Distressed debt may be an option for return-seeking or diversification-seeking investors willing to assume higher levels of risk.

What Is Distressed Debt?

Distressed debt, also known as distressed credit or distressed securities, are debt instruments that generally trade at significant discounts and with greater-than-average spreads for their industry.1

Distressed debt opportunities typically involve securities in outright default or experiencing operational or financial distress. As one well-known asset manager puts it, they may be, in some cases, “good companies with bad balance sheets.”2 As a result, the investment takes the form of loans or bonds intended to aid companies facing significant challenges. These high-risk distressed securities are considered “below investment grade,” with credit ratings of CCC or lower,3 as the distressed organization may be in or near bankruptcy.4

While individual distressed opportunities can emerge in any market environment, certain credit market conditions may impact more companies and thus lead to a larger opportunity set. For instance, an expanding credit market may lead to higher company valuations and greater use of corporate leverage. A subsequent tightening in the credit market and/or recession may later cause a drop in borrower cash flow, leading to defaults on the mountain of debt previously accumulated. Distressed funds have been formed to buy this debt, take borrowing companies through a capital restructuring, and seek to benefit from the potential economic and/or business recovery.5

Distressed debt strategies tend to be employed by hedge funds, private equity funds, and specialized debt managers.6 Financial advisors who wish to consider distressed debt strategies may seek out specialty funds exclusively focused on these opportunities or ones that incorporate distressed debt within a more broadly diversified portfolio.

Why Invest in Distressed Debt?

Acquiring distressed debt below par value may create viable investment opportunities for return potential, but not without certain risks, and with no guarantees.7 Investors in distressed debt markets can become major creditors in a company and could have significant influence during a liquidation process or reorganization. These investors may potentially benefit from an increase in the value of the distressed debt after a restructuring and turnaround.

The potential for reward comes with risk, especially given that the quality and volume of distressed debt opportunities are highly cyclical and that the window for outsized returns can be short. A useful way to understand the risks and return drivers of various investments can be to categorize their exposure to various base market exposures. Defining, measuring, or scoring some of these risk factors can improve an investor’s ability to properly judge the risk and potential return of different portfolios.

What Are Some Common Distressed Debt Investing Strategies?

While each strategy employed within the distressed space is distinct, many distressed debt fund portfolio managers use a hybrid of strategies as the marketplace dictates. Below are some of the distressed debt investing strategies employed by alternative asset managers.

