What You'll Learn

Both considered real assets, infrastructure and commercial real estate investments share many characteristics at the asset level, such as their potential ability to return relatively consistent cash flows.

The private infrastructure asset class appears to be more sensitive to inflation, compared to private real estate and global public equities, suggesting its diversification potential.

Both real estate and private infrastructure have historically had relatively low correlations to global public equities; yet, infrastructure demonstrated less convergence than real estate in equity down markets.

When both added to a traditional 60/40 stock-and-bond portfolio in equal allocations, infrastructure and real estate strategies in the aggregate would have enhanced the risk/return profile of a traditional stock and bond portfolio across the risk spectrum between March 2008 and March 2023.

Its potential income and capital growth opportunities and its diversifying features are among the attributes that have made commercial real estate a historically sought-after asset class for institutional investors.1 However, valuations have become a recent concern as the rapid rise in interest rates pushed the market into a sluggish, price discovery phase.2

More attention now seems to be turning to infrastructure,3 which shares similar attributes to real estate. After all, infrastructure and real estate are both real assets with cash flow generated from some “real” combination of brick, concrete, and steel, constructed ideally in a high-utility location. In addition to these more obvious similarities, to what degree has infrastructure—a relatively newer asset class for both institutional and private investors—demonstrated the portfolio construction attributes that have historically made real estate investing attractive? And how are the asset classes differentiated, if at all, on a risk and return basis?

Comparing Private Infrastructure and Real Estate’s Income-Generation Potential

As mentioned before, investors have been drawn to real estate—specifically core real estate—for its income potential, given the ability for real estate assets at large to generate a consistent cash flow. Indeed, core rental markets generally have fixed rents, making rental income fairly consistent, though not guaranteed.4

Consider a grocery store in a shopping mall with a 30-year lease, an example of a common core real estate asset. An investor in this hypothetical property might expect to generate both capital appreciation and income, with the majority of this return made up of the latter.5 The tenant of this core asset, the grocer, would be subject to the leasing agreement that underpins the cash flow of this deal for the investor.

In the example above, a 30-year lease would obligate the tenant of the grocery property to pay rent and thus provide cash flow for the real estate investor for three decades. However, infrastructure assets like toll roads, for example, may have a life of up to 60 years on average.6 Such an asset may also be regulated under factors like rate of return, providing potentially stable cash flows backed by certain legislation. A toll road may also be less economically sensitive, as its utilization is less dependent on the ability or willingness of commercial tenants to maintain and pay their leases, a feature of commercial real estate properties.

Due to the relatively longer-term and in some cases contractual cash flows related to infrastructure assets, the income streams they can generate may be even more stabilized and consistent than commercial real estate assets, which tend to operate in more competitive markets with relatively shorter contracts.7 In comparison to real estate, these consistent cash flows make up a greater percentage of total returns overall, potentially enabling broader diversification as they supplement income and achieve capital appreciation over the long term.8

But do those inherent differences at the asset level actually make a difference in the return profiles at the asset class level? We explore further below.

Comparing Private Infrastructure and Real Estate’s Sensitivity to Macroeconomic Factors

We first seek to understand the similarities and differences between infrastructure and real estate funds through the lens of their sensitivities to macroeconomic factors. Doing so may help in assessing how they behave similarly or differently to better understand their relative contributions to mitigating total portfolio risk. We compare these indices against global equities as both private infrastructure and real estate indices are composed of global constituents.

