General partner (GP) stakes have seen growing interest in recent years, fueled by broader expansion across the asset management industry. For financial advisors, these strategies may offer a differentiated way to participate in the long-term economics of private market firms. But to understand why a rising number of alternative managers are entering the space, and why allocators are taking note, it’s important to first define what GP stakes are and the potential opportunities they present.1

In this piece we’ll dive into defining GP stakes, the mechanics behind these investments, and what may be at stake looking ahead.

What Are GP Stakes?

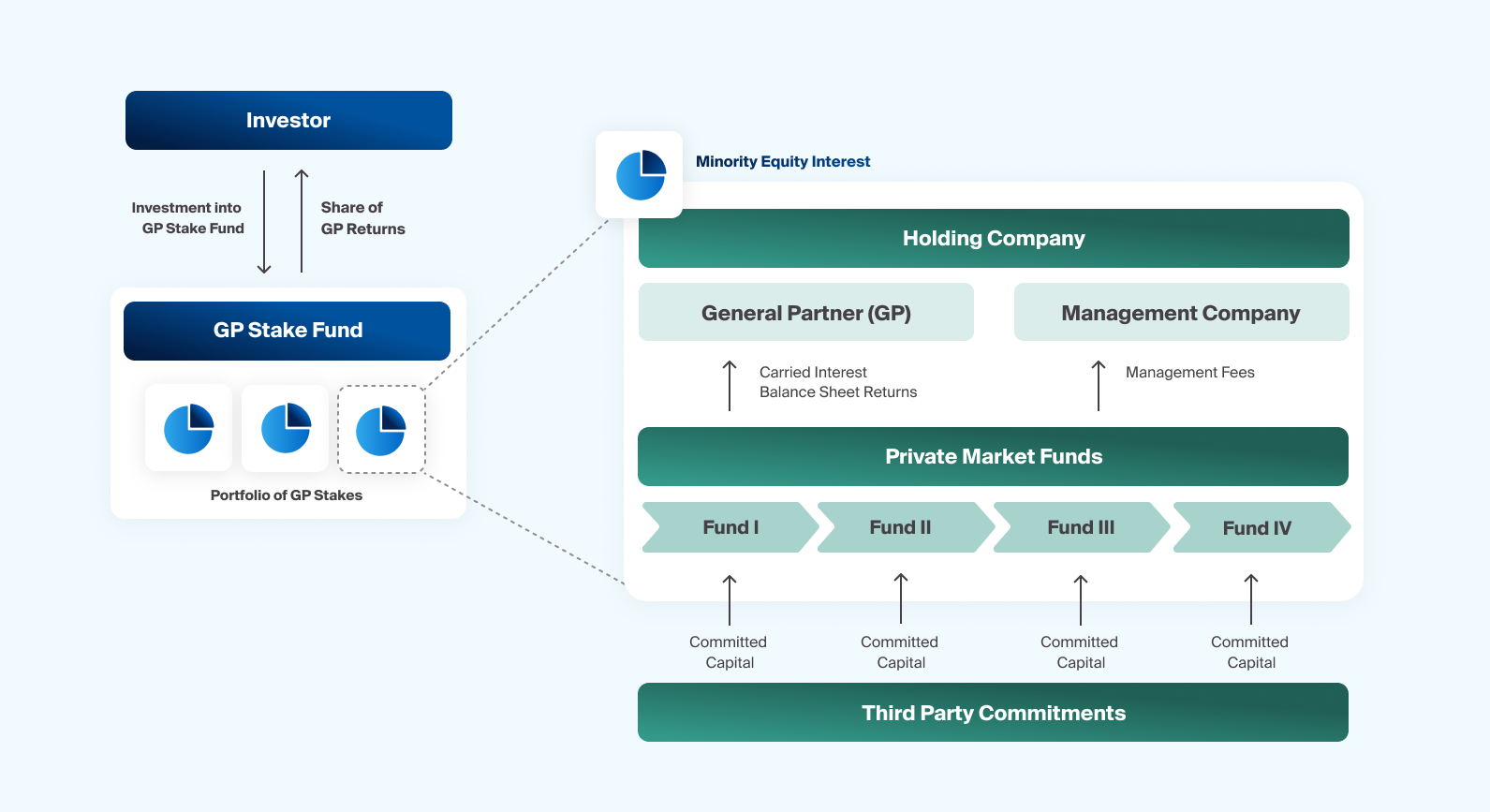

GP stakes involve the acquisition of minority equity interests in the management companies of established private market alternative asset managers.2 This investment approach allows investors to secure an investment in a piece of the private asset management industry without taking on a controlling role.

More specifically, GP stakes are direct equity investments that represent a minority ownership position, typically around 20%, in a general partnership's underlying management company.3 These stakes are usually non-controlling and non-voting, indicating a passive investment approach. GP stakes can also give private equity firms access to long-term capital without the pressure, disclosure requirements, and shareholder demands that come with going public, which may help these firms stay focused on performance and growth.

Stakes can be held in various segments of the alternative asset market controlled by GPs, such as in asset classes like private equity, private credit, real estate, infrastructure, and venture capital. Like any equity interest in a private or public company, a GP stake is often a perpetual and transferable security, meaning it can, in certain circumstances, be financed, recapitalized, or sold.

Investment Mechanics and Performance

Investments in GP stakes seek to generate returns through multiple streams, including pro-rata shares of management fees on limited partner (LP) commitments in the GP, carried interest, balance sheet returns, and capital appreciation.4 These investments seek returns that can resemble private equity-like multiples of invested capital with ongoing cash flows such as private credit or mezzanine financing.5

GP stakes fund structure is

One of GP stakes’ main appeals is their high-yield potential. GP stakes investments seek returns ranging from 7% to potentially mid-teens over time, with mature portfolios potentially increasing in value.6 A typical GP stakes fund structure is designed for a longer time horizon, typically exceeding 10 years, allowing investors to avoid frequent reallocations. As we discuss above, there are several motivators for GP stakes investments, including potential for stable returns through management fees, and some downside protection. Carried interest can offer added growth opportunities based on a GP’s existing and future performance.

A diversified GP stakes portfolio may further enhance this approach, offering some layers of potential downside protection; it can diversify across different strategies, vintages, geographies, and firm sizes. This not only has the potential to smooth investors' cash flows but may also align them with the broader growth trends in the private markets.

Driving Forces Behind GP Staking

Several factors contribute to the popularity of GP staking:

