In case you missed it, check out some of our recent CAIS platform enhancements.

Export Bespoke Structured Note Holdings Reports to Better Review Client Allocations from the CAIS Platform

To better serve you and your structured investments business, we have launched a new tool designed to help you more efficiently manage your book of business and easily monitor and export structured note holdings.

The new PDF reporting functionality may help you have easier conversations and provide more transparency when reviewing structured notes.

Create Holdings Report

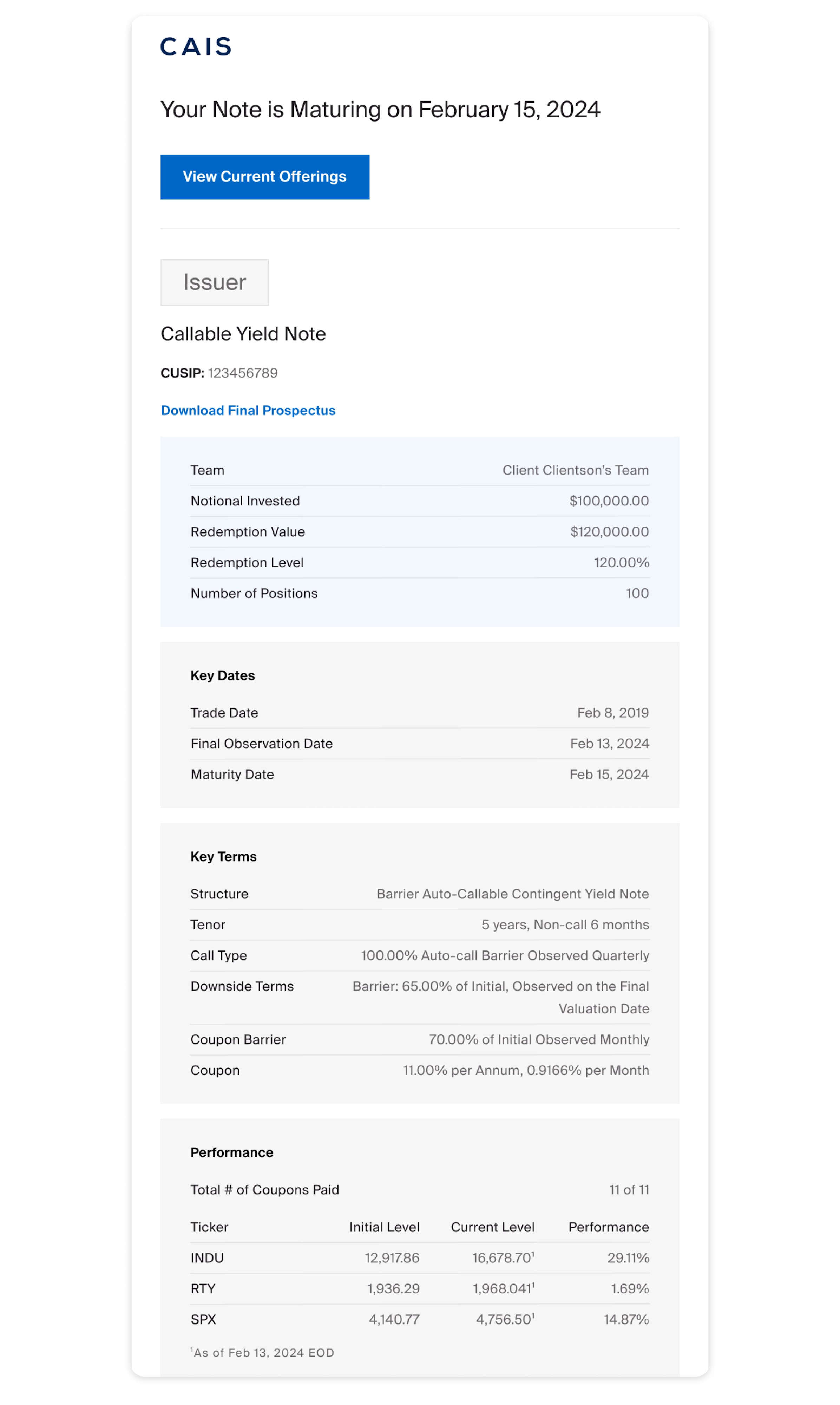

Structured Investments Redemption Notifications

Advisors can receive automated notifications from the CAIS platform to alert them of upcoming call- and maturity events for their structured notes, detailing key note terms and performance information. Redemption notifications may help advisors stay up-to-date on reinvestment opportunities.