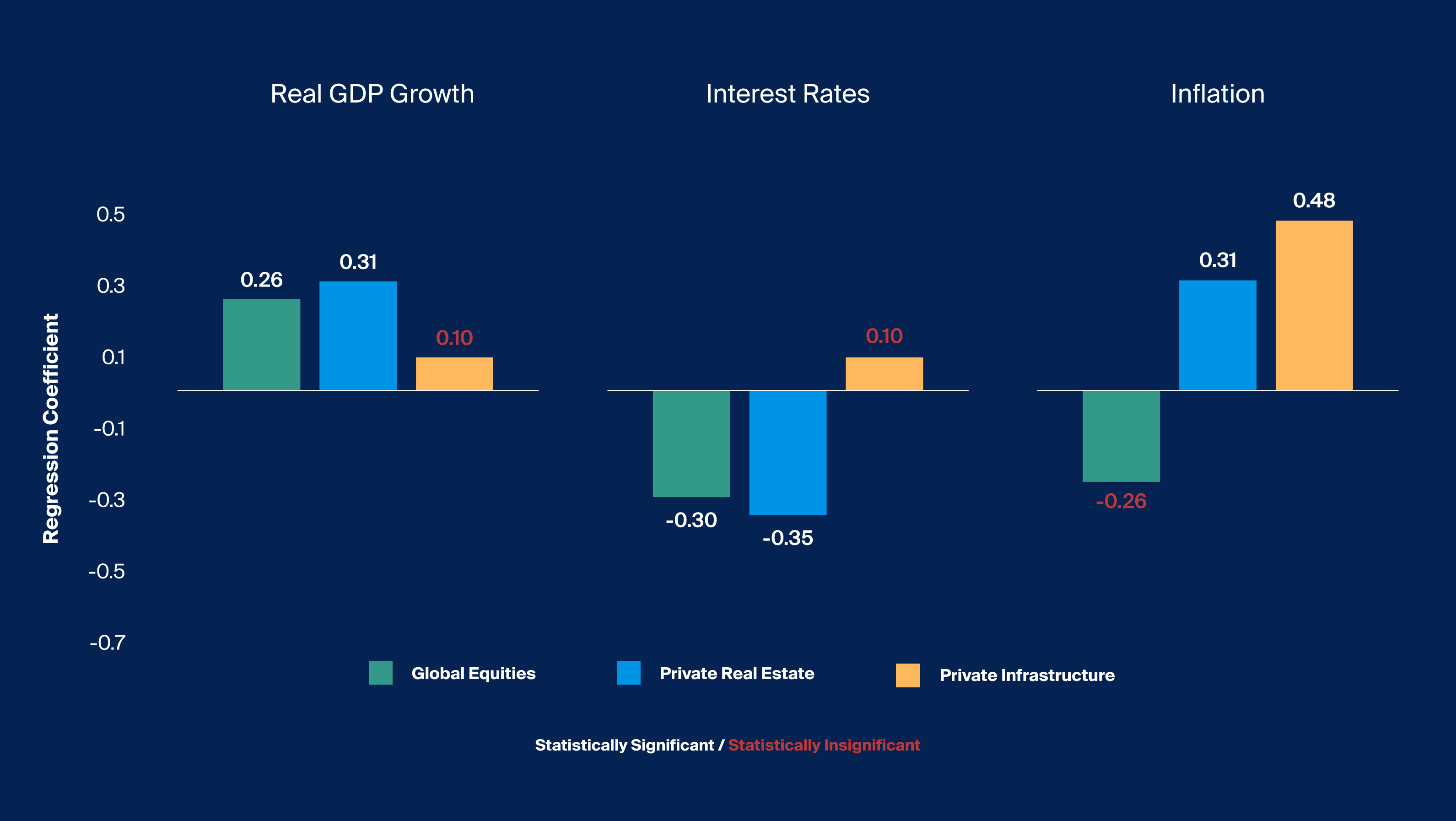

Source: Bloomberg, Preqin, Global Equities represented by MSCI World Index, Fixed Income represented by Bloomberg Barclays US Agg Total Return Value Unhedged Index, Private Real Estate represented by Preqin Real Estate Index, Private Infrastructure represented by Preqin Private Infrastructure Index, Real GDP Growth represented by GDP US Chained Dollars YoY SA, Interest Rates represented by US Generic Govt 10 Yr, Inflation represented by US CPI Urban Consumers YoY NSA, analysis conducted using excel regression using the three economic measures as independent variables, and GDP lagged 3 quarters, confidence interval of 95%, coefficients represent standardized regression coefficients, analysis conducted from March 2008 to March 2023. Note that it is not possible to invest in an index.

Private infrastructure has exhibited a greater positive relationship with US inflation compared to global public equities and private real estate (Exhibit 1)

How Sensitive Are Infrastructure Returns to Economic Growth?

Unsurprisingly, global public equity performance, represented by the MSCI World Index, exhibited a positive and statistically significant sensitivity to real GDP growth. For this regression model, we selected a lag of three quarters for GDP, given public equity’s tendency to front-run the economic cycle.9 Private real estate investments also exhibited a strong positive and statistically significant relationship with GDP growth. Economic growth has therefore historically been supportive of equity and real estate returns, while the opposite was true in economic downturns.

A statistically insignificant real GDP coefficient for infrastructure indicates that in this particular analysis there is not enough evidence to conclude there is a relationship between real GDP growth and infrastructure returns.

Do Interest Rates Impact Private Infrastructure Investments?

Both public equities and real estate strategies exhibit statistically significant negative sensitivity to interest rates, supporting the intuition that rising rates have a negative impact on these asset classes. An increase in the discount rate, which is theoretically used to price all assets, typically forces a repricing across all asset types—particularly those that are more highly levered or those with cash flows expected further in the future.