Secular Growth Trend

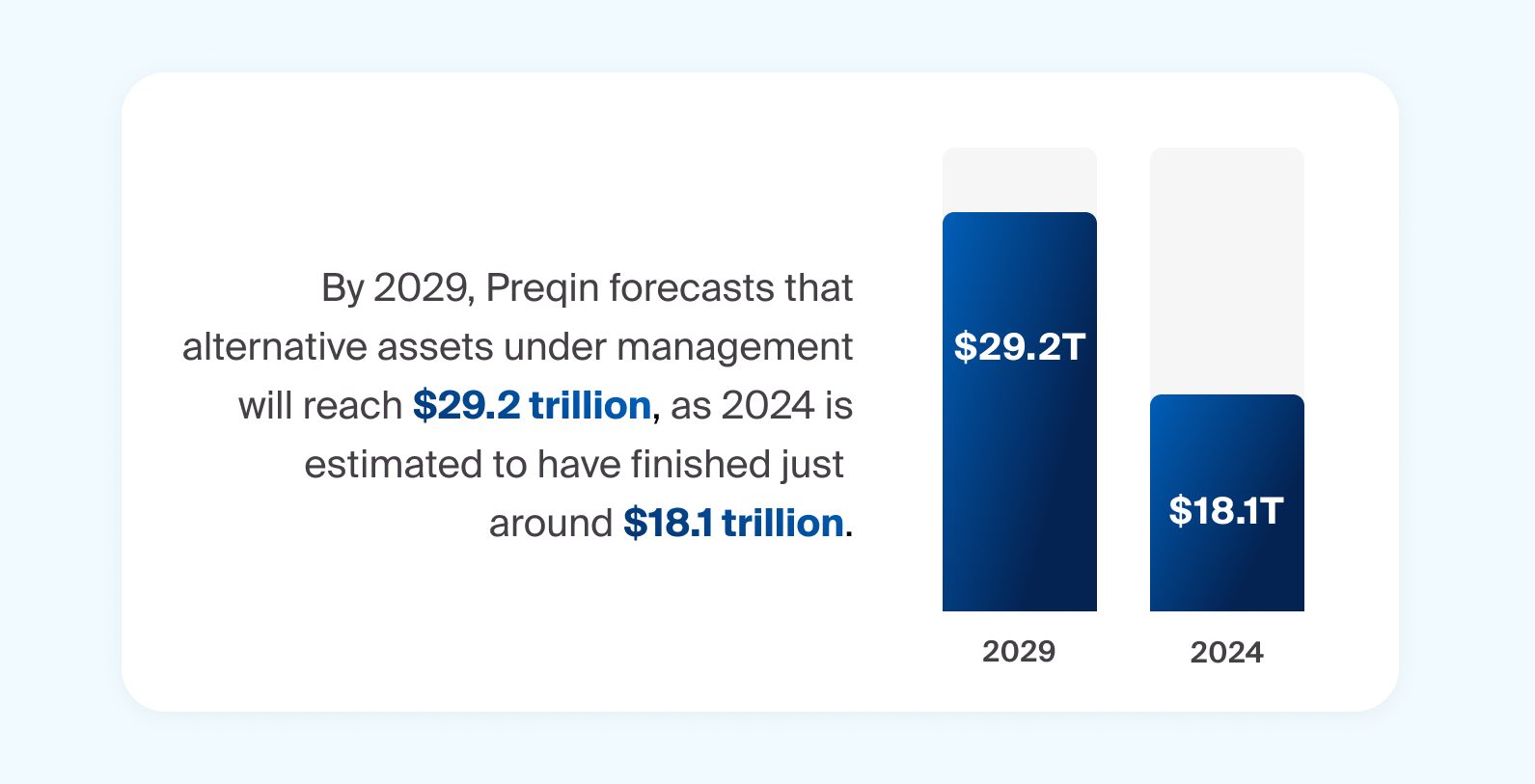

There is notable growth in assets under management and fundraising within private markets, making GP stakes a strategic play on this expansion (Exhibit 2).

Footnotes

Source: Preqin, Future of Alternatives 2029; AUM values for 2024 to 2029 forecasted by Preqin.

Forecast for alternative assets under management

Consistent Capital Demand

GPs may frequently require capital for various financial and strategic enhancements to their businesses.

Financial Considerations

Minority stakes can enable GPs to engage in larger commitments to support fundraising, seed capital deployment in new products, or pursuing geographic expansion through mergers and acquisitions.

Strategic Approaches

Investment from larger and more reputable buyers can enable GPs access to greater scale and resources, from counsel and business support to global distribution networks.

Changing Value Creation Dynamics

Operational improvements in private equity are increasingly becoming a majority source of value creation in private equity, which differs greatly from years previously dominated by leverage and multiple expansion.7

Risks and Considerations When Investing in GP Stakes

Like most private capital strategies, the main risk, among others, involves portfolio companies significantly underperforming in growth and profitability. Investors in GP stakes need to closely monitor fundraising capabilities, fee structures, and market competition. GP stakes are also generally illiquid, and the secondary market for these investments may be considerably limited.

Investing in GP stakes presents a potential opportunity for those looking to benefit from the growth of the private markets while seeking to manage risks through a diversified, long-term investment strategy.