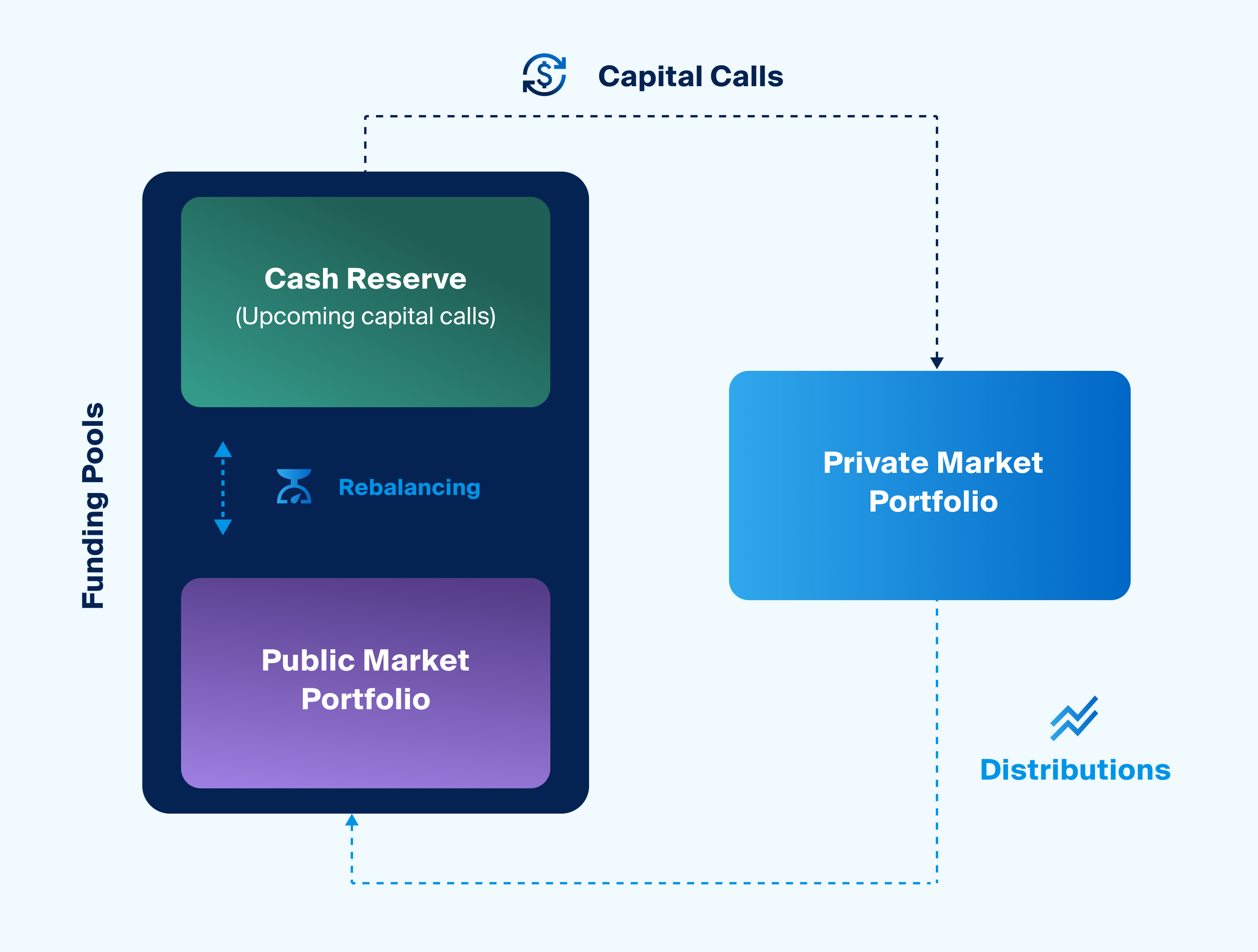

Building a private market portfolio with finite-life, drawdown structures introduces relatively more complexity and may require a more active approach to cash management compared to evergreen, fully-funded structures.

To meet capital calls while limiting cash drag, investors in drawdown structures should pay special attention to their available cash. If they have an insufficient cash reserve, investors may be forced to sell assets during inopportune market conditions to fund their capital calls.9

Source: Daniel Murphy et al., “Calling Patterns: Why Private Fund Cash Flow Management May Need to Evolve,” Goldman Sachs, Dec. 15, 2022.

Footnotes

For illustrative purposes only.

Investing through drawdown structures generally requires maintaining cash reserves to fund capital calls or using distributions from mature commitments to replenish and rebalance funding pools.

Investors with more established private markets portfolios can sometimes use distributions from their more mature commitments to replenish cash reserves, with excess amounts reinvested in other areas of the portfolio to maintain their target weightings. Financial advisors, therefore, must keep track of their expectations not only for their clients’ future capital calls but also for their distributions from existing private market allocations. They can then adjust the cash reserve when either exceed or fall below expectations.10

To ease the unpredictability of capital calls and attempt to smooth the investor experience, some funds are adopting a simplified approach to drawing capital using subscription call lines. These loans taken out by the GP during the fund’s investment period are used as proceeds to deploy capital instantly, limiting the anticipation of the arrival of LP funds. This method may also increase a fund's IRR since there may be a shorter time frame between cash contributions and distributions as the number of separate capital calls may be consolidated.11