For infrastructure strategies, a lack of statistical significance rules out a compelling relationship. Infrastructure may have the ability to pass through a rising cost of capital—either because of their monopolistic pricing power or, in the case of regulated assets, adjustments to price controls like those permitted when inflation rises.10 This increase in cash flows can offset increases in the discount rate, offsetting the otherwise negative impact on valuations.

What Is the Relationship Between Infrastructure and Inflation?

For inflation, global equities exhibit a negative, but statistically insignificant, sensitivity to inflation. The positive, statistically significant sensitivity for private real estate suggests a strong positive relationship between real estate returns and inflation. A larger, positive, and statistically significant sensitivity to inflation implies that infrastructure investments have historically acted as an even more effective hedge against inflation. As inflation increased, the returns on infrastructure assets also tended to rise. If this relationship were to persist, infrastructure would appear to be a potentially attractive choice during inflationary periods.

These findings across the differences in sensitivity to macroeconomic indicators suggest private infrastructure may act as a complement to both public equities and private real estate. While real estate historically had greater sensitivity to economic growth (and thus participated more strongly in economic expansions), infrastructure was demonstrably impacted most by inflation; there was insufficient evidence that GDP and interest rates had a relationship to infrastructure's returns.

Assessing Private Infrastructure as a Diversifier

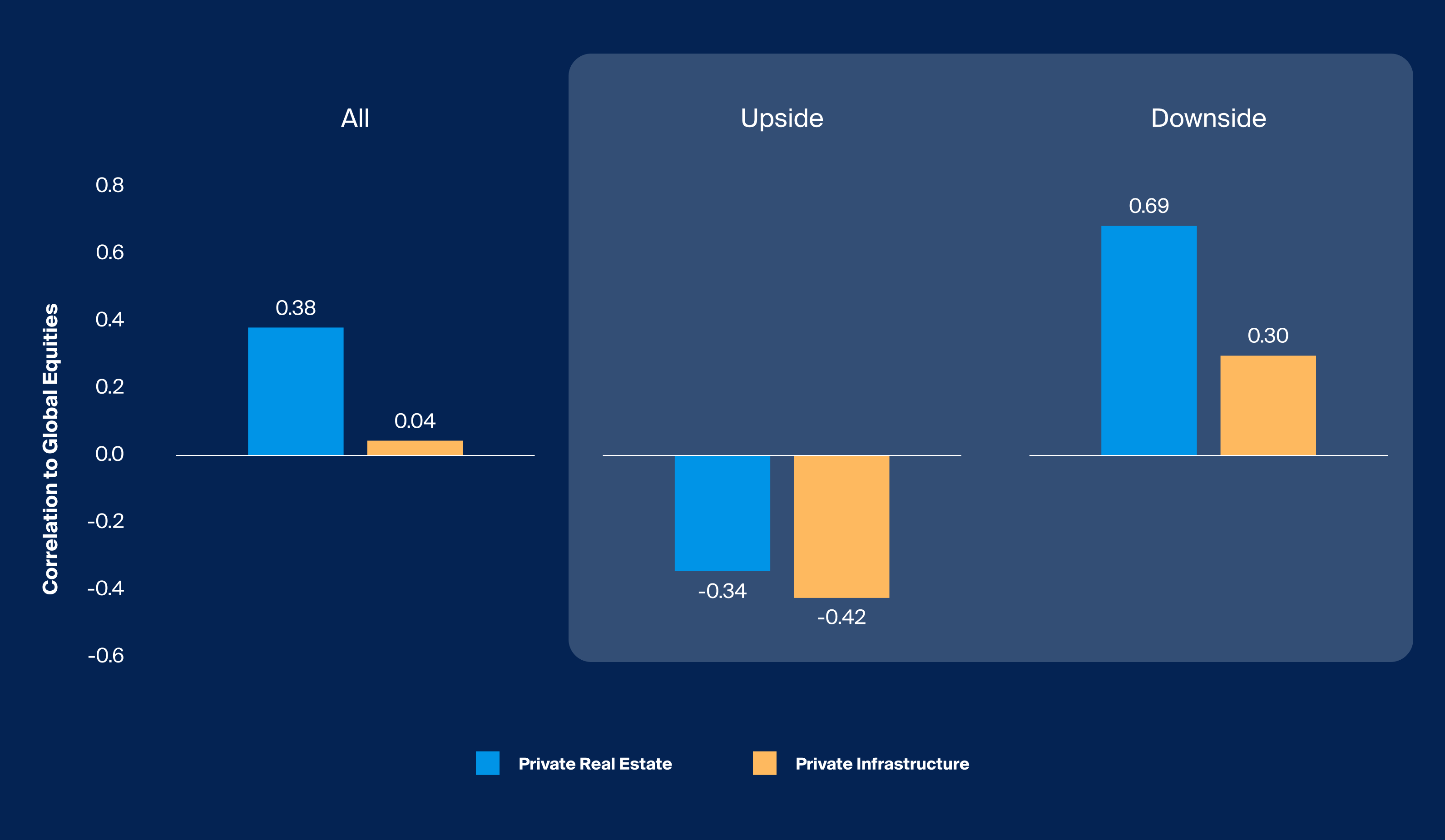

Low correlation is recognized as a key indicator of an asset class or investment’s diversification potential for a portfolio. However, a single statistic may obfuscate what may be desirable. What investors may seek in a “diversifier” is one that importantly diverges when public equities—the core engine of growth in a traditional asset allocation—have a negative performance period (i.e., “downside divergence”), but converges when equities have a positive performance period (i.e., “upside convergence”).11 Such an asset would exhibit a relatively low correlation in equity down markets and relatively higher correlation in equity up markets.

Private real estate and infrastructure both have relatively low correlations historically to global public equities; however, here we isolate how they behave relative to public equities in up and down equity markets. Our findings suggest that both asset classes exhibit the type of downside convergence behavior previously described but to different extents. In the downside, infrastructure historically had a relatively low correlation of 0.3 to equities, suggesting it may serve as a better diversifier than private real estate.

Source: Bloomberg, Preqin, Equities represented by MSCI World Index, Real Estate represented by Preqin Real Estate Index, Infrastructure represented by Preqin Private Infrastructure Index, Upside and Downside correlations calculated based on negative or positive quarterly equity return, correlation is the non-rolling correlation of each index to equity over the period of positive or negative return, analysis conducted from March 2008 to June 2023. Note that it is not possible to invest in an index.

While both private real estate and infrastructure returns converged with global equities in downturns, infrastructure exhibited a lower correlation (Exhibit 2)