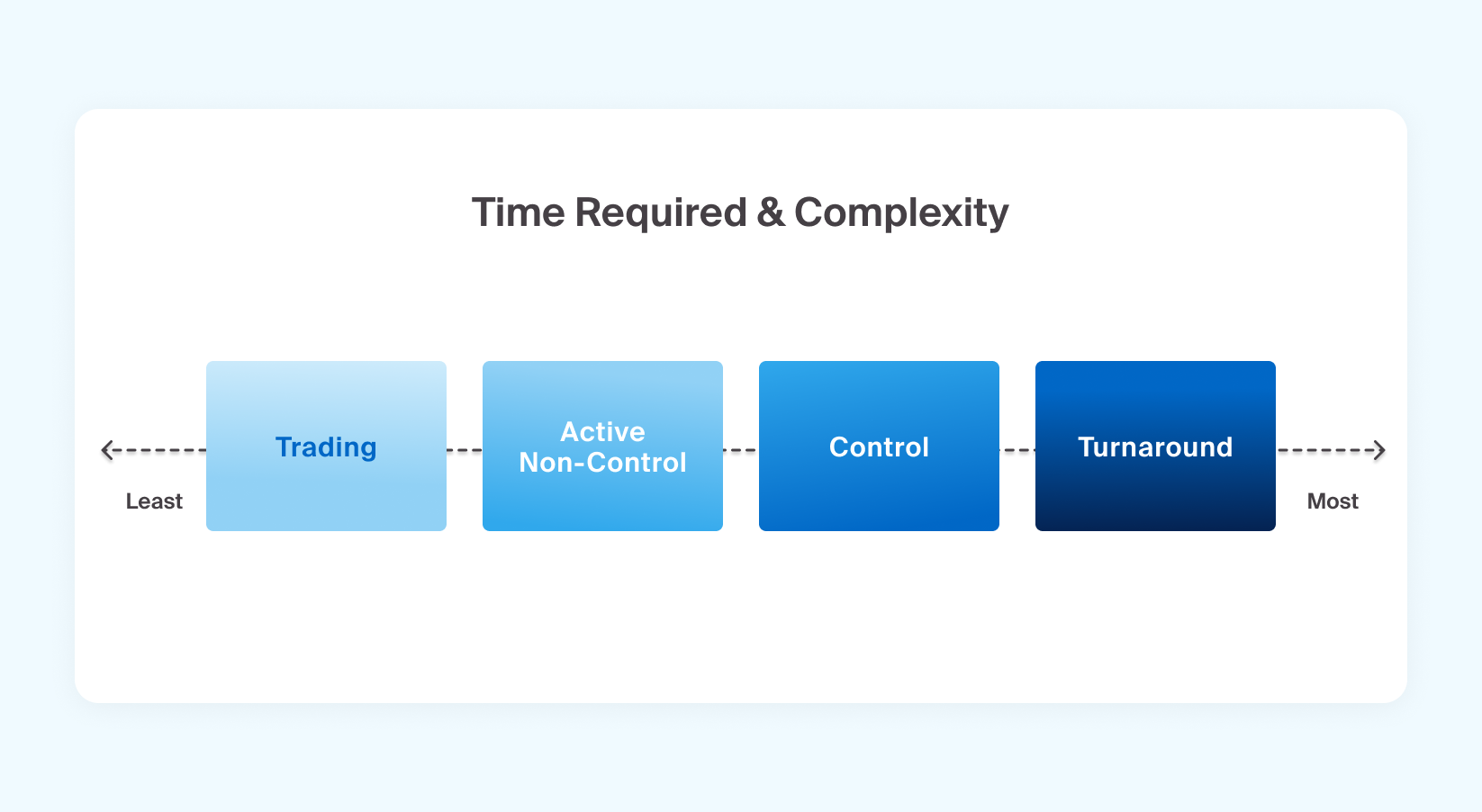

You might think of these strategies along a spectrum, where time and complexity grow. Trading strategies, for example, tend to be shorter term and require the least involvement, whereas turnaround strategies often require a fund manager to be much more committed over a longer period.8

Distressed Debt Trading

Distressed debt trading involves purchasing debt obligations, such as high-yield bonds, that are trading at a distressed level in anticipation of reselling those securities at a higher valuation, generating a trading profit. Funds employing this strategy generally seek to invest in debt obligations they believe are undervalued. The holding period on this type of investment is typically short, which generally makes this strategy the most liquid among distressed debt investment approaches.9

Distressed Debt Active Non-Control

Active non-control strategies aim to accumulate significant positions in companies that appear likely to declare bankruptcy or that are already experiencing a bankruptcy and/or a restructuring process.10 The fund manager may aim to gain influence in bankruptcy negotiations with the possibility of maximizing returns; however, in non-control strategies, the fund’s interests generally remain subordinate. In some cases, litigation costs may also limit potential returns. As a generally complex procedure, this strategy typically necessitates a longer holding period, a greater level of risk tolerance, as well as a larger, more concentrated position.

Distressed Debt Control

In this strategy, a fund manager aims to build a controlling position in a target company's fulcrum debt, with the expectation that the position will convert to equity ownership during bankruptcy proceedings.11 After the manager wins control, it typically seeks to maximize potential profitability through restructuring, merging, or liquidation.

Restructuring or Turnaround

Distressed credit funds may also use equity to buy target companies, before or during an expected bankruptcy process. The goal is generally to gain control of companies under par value and then restructure them.

Footnotes

The graphic above is included for illustrative purposes only.

Distressed Debt Investment Strategies

Risks and Considerations When Accessing Distressed Debt Opportunities

When considering the role that distressed opportunities may represent, we believe financial advisors should balance the illiquidity premium, differentiated return drivers, and portfolio diversification opportunities presented by the asset class. Distressed strategies require an experienced and active hand to navigate effectively. Financial advisors should bear that in mind as they perform due diligence on the asset managers to whom they are entrusting their client assets.

The following characteristics may be helpful to keep in mind when assessing a distressed debt and credit fund and its manager:

A track record that demonstrates experience managing distressed debt and leveraged loans and confirms a deep understanding of the bankruptcy and restructuring process

An appreciation for the cyclical opportunities that can arise in the distressed sector and the liquidity to take advantage of those opportunities

Intimate knowledge of the factors contributing to a specific issuer’s distressed condition, as well as the issuer’s capital structure across all credit and loan facilities and corresponding opportunities

A robust understanding of the industries, operational norms, and competitive landscape of the issuers in the fund’s portfolio

Distressed debt strategies introduce many of the same risks common to other alternative investments, such as liquidity risk and loss of investment principal. In addition, depending on the strategy employed, distressed debt investors should be mindful of a potential lack of information about a company’s underlying finances and the potential for future market-level or company-level distress.