What You Will Learn

Investor interest in opportunistic private real estate appears to be picking up, especially as the broader real estate market looks for greater stability.

On the back of historic tightening of monetary policy, higher interest rates drove cap rates up, reflecting risk levels investors could not tolerate. As a result, valuations fell, and transaction activity stalled.

The real estate market is approaching a wall of maturities. Investors piled up on real estate loans during more than a decade of low interest rates and loose credit availability, and now the volume of loans approaching maturity in 2024 appears to be reaching new heights.

Real estate assets still carry elevated levels of risk, particularly in office buildings, the properties most impacted by the work-from-home trend.

As a broader real estate market reckons with a wall of unsustainable debt, opportunistic real estate funds may now have an opening to serve as a funding source for assets with solid fundamentals but shaky debt structures.

And investors seem to be taking note. In a survey by White & Case, industry participants ranked opportunistic real estate as the most popular real estate investment strategy for new funds heading into 2024.1

In this piece, we explore the conditions that have arisen for private real estate investing in recent years and aim to identify drivers of this apparent appetite for more opportunistic strategies.

The Rise and Fall of Real Estate Lending Volume

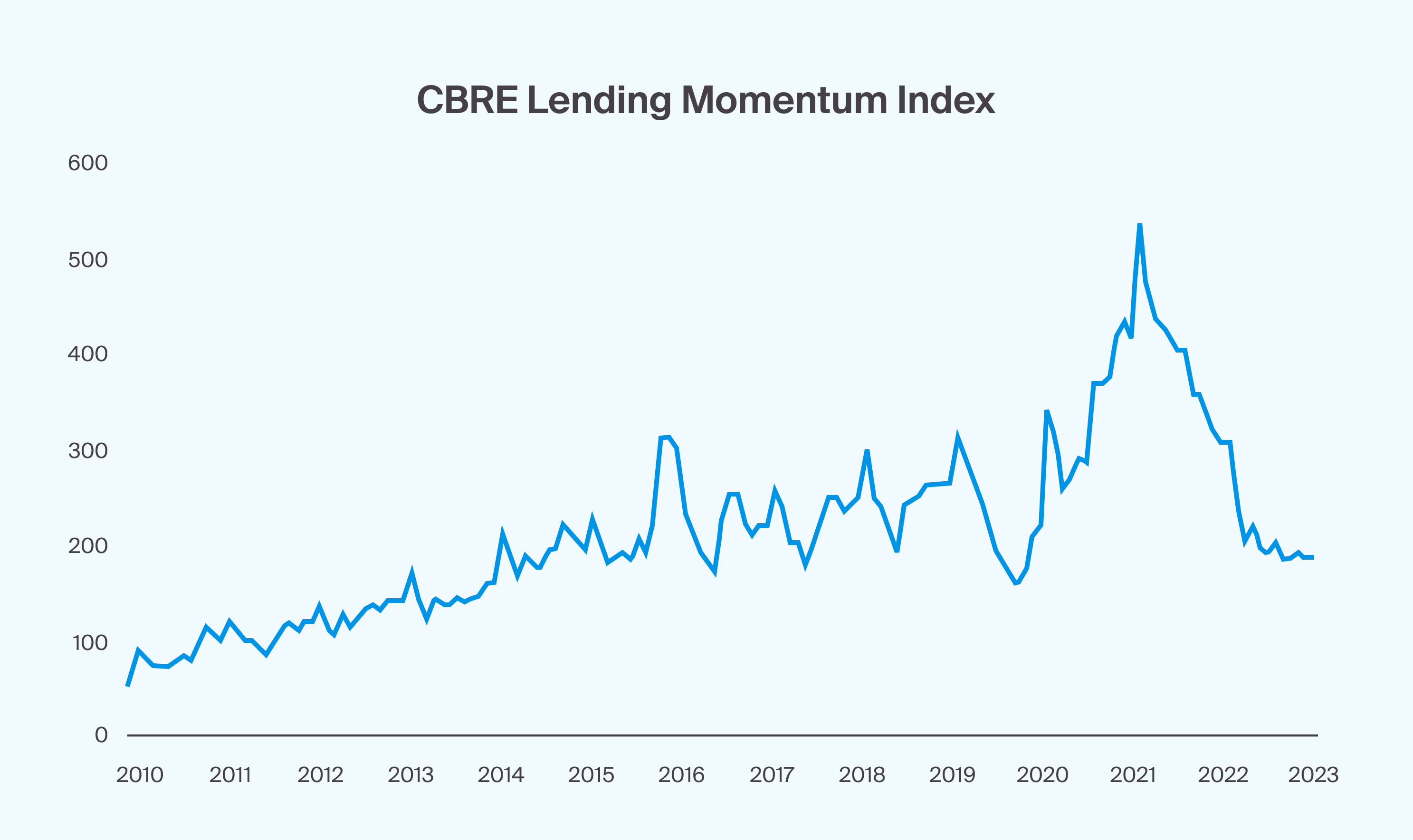

In the years following the global financial crisis and into the first couple of years of the COVID-19 pandemic, property owners and real estate investors took on riskier loan positions, leaning into the era’s low interest rates and less restrictive borrowing terms. As the pandemic progressed and the Federal Reserve injected liquidity into the economy, commercial real estate lending momentum accelerated into the end of 2021 (Exhibit 1).