Implications for Asset Allocation With Private Infrastructure and Real Estate

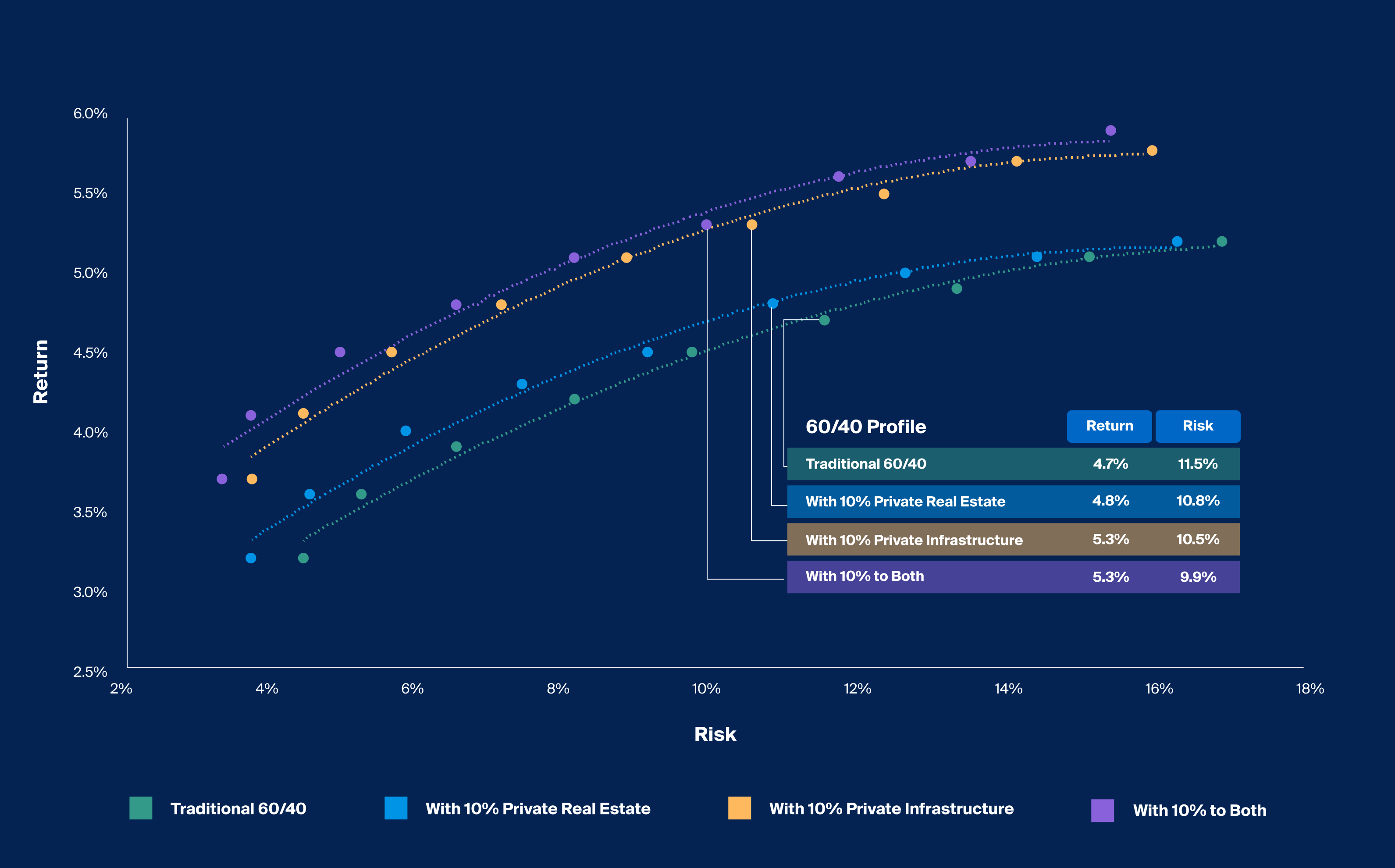

To explore the potential implications of utilizing infrastructure and private real estate in a multi-asset class portfolio, we look at the historical impact on total portfolio risk/return starting from a traditional stock and bond portfolio.

Historical data is not indicative of future performance. These asset classes may behave similarly or differently in the future compared to the period of analysis, which is since the inception of the Preqin Infrastructure Index in 2008. The future macroeconomic environment remains uncertain and how these asset classes perform is not guaranteed.

Our goal, therefore, is not to make predictions but to assess the magnitude of impact on historical risk/return profiles of traditional equity and fixed-income-exclusive portfolios with hypothetical allocations to private real estate and infrastructure assets. For the purpose of this exercise, we introduced historical allocations of 10% each to private real estate and private infrastructure to stock and bond allocations ranging from 10% bonds and 90% equities to 90% bonds and 10% equities. We also added 10% of both to the same hypothetical portfolios.

This is by no means a recommendation, but strictly an academic exercise to assess the historical impact of including these asset classes to traditional portfolios. It’s also important to note that these indices represent an aggregation of funds, and therefore, the impact of individual funds on the same portfolios would have varied. Also, the private markets indices used below are composed of individual funds and calculated net of fees.

Source: FOR DISCUSSION PURPOSES ONLY – ILLUSTRATIVE – NOT AN INVESTMENT RECOMMENDATION Analysis conducted through Venn, return represents annualized return, risk represents volatility, points across the risk and return spectrum are composed of incremental changes in allocations between equities and fixed income ranging from 90% equity and 10% fixed income to 10% equity and 