Portfolio Management

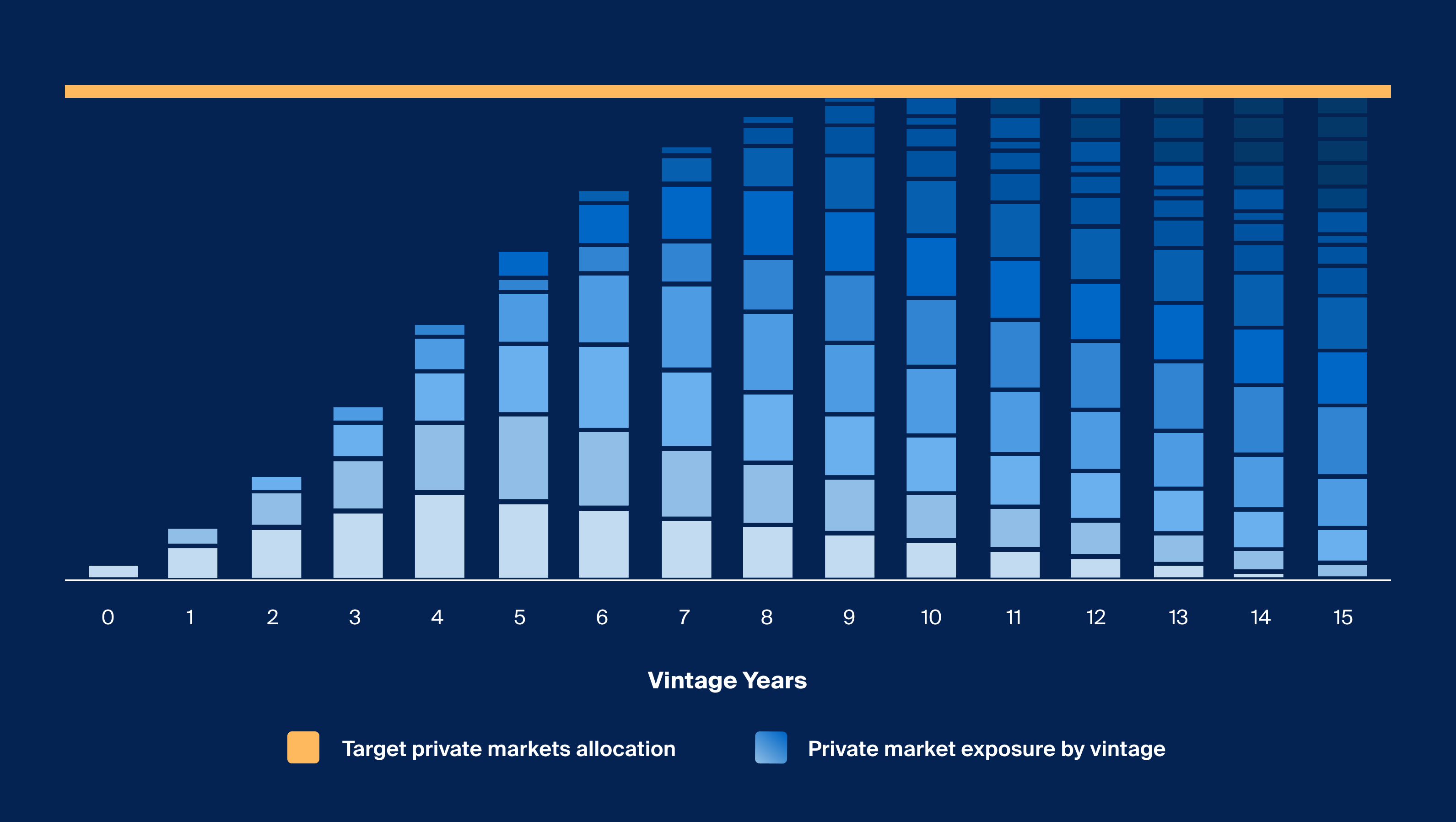

When investing with finite-life, drawdown structures, advisors may seek to pace their clients’ commitments over multiple vintages in pursuit of vintage diversification. Yet, commitment pacing may lengthen the time required to reach a client’s target private markets allocation. Subsequent commitments are also required to attempt to maintain a target allocation.12

Source: Paul Erlendson, Alexander Browning, Jay Kloepfer, “Legacy and Budget Stabilization Fund Advisory Board, Asset Allocation Review: Phase One,” Feb. 12, 2021.

Footnotes

For illustrative purposes only. Actual achievement of target exposure may take longer or shorter than is depicted based on an investor’s commitment sizes, performance of funds, target allocation and other factors.

Achieving and maintaining a target allocation using finite-life funds with vintage diversification may require implementing a multi-year commitment pacing program.

For certain investors, the opportunity for near-instantaneous deployment of capital into a fully funded, evergreen fund may enable a more measurable allocation to private markets.

Since allocating to an evergreen fund can provide an investor with the broad diversification of the portfolio's underlying investments, some funds allow investors to continually recycle their distributions into reinvestment plans known as DRIPs. In these funds, LPs can elect to have distributable proceeds reinvested in exchange for additional interest. While DRIPs are similar to the recycling provisions in finite-life funds, these plans are perpetual.13

Understanding Complexity Across Fund Structures

For investors who are both able and willing to deal with their complexity, finite-life, drawdown structures continue to offer strong alignment between investors and managers for certain strategies. For those seeking to gain immediate exposure to private markets with a potentially less onerous portfolio management process, evergreen fully funded may be preferable. Either way, structure innovation and the growing prevalence of options for private market investing bode well for investors seeking to gain exposure to these asset classes.

Ultimately, investing in private markets requires long-term thinking, regardless of fund structure. While evergreen funds can offer relative flexibility, they should not be viewed as short-term holdings. Restrictions to redemptions, particularly in times of market turmoil, mean these structures are more suitable for a long-term strategic asset allocation given the nature of private market investing.