Structured Investments Redemption Notifications View

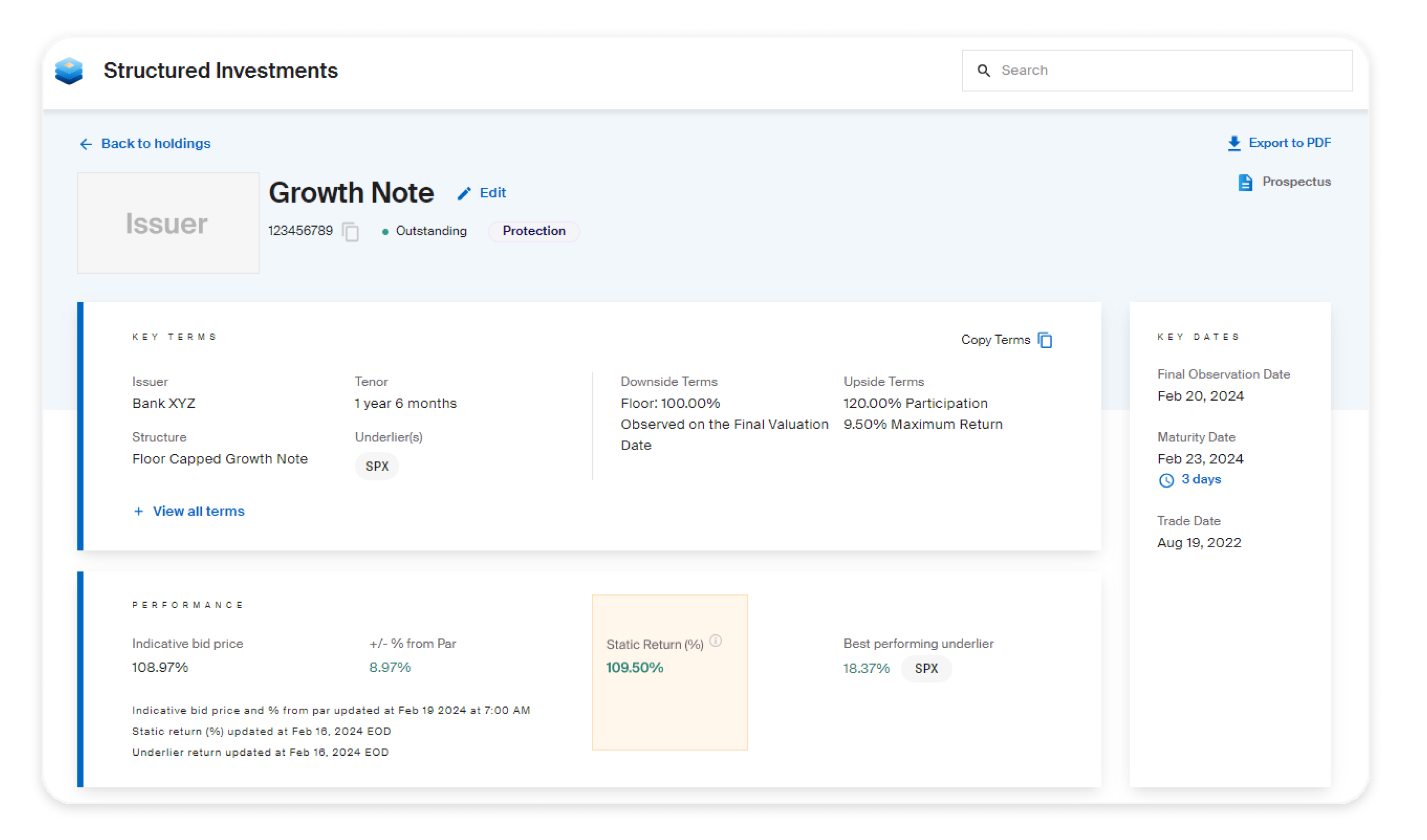

Static Return and Redemption Level for Structured Notes

Static Return

View the static return1 of structured notes to observe a hypothetical illustration of a note’s payment at maturity based on the subject underlier(s) closing level as of the date listed on the platform.

