What you’ll learn:

A new macroeconomic environment has emerged following the COVID-19 pandemic, drawing sharp contrasts with the post-GFC, zero interest-rate policy period, in which traditional investment strategies appeared to dominate.

Strategic allocations and the diversifying potential of certain strategies, like hedge funds, may be different amid the relatively heightened inflation and interest rates today.

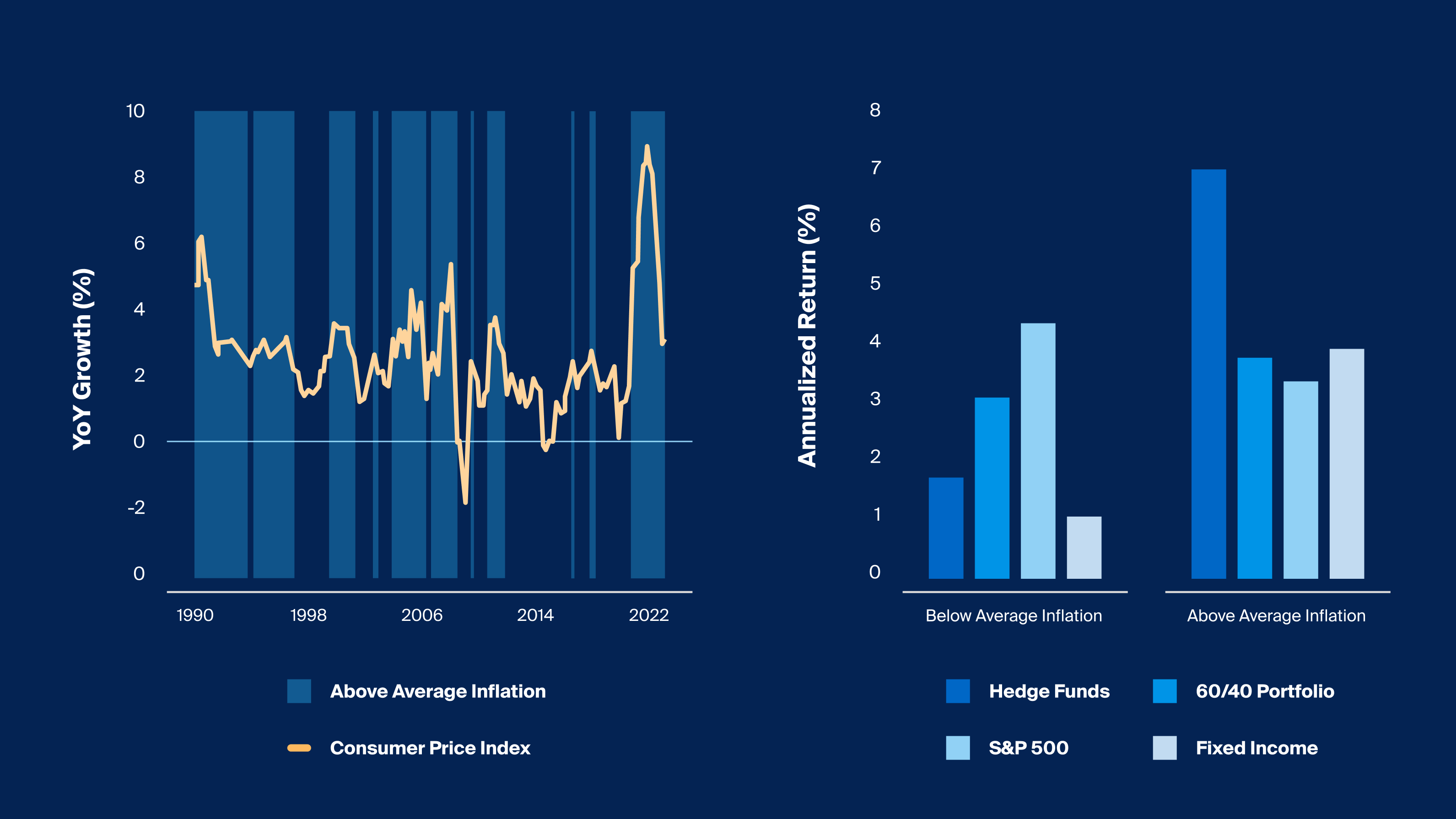

Since 1990, across periods of above-average inflation, hedge funds have generated an annualized net return far in excess of public equities and traditional fixed income.