90% fixed income, at each point, allocations to private market indices are sourced from equity and fixed income equally. Traditional portfolio composed of Equities and Fixed Income with Equities represented by MSCI ACWI Net Return Index, Fixed Income represented by Bloomberg Barclays US Agg Total Return Value Unhedged Index,,Preqin, Real Estate represented by Preqin Real Estate Index, Infrastructure represented by Preqin Private Infrastructure Index, return represents annualized return, risk represents volatility points across the risk and return spectrum analysis conducted from March 2008 to March 2023. Note that it is not possible to invest in an index.

Historically, inclusion of private real estate and infrastructure improved risk and return for asset allocations across the risk spectrum (Exhibit 3)

According to our analysis (Exhibit 3), allocating 10% to private real estate historically would have reduced the volatility of a traditional portfolio of stocks and bonds across the risk-return spectrum. In this exercise, the private real estate allocation was funded equally from stocks and bonds (5% each). A 10% allocation to infrastructure, again sourced equally from stocks and bonds, would have improved risk and return even further.

This suggests that, historically, infrastructure may have served effectively as a complement, likely due to differences in correlation and sensitivity to macroeconomic factors as previously described.

It is important to note that both real estate and infrastructure asset classes comprise a diverse set of assets and strategies, potentially with differing sensitivities to macroeconomic factors. Each is also subject to idiosyncratic risk, such as political risk as a result of their local regulations and the supply and demand in their particular markets.12 Advisors should conduct a thorough due diligence process when considering real asset managers, seeking to understand the strategies they employ, the characteristics of the types of assets that they invest in, and their ability to select and potentially improve assets.