Structured Investments Static Return View

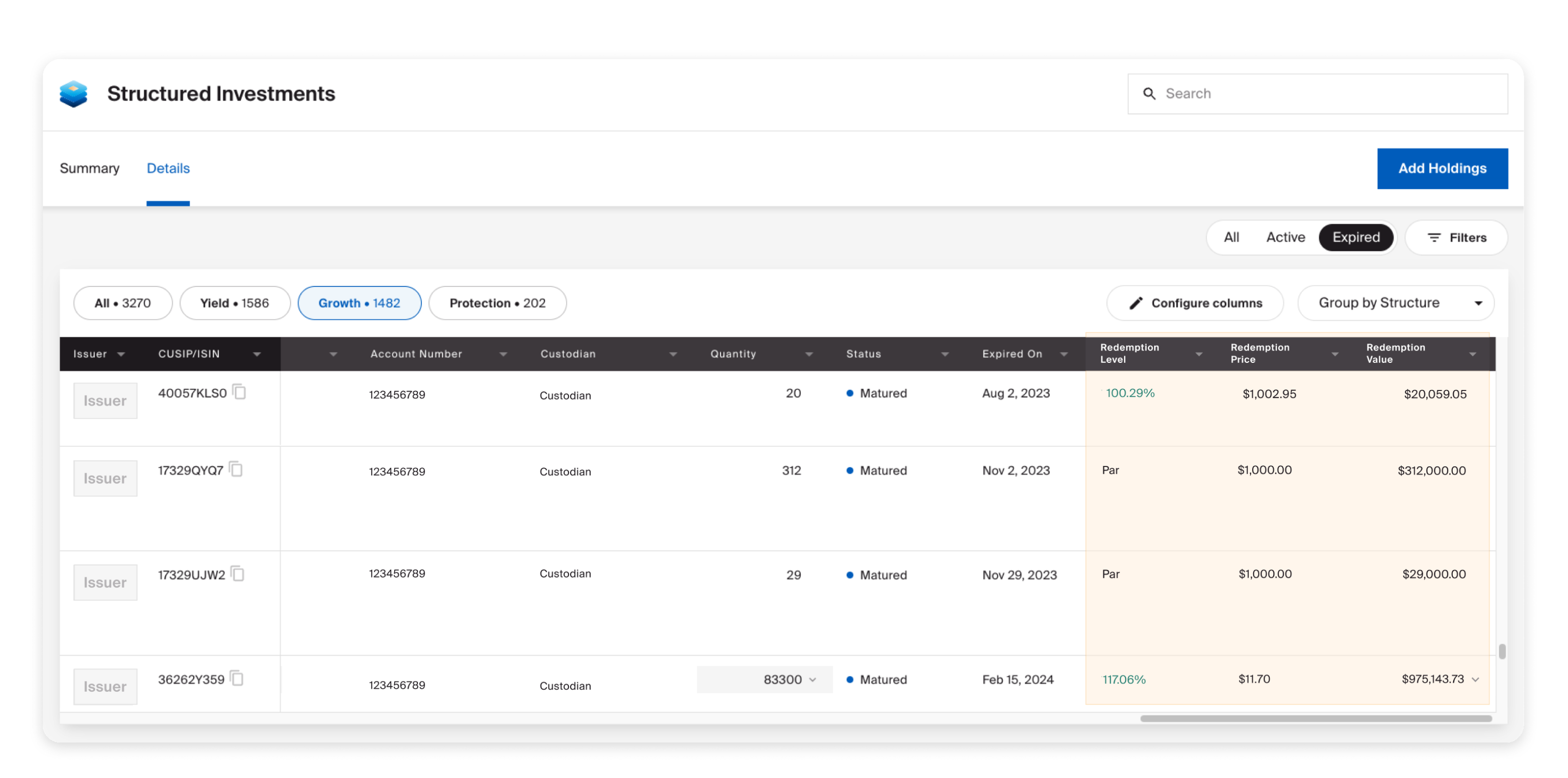

Redemption Level

Review the redemption level of structured notes, allowing you to view a note’s payment at the time the note was called or matured.

Structured Investments Redemption Level View

Home Office Approver View

Certain Home Office team members can now access a new Home Office Approver view within the product menu. This view allows team members to easily filter approved funds and share classes for their firm against the complete fund offering of our platform, allowing them to discover more funds on our marketplace.