However, since March 2022, when rates started rising, pre-existing terms on those riskier loans have made repayments more challenging. Therefore, activity declined precipitously. The CBRE Lending Momentum Index, which tracks the pace of CBRE-originated loan closings, dropped 38.1% from its peak, year-over-year, in the fourth quarter of 2023.2

With the cost of debt relatively high by the standards of the previous decade, commercial real estate loans have simply become unattainable for many would-be borrowers.

Footnotes

Source: CBRE Capital Markets, CBRE Research, Seasonally adjusted, 2005 average = 100, as of Q4 2023

The pace of commercial real estate loan closings plummets since its Q3 2021 peak (Exhibit 1)

Banks Withdraw From Lending, Refinancing and Exit Hurdles Grow Higher

With rates higher than before, banks—which had once been commercial real estate’s go-to lenders—turned sour toward commercial real estate loans, tightening their lending standards and leaving borrowers to grapple with more costly, harder-to-get loans.3

According to the Mortgage Bankers Association, commercial and multifamily mortgage loan originations declined by 49% year-over-year in the third quarter of 2023.4 Banks are vetting borrowers more selectively, and only the most trusted borrowers with structurally sound projects may be able to secure financing.

Cap Rates Rise, Transaction Volume Plateaus, Dry Powder Accumulates

As banks pulled back, we have also seen a seesaw effect: higher financing costs caused capitalization rates to rise and waning demand caused prices to fall. According to Green Street, commercial property prices are down 21% since their peak in 2022, as of June 2024.5 Thus, the gap between what buyers and sellers were willing to pay and charge, respectively, broadened, stalling activity.

US commercial real estate transaction volume declined 51% to approximately $374 billion in 2023 from almost $771 billion in 2022, according to MSCI Real Assets. Multifamily property sales plunged 61% year-over-year in 2023 and office deals declined 56%.6

Amidst the decline in transaction activity and deal volume, real estate managers slowed deployments, accumulating capital. According to Preqin, US private real estate funds have just over $500 billion of dry powder, while opportunistic funds have around $200 billion of that amount of capital on the sidelines.7

Opportunistic real estate managers may be well situated to capture opportunities from banks’ retrenchment from lending, with record dry powder at the ready. However, for these opportunities to come to fruition, specific market environment changes, which we’ll outline next, may have to go into effect.