Hedge funds underperformed both publicly traded equities and a standard 60/40 portfolio (see Exhibit 1 for definition) in the prior economic period following the GFC. Since 1990, however, hedge funds outperformed both in periods where interest rates were closer to their longer-term historical norms.

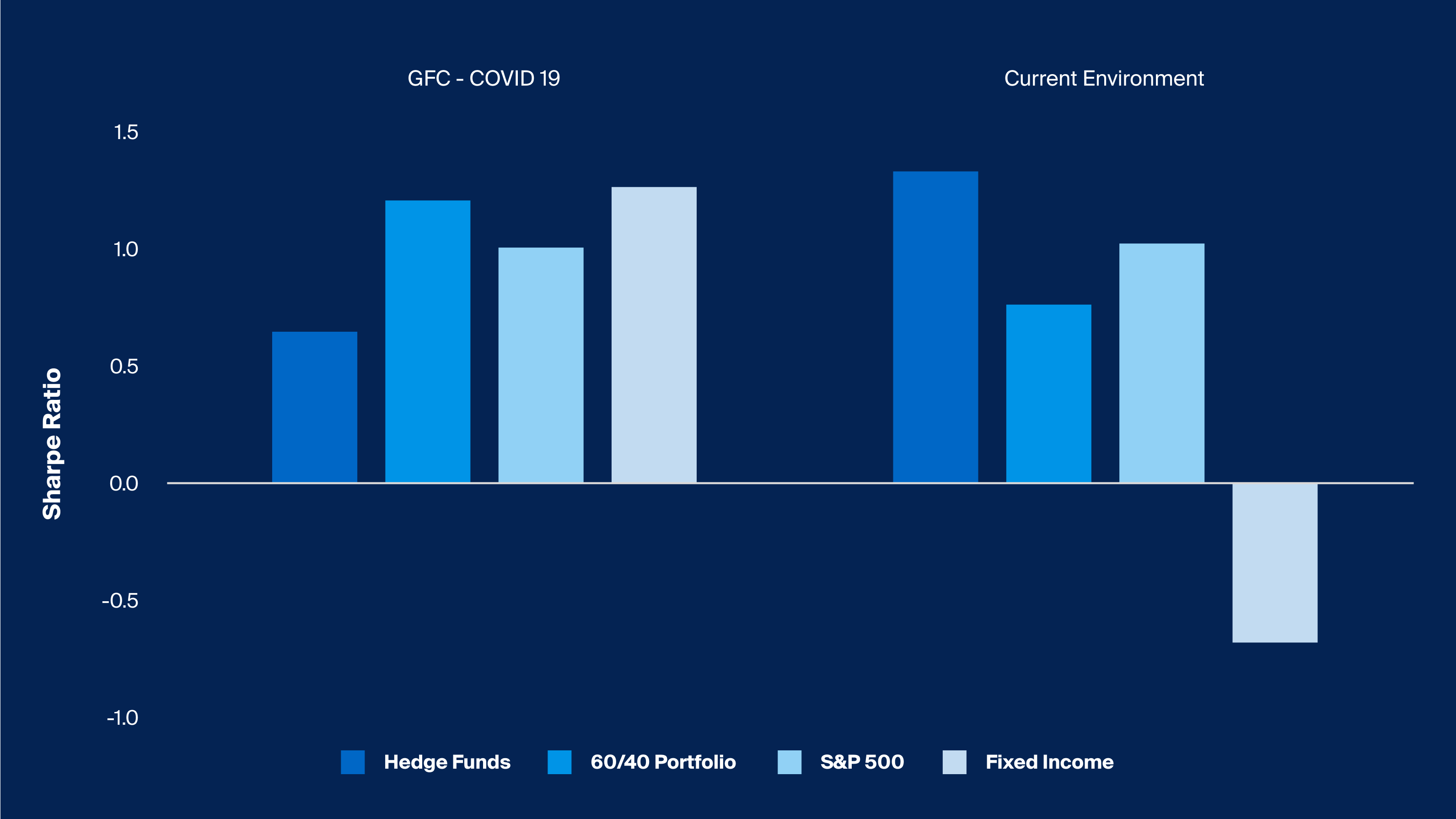

Though hedge funds likely will add substantial complexity and risk to a portfolio, collectively, they have delivered better risk-adjusted net returns compared to traditional asset classes in this new macro environment that has followed the COVID-19 pandemic (Exhibit 3).

The economic environment that followed the global financial crisis (GFC) spurred remarkably steady economic growth. The characteristics of this period were driven by zero interest-rate policies (ZIRP). As the cost of capital was kept at record lows and inflation stayed muted, a rising tide of liquidity appeared to lift all boats.

The traditional 60/40 allocation to equities and fixed income generated investors more than 9% per year through this period.1 In a sense, it didn’t pay to be diversified away from US equities. Right or wrong, investors in that environment seemed to question whether costlier and more complex products, like hedge funds, were justified compared to simpler, cheaper products that seemed to offer persistently higher nominal returns.

But following this period, a new macroeconomic environment—characterized by heightened risks and catalyzed by the COVID-19 pandemic—has since materialized. We’ve seen inflation reach multi-decade highs, and meanwhile, interest rates rose at their fastest pace in history. This rapid return to a more historically “normal” cost of capital and a persistently heightened rate of inflation have raised doubts about whether the investment strategies that worked for investors in a much more benign environment can continue to deliver.

Interest in hedge funds has resurfaced given their potential for diversification,2 a feature that may have fallen on deaf ears during the pre-pandemic environment. Is this renewed interest justified? How have hedge funds actually performed relative to public equities, bonds, and the 60/40 portfolio in environments like the one we’re in today? And what might explain their relative performance?

As we look back and then reflect on the path ahead, historical performance data seems to suggest advisors might benefit from considering a more active approach as they adapt portfolios to meet client objectives in this new (but historically more normal) macroenvironment. Of course, past performance is no guarantee of future results.

Hedge Funds and Inflation

After staying below the Fed target rate of 2% for the majority of the period following the GFC, starting in 2021, inflation came roaring back, reaching its highest level in decades last June.3 With inflation potentially remaining “sticky” and persistently high (by recent historical standards) in this new economic regime,4 we look back since the inception of the HFRI Fund Weighted Composite Index to assess how hedge funds have performed in periods of above-average inflation.

Since 1990, across periods of above-average inflation, hedge funds generated an annualized return of 7.1%, far in excess of public equities and traditional fixed income, which generated 3.4% and 4.0%, respectively (Exhibit 1).

Source: Source: HFRI, Hedge Funds represented by HFRI Fund Weighted Composite Index, Bloomberg, S&P 500 represented by S&P 500 Index, Fixed Income represented by Bloomberg Barclays US Aggregate Bond Index, 60/40 portfolio represented by 60% weighting to S&P 500 and 40% weighting to Fixed Income, Inflation represented by CPI YoY Index, as of July 2023.

Source: HFRI, Hedge Funds represented by HFRI Fund Weighted Composite Index, Bloomberg, S&P 500 represented by S&P 500 Index, Fixed Income represented by Bloomberg Barclays US Aggregate Bond Index, 60/40 portfolio represented by 60% weighting to S&P 500 and 40% weighting to Fixed Income, Inflation represented by CPI YoY Index, as of July 2023. dd

Why may that be the case? In periods of elevated inflation, central banks are mandated to bring consumer prices down to their target rate. As a result of tightening monetary policy, interest rates typically increase, causing a repricing of assets across markets. These changes can introduce opportunities as a result of both dislocation and dispersion.5

Since hedge funds can employ a diverse set of strategies, like taking short positions, and can access parts of the market, like commodities, not available to traditional, long-only funds, they can potentially take advantage of these multidirectional shifts in pricing. Such flexibility can allow them to offer a differentiated source of return compared to funds that are subject to more directional exposures.6

Hedge Funds and Interest Rates

The Fed’s tightening of monetary policy beginning in 2022 has been the fastest acceleration of interest rate hikes in decades.7 It’s important to note, however, that the ZIRP of the pre-pandemic environment was a unique one—interest rates have never in history been so low for so long. So, in a broader historical context, interest rates, as measured by the Effective Federal Funds Rate, have returned to a level that is closer to the historical average of 4.6% going back to 1954.8

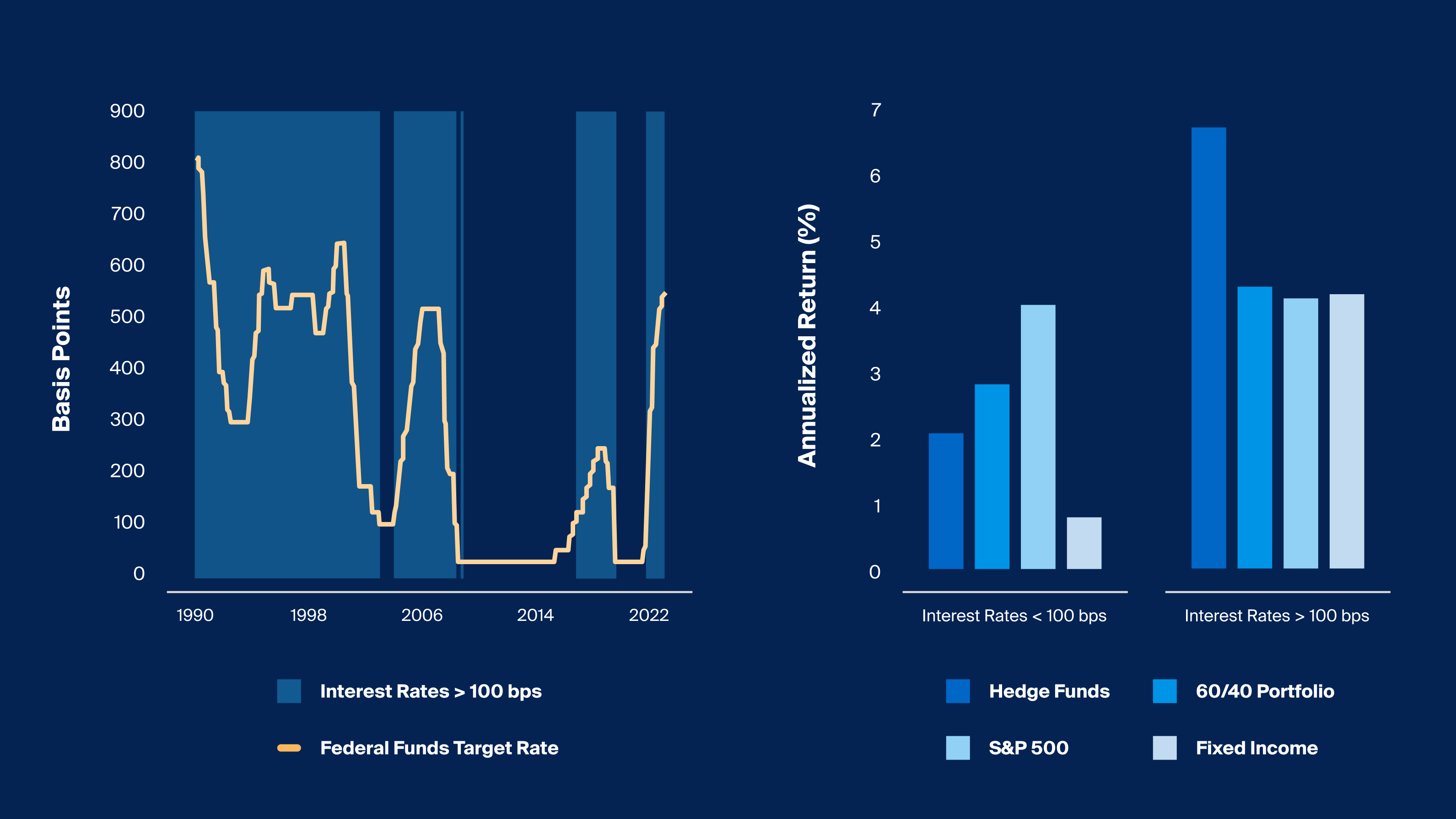

While hedge funds underperformed both public equities and the 60/40 in low-to-zero rate environments, hedge funds outperformed public equities and the 60/40 in periods of more “normal” interest rates (as defined by the Fed target rate exceeding 100 basis points) since 1990 (Exhibit 2).

Footnotes

Source: HFRI, Hedge Funds represented by HFRI Fund Weighted Composite Index, Bloomberg, S&P 500 represented by S&P 500 Index, Fixed Income represented by Bloomberg Barclays US Aggregate Bond Index, 60/40 portfolio represented by 60% weighting to S&P 500 and 40% weighting to Fixed Income, Interest Rates represented by Federal Funds Target Rate Upper Bound Index, as of July 2023.

Source: HFRI, Hedge Funds represented by HFRI Fund Weighted Composite Index, Bloomberg, S&P 500 represented by S&P 500 Index, Fixed Income represented by Bloomberg Barclays US Aggregate Bond Index, 60/40 portfolio represented by 60% weighting to S&P 500 and 40% weighting to Fixed Income, Interest Rates represented by Federal Funds Target Rate Upper Bound Index, as of July 2023.

In a historically unique low-to-zero interest-rate environment, hedge funds were faced with a number of challenges. The reduced volatility that accompanied ZIRP limited hedge funds’ opportunity to take advantage of pricing inefficiencies. The cost of borrowing stock to short also increased.9

While hedge fund strategies differ, many maintain a less than 100% net long exposure, which would have been detrimental to nominal returns when public equities marched upwards with little reprieve. Hedge funds also typically hold cash balances that exceed that of traditional funds, and with short-term rates near zero, that caused a significant drag on total portfolio returns.10

Security selection also awarded much lesser alpha through this period, as multiples all rose in tandem; in fact, S&P 500 earnings nearly doubled between 2010 and 2021, making equities that performed in excess of beta more elusive.11 However, higher interest rates can cause greater dispersion in the performance of equities, making security selection of greater importance.

Certain hedge funds may be well equipped for such an environment. Active security selection may drive alpha as greater intra-market and inter-market dispersion presents a broader range of opportunities.12 In addition, as stress potentially rises as higher interest rates pull liquidity from the market, hedge funds may be able to employ the tactics to capture various situational downsides.13

Will Hedge Funds Reemerge?

During the period that followed the GFC, and up until the public market reaction to the COVID-19 pandemic, hedge funds broadly had failed to deliver even on a risk-adjusted basis, as measured by the Sharpe ratio, falling short of both public equities and traditional fixed-income indices.

We’re only around 40 months into the current macro environment at the time of writing, but hedge funds have so far boasted a 1.34 Sharpe ratio compared to 0.77 for the 60/40 portfolio and 1.03 for the S&P 500 (Exhibit 3). This may imply hedge funds have so far delivered a better return for every unit of risk, as measured by volatility, compared to traditional asset classes in this new era.

Source: Source: Venn, HFRI, Hedge Funds represented by HFRI Fund Weighted Composite Index, Bloomberg, S&P 500 represented by S&P 500 Index, Fixed Income represented by Bloomberg Barclays US Aggregate Bond Index, 60/40 portfolio represented by 60% weighting to S&P 500 and 40% weighting to Fixed Income, GFC – Covid-19 period measures performance between March 2009 and March 2020, Current Environment period measures performance between April 2020 and July 2023, as of July 2023.

Source: Venn, HFRI, Hedge Funds represented by HFRI Fund Weighted Composite Index, Bloomberg, S&P 500 represented by S&P 500 Index, Fixed Income represented by Bloomberg Barclays US Aggregate Bond Index, 60/40 portfolio represented by 60% weighting to S&P 500 and 40% weighting to Fixed Income, GFC – Covid-19 period measures performance between March 2009 and March 2020, Current Environment period measures performance between April 2020 and July 2023, as of July 2023.

By looking at the risk-adjusted returns, we can start to paint a picture of what hedge funds may offer. Their potential role as a diversifier has become especially relevant as the ability of traditional equity and bond strategies to diversify one another through a lower correlation has come under pressure.14

Understanding the Risks of Hedge Fund Strategies

The unique environment where passive, beta strategies once thrived now appears to be in our rear-view mirror. Advisors may instead return their attention to diversifying strategies, like hedge funds, that have historically thrived in more “normalized” market conditions.

While the opportunity for hedge funds to continue to outperform appears likely based on the historical performance of the broad HFR index, advisors must remain vigilant in understanding the risks of hedge fund strategies.

Manager selection especially remains important. Since 2008, the performance dispersion between first-quartile and third-quartile managers was as high as 10 percentage points. In volatile environments, this dispersion has reached over 20 percentage points.15 These spreads in performance suggest that choosing high-performing managers can be vital in constructing a well-diversified portfolio. Hedge funds also take on a considerable amount of risk; in addition to being subject to relatively less regulatory scrutiny than many traditional investments, like stocks, bonds, or mutual funds, many strategies employ significant leverage, which can exacerbate potential losses.