Home Office Approver View

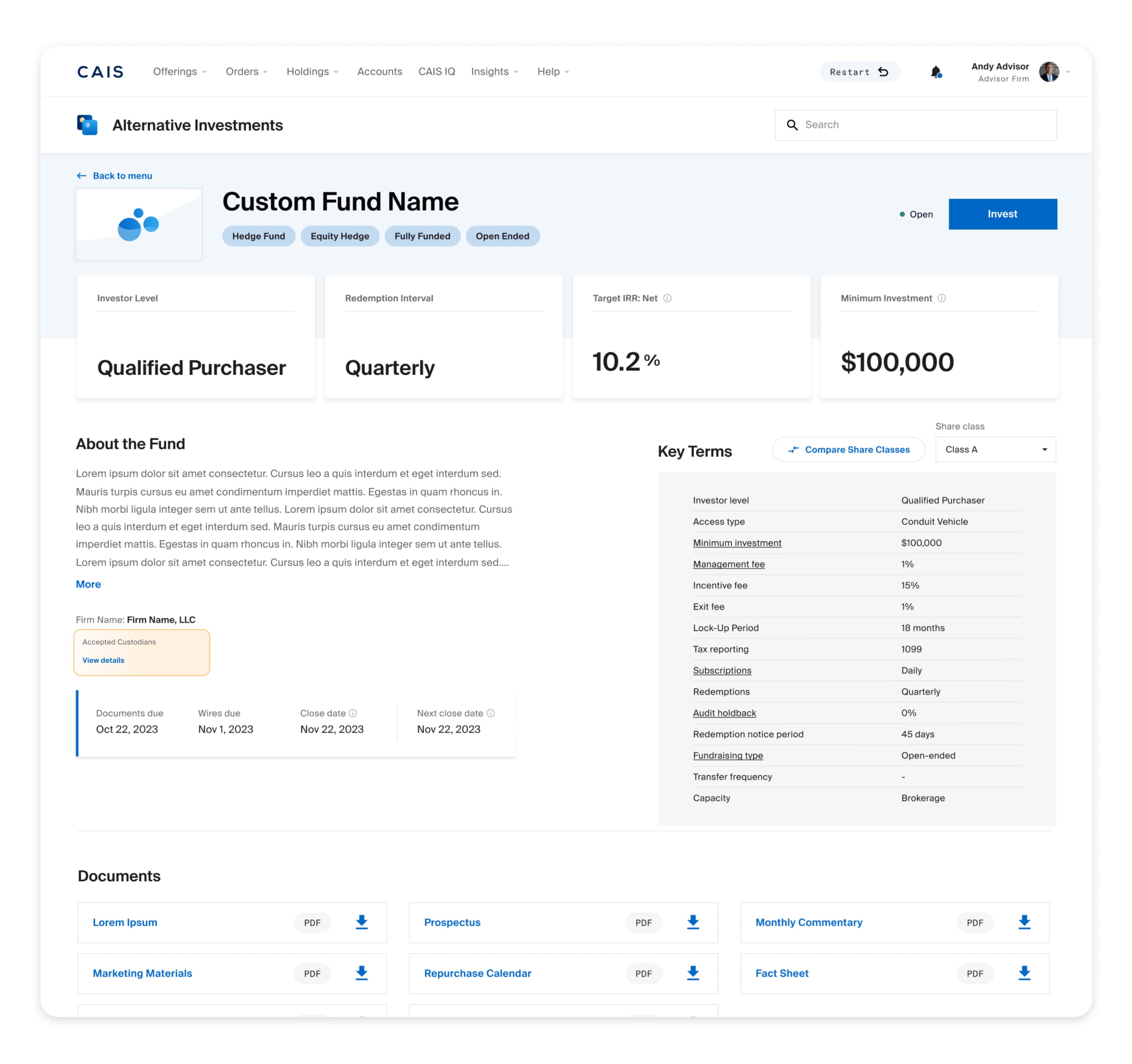

Accepted Custodians View on Fund Pages

Our fund pages, which already contain over 100+ data points to support informed choices during the pre-trade process, now list the accepted custodians for each fund – so CAIS platform users know where a given fund is recognized before they invest on behalf of their clients.

Custom Funds Accepted Custodians View

“In-Good-Order” Notifications and Fund Wire Status

In addition, we’ve enhanced our trade process to show “In-Good-Order” (IGO) and fund wire statuses to help streamline workflows for more visibility across portfolios.

Personalized, Configurable Pre-Trade Views

Based on your user feedback, CAIS platform users can now customize a personalized view of the alternatives investments menu and the structured investments menu. This feature enables users to get information when they want it, and where they want it.

In addition, platform users can save multiple customized views, allowing them to toggle between your preferred way of reviewing alternative investment products.

Custom Views

Orion Alternative Investments Powered by CAIS

Orion and CAIS have joined forces supporting the independent wealth ecosystem, empowering Orion Wealth Advisory and OCIO users to:

Access a high-conviction menu of alternative investments curated by Orion from leading asset managers to help advisors realize the benefits of an alts allocation for their clients

Leverage CAIS’ direct reporting integration with Orion Tech, providing a consistent experience enhancing portfolio reporting, planning, and management

Utilize streamlined workflows across the pre-trade, trade, and post-trade experience