Sizing Up a Towering Wall of Maturities

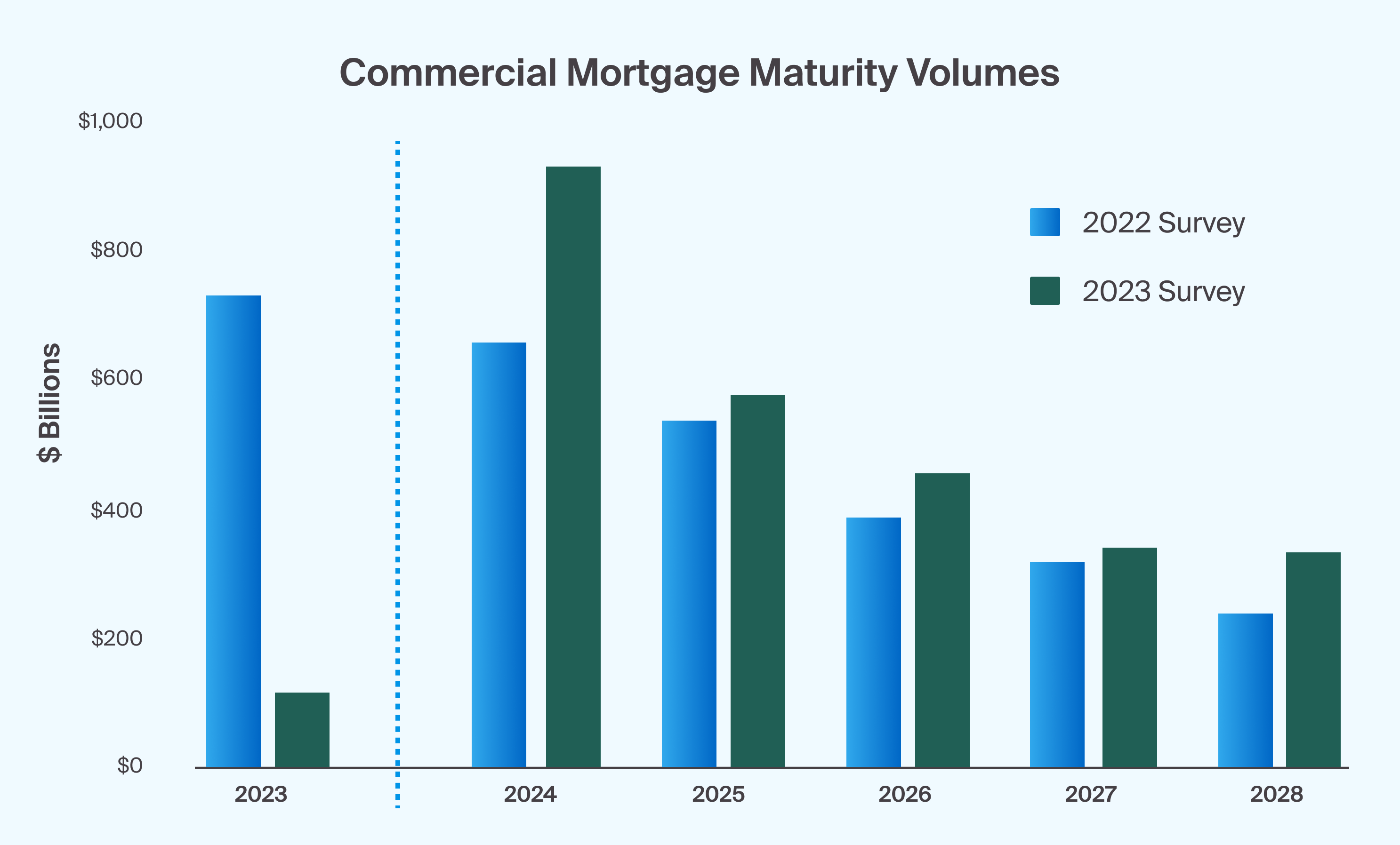

Much of the real estate debt that piled up during the low-interest-rate era is set to mature in 2024 and onwards (Exhibit 2). As such, a maturity wall now looms for borrowers, raising concerns about whether they’ll be able to find a lifeline with new lenders as refinancing remains difficult.

According to the 2023 Commercial Real Estate Survey of Loan Maturity Volumes, 20% of the $4.7 trillion of outstanding commercial mortgages held by lenders and investors will mature in 2024—a jump of 28% from what matured in 2023.8

Part of the increase in the number of loans expected to mature this year is attributable to extensions on loans that would have matured in 2023. Therefore, the volume of commercial mortgage debt maturing in 2024 soared to $929 billion, as of the end of 2023, from the $729 billion estimated a year earlier.9

Footnotes

Source: Mortgage Bankers Association

2024 Commercial Mortgage Maturities Surge as Creditors Extend 2023 Pay Dates (Exhibit 2)

In other words, approaching deadlines for property owners to recapitalize paired with the sheer volume of debt maturities represent a massive opportunity. Decisions must soon be made. Exit hurdles and inaccessibility of the lending market will make these decisions even more challenging. Owners will avoid selling at discounts and—if they are fortunate enough to secure lending—hesitate to finance at higher rates, if at all. So, who will aid owners as they navigate these challenges?

What May Lie Ahead for Opportunistic Real Estate

When the Fed will start cutting rates remains anybody’s guess, but a consensus that rates have peaked is brewing.10 While inflation has not dropped to the Fed’s target of 2%, it declined to 3% year over year in June. If inflation recedes further, interest rates start descending, and cap rates respond by declining accordingly, solid real estate fundamentals—along with the anticipated volume of loan maturities—may foster activity within opportunistic real estate.

If these expectations come to fruition, we may see real estate transaction volume start to increase as cap rates narrow and debt capital becomes more available. In addition, commercial real estate prices could continue to rebound, helping regional banks address substantial amounts of commercial real estate loans on their balance sheets.

All of this may potentially help to spur a resurgence of activity in commercial real estate, but a more unique set of factors may broaden the opportunity set even sooner for more specialized and well-capitalized opportunistic real estate strategies.

Some borrowers unable to restructure their debt and obtain new loans amid the looming wall of maturities may resort to selling their assets at discounts. These forced sales could potentially create opportunities for real estate asset managers to acquire equity of properties that may be high quality for much less, improving their capital structures to generate returns. But for those looking to refinance their loans to address maturities, the other side of this opportunity may materialize.

Opportunistic real estate managers can step in to fill the void left by banks who shifted their focus to address pre-existing loans in their balance sheets. In fact, as of the third quarter of 2023, banks still held about 50% of the outstanding commercial real estate debt at the time.11 If banks were to reduce their share of outstanding loans down to 40%, for example, the resulting gap in lending would reach $500 billion—leaving room for funds with dry powder available.

Manager selection and industry relationships are likely to remain relevant drivers of performance, as operational stability, effective risk management practices, and experience will be required for those deploying capital into these potential opportunities.

Considering the Risks in Opportunistic Real Estate

Advisors should recognize that opportunistic real estate strategies bear certain risks, including, but not limited to the fact that they often employ higher levels of leverage to cover high costs and boost returns and are less liquid than their public counterparts.

Office space still carries higher risk levels, as occupancy rates remain below pre-pandemic levels, leaving a sizable portion of inventory available for lease, sublease, or sale.

It’s also important to keep in mind that private real estate investments follow a pattern known as a J-curve, which consists of negative cash flows in the early years, due to capital calls and management fees. It may take several years for properties to reach new market values or